by Tim Sharp, researched by Jack Williams

One of the first events past the post of 2024 is the upcoming election in Taiwan which could have huge knock on effects for markets, the Magnificent Seven in particular…

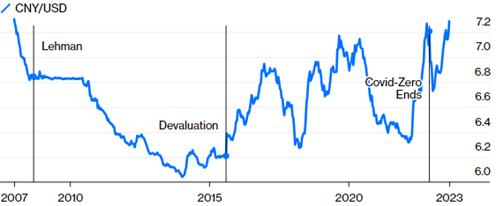

With Taiwan heading to the polling booths on Saturday 13th January 2024, perhaps the main question for inhabitants of the small independent island is how they will choose to deal with China moving forward following heightened tensions between the democratic island and those whom have laid claim to the territory.

Lai Ching-Te from the pro sovereignty party is currently the favourite amongst voters, however the opposite could be said for how he is viewed by the Chinese Communist Party (CCP) who have laid claim to Taiwan and increased both tension and activity in the straight bordering of the island in recent years.

It is worthy to note, we do not foresee an immediate military response similar to some of the nightmare scenarios being peddled by various media outlets and on social platforms, however it could have an interesting consequence for developed markets such as the US, and particularly the Magnificent Seven.

Bank of America issued a report on the 9th of January 2024 where the firm detailed its ‘Biggest Surprises to Brace for this Year’, saving the pole position for geopolitical risks to Magnificent Seven stocks and US equity markets.

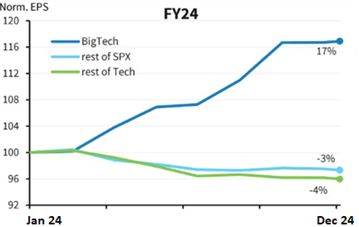

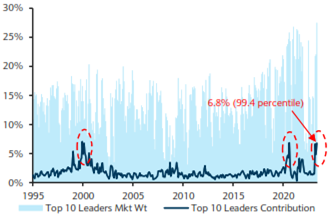

The Magnificent Seven have dominated markets this year, ultimately responsible for nearly two thirds of US500 Index gains in 2023 and helping propel the Nasdaq higher by 43.4% to close out its biggest annual rise since 2020.

These well performing names are not without risk, and it is their concentration and correlation which becomes problematic. All of the Magnificent Seven names rely heavily on Taiwan for it’s business. Companies such as Amazon, Apple, and star of the market last year, Nvidia (+234% LTM) are all super exposed to Taiwanese Semiconductor manufacturing companies such as TSMC whom build their next generation chips needed.

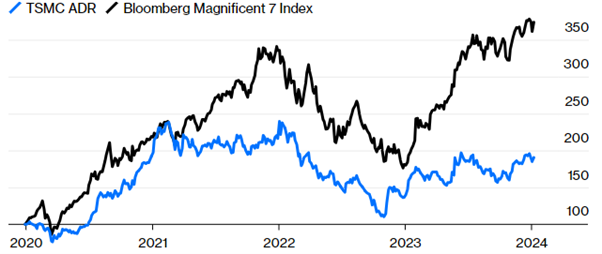

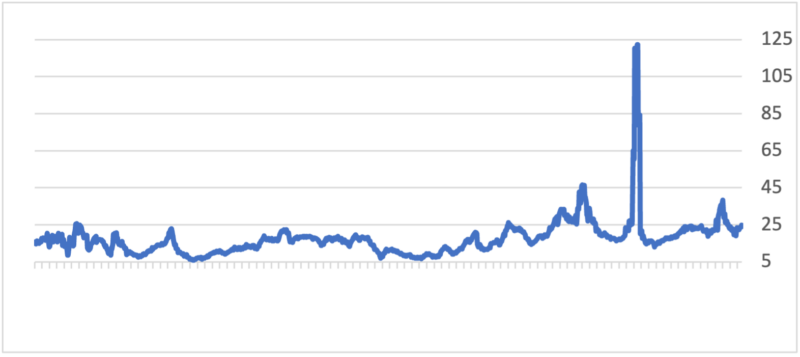

This overdependence has seen stock concentration between the Magnificent Seven and Taiwanese manufacturers such as TSMC rise to an all-time high of 66%. This concentration poses significant risks, amplifying vulnerabilities in the supply chain and potentially impacting wider technology markets.

Figure 1 – Correlation of MAG7 to TSMC Reaches ATH of 66% (Bloomberg)

With the Magnificent Seven also currently holding a record share of the US market (not helped by market cap weighted indices) this leaves the entire US stock marker severely responsive to any complications to the supply of semiconductors

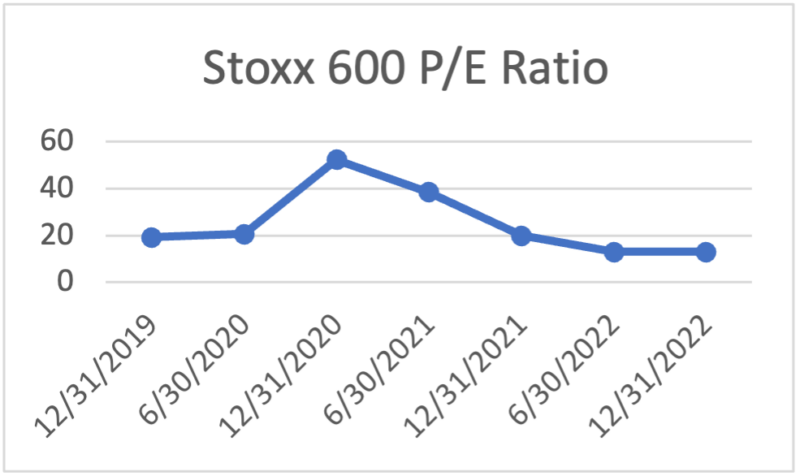

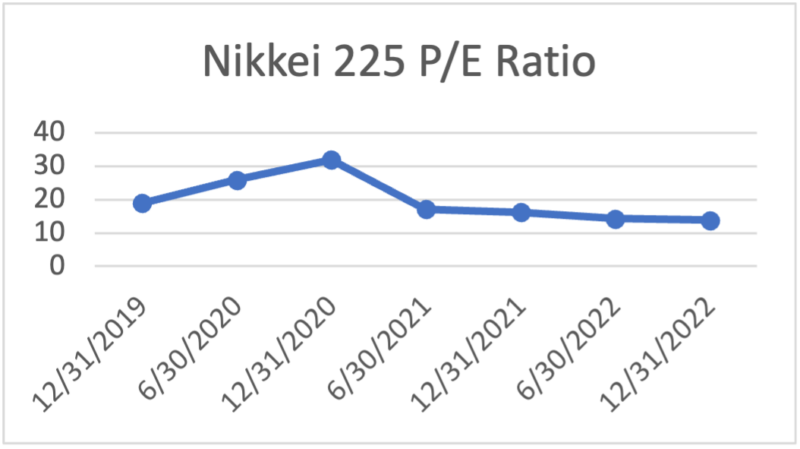

Figure 2-Mag Seven MCap Compared to Nations (Source: Factset)

To emphasise the scale of this concentration within markets the Magnificent Seven’s combined Market Cap eclipses the stock market capitalisation of Canada, Japan and the U.K….Combined!

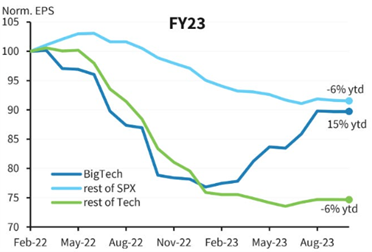

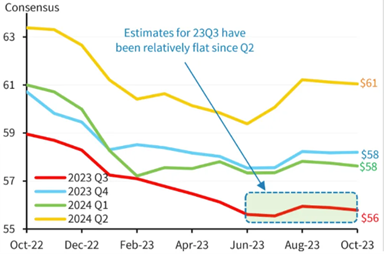

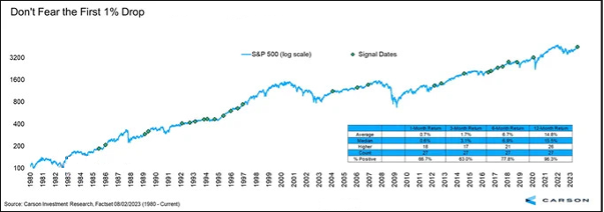

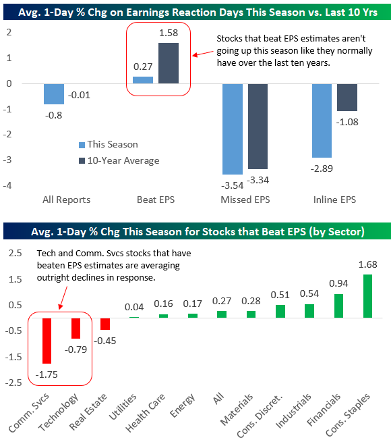

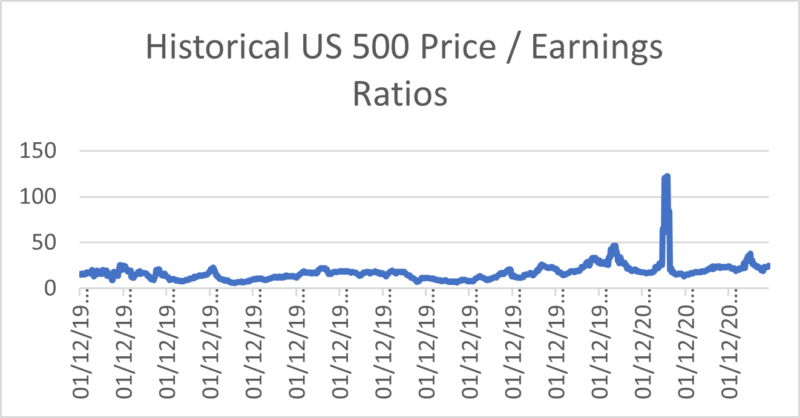

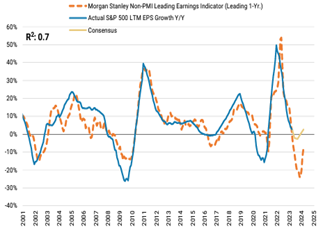

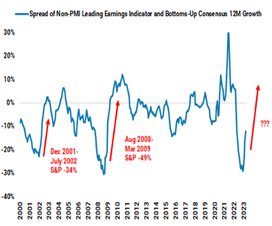

But it is not all doom and gloom! Over the past 90 days Wall St analysts have cut their targets for Q4 2023 earning estimates by far more than usual for this period, meaning a lower bar than expected could be in place and a potential surprise to markets further down the line.

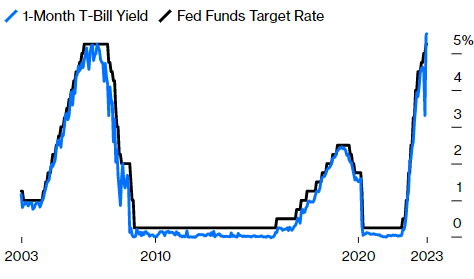

With wider acceptance that the rally towards the end of last year resulted from premature excitement surrounding rate cuts in 2024, not as a result of accelerating corporate fundamentals, this leaves the prospect of a corporate recovery still on the table.

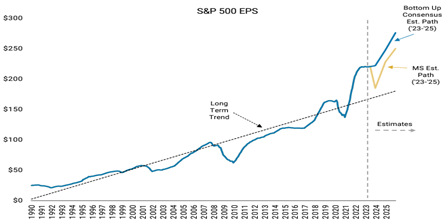

With analysts having cut earnings estimates for the US500 Blue Chip index by around 6% since early October, Edward Yardeni of Yardeni Research sees it as perhaps overdone and sees corporates in much healthier positions, setting his EPS estimate for 2024 US500 at $270, up $26.40 from the $244.60 EPS from last year.

Table 3-US 500 Returns Around End Of Fed Hiking Cycles (Goldman Sachs)

References:

www.zerohedge.com. (2024.) The Market Ear. Front running the ‘low bar’ | Zero Hedge. 09/01/2024 [online] Available at: https://www.zerohedge.com/the-market-ear/front-running-low-bar

Authers, J. (2024). Bloomberg News Magnificent Seven Risk Runs Through TSMC. [online] www.bloomberg.com. Available at: https://www.bloomberg.com/opinion/articles/2024-01-10/magnificent-seven-risk-runs-through-tsmc-and-taiwan-s-election

Lee, I. (n.d.). Bloomberg – Magnificent Seven’ Warning, IPO Return Among BofA’s 10 Surprises on Wall Street. [online] www.bloomberg.com. Available at: https://www.bloomberg.com/news/articles/2024-01-09/bofa-warns-on-magnificent-seven-in-10-surprises-on-wall-street?srnd=undefined

Liu, E. (n.d.). The Magnificent 7 Are Larger Than Entire Countries’ Stock Market. [online] www.barrons.com. Available at: https://www.barrons.com/amp/articles/apple-tesla-nvidia-magnificent-seven-stock-market-8d355cb3

Fox, M. (n.d.). Here’s a complete rundown of Wall Street’s 2024 stock market predictions. [online] Markets Insider. Available at: https://markets.businessinsider.com/news/stocks/2024-stock-market-investment-outlooks-wall-street-prediction-roundup-sp500-2023-11

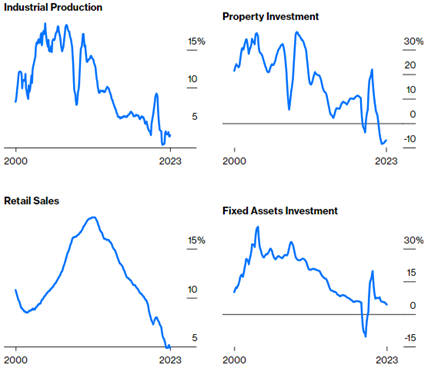

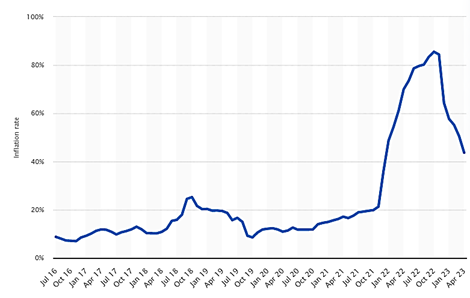

Figure 2-6M Moving Average of YoY Growth Metrics (Bloomberg Data/Bloomberg.com)

Figure 2-6M Moving Average of YoY Growth Metrics (Bloomberg Data/Bloomberg.com)

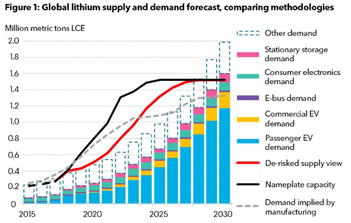

The question in many investors are pondering is with such a structural change emerging with Lithium and it’s strong future prospects, will these pockets of uncovered supply really put a dampening on the long term spot price or has the negativity amongst investors perhaps been overdone, with more use cases coming forward, can the scales of supply and demand equalise once again for Lithium as EV’s, Battery Storage and green energy increase in popularity and availability.

The question in many investors are pondering is with such a structural change emerging with Lithium and it’s strong future prospects, will these pockets of uncovered supply really put a dampening on the long term spot price or has the negativity amongst investors perhaps been overdone, with more use cases coming forward, can the scales of supply and demand equalise once again for Lithium as EV’s, Battery Storage and green energy increase in popularity and availability.