Author: admin@hottinger.co.uk

June Strategy Meeting: With rate cuts on the horizon, be careful what you wish for

by Rob Cloete

Regional monetary policy, prospects for future easing and the potential for divergent interest rate paths continue to dominate headlines and influence investor positioning. The Eurozone’s widely anticipated June rate cut unusually stole the march on the Federal Reserve, with policymakers willing to risk the adverse ramifications of a strong Dollar for the sake of averting a recession amidst lacklustre economic data. As attention turns stateside, the future path remains unclear, and further complicated by the upcoming elections and inclination for the Federal Reserve to remain unbiased. Meanwhile, the ‘risk on’ (short volatility) environment that’s been in place largely uninterrupted since October 2022 has contributed to lofty valuations across both equities and credit. This note seeks to determine whether hopes pinned on future easing to further drive valuations may be misplaced.

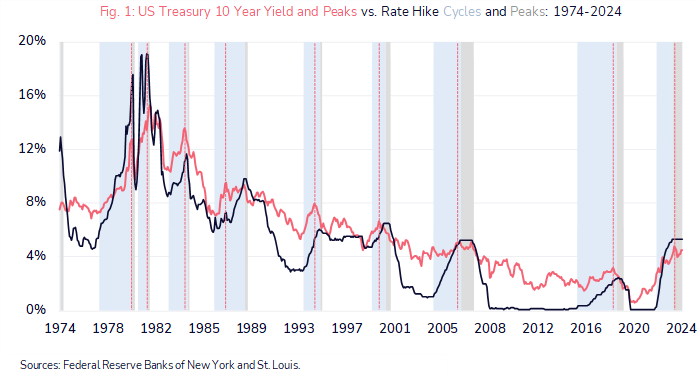

Figure 1 above reflects the relationship between the nominal 10-year treasury yield (coral line) and the policy rate. The vertical dotted lines illustrate that, the market being a future discounting mechanism, treasury yields typically peak during rate hike cycles (light blue bars) and prior to cycle peaks (grey bars). The Federal Reserve paused hikes in the current cycle in August 2023. Should the current level prove to be the cycle peak, then the ‘top may be in’ for treasury yields in this cycle. We remain constructive on duration and are positioned accordingly, not least due to the asymmetric prospective returns from convexity. A rate cut of 100 bps would result in a 12% appreciation in the 10-year treasury, while an equivalent rate rise would cause just a 3% decline. Elsewhere, while nominal yields on credit are optically attractive, with the US High Yield Index for example offering a yield to maturity approaching 700 bps, the spread over government paper is negligible at around 300bps (and near the bottom of the 300-900bps range since 2010 and some 200bps below the average over that period). Refinancing costs have declined, and the maturity schedule provides flexibility, but risk-adjusted compensation remains inadequate.

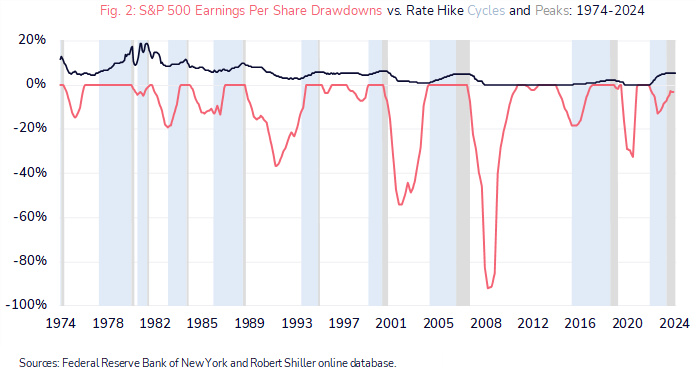

Figure 2 below shows that, contrary to popular opinion, a rate cutting environment may not support equities: rate cutting cycles have historically regularly preceded earnings recessions. The coral line reflects the S&P 500 earnings per share declines that have typically occurred during rate cycle ‘pauses’ (grey bars) and before rate cuts begin. With equity valuations currently elevated (a forward PE ratio of 21x, from which subsequent annualised ten-year returns have been paltry, ranging from 0% to 5% in data going back to 1988), the stakes are high. With multiples having expanded to the point that the risk premium over ‘safer’ investment grade credit is now negative, we maintain our view that earnings will need to do the heavy lifting if major equity indices are to continue their upward trajectory. On this front, there is cause for optimism, with FactSet consensus forecasts anticipating double digit earnings growth in each of the next two years (11% in 2024 and 14% in 20251). While constructive and selective with our equity allocation, we remain cautious, and conscious that stock markets have tended to peak in anticipation of rate cutting cycles (and not during them). Further, equity indices decline in advance of earnings declines, so we remain attuned to changes in earnings expectations as a warning signal that the prevailing ‘risk on’ environment – particularly in the more momentum driven pockets – may be about to turn.

Going forward, while wary of index levels and valuations, we continue to apply our bottom-up approach and valuation discipline to equity selection, exploiting the risk budget that safer allocations elsewhere (to government bonds, gold, and diversifying alternative funds exposures) permits us.

Sources:

1 Butters, J. (21 June 2024). FactSet Earnings Insight. [online].

Available at: https://www.factset.com/earningsinsight

2 Federal Reserve Bank of St. Louis. ICE BofA US High Yield Index Option-Adjusted Spread. [online].

Available at: https://fred.stlouisfed.org/series/BAMLH0A0HYM2

June Investment Review: “Risk – on” driven by Mega Tech

by Tim Sharp

Global equities had a strong May gaining 4.2% after losing 3% in April with US markets once more leading the way as markets turned “risk-on” largely driven by positive corporate earnings. Technology was the strongest sector up approximately 8% and the “Magnificent 7” gained 10%[i] with the main catalyst being Nvidia with another set of outstanding results. Energy, Autos, and Travel were the weakest sectors as energy and discretionary sectors underperformed. US equities gained 4.8% while Europe added 2.6%, and a weaker dollar assisted emerging market equities to a positive result, +1.95%.

Following the release of the results for Nvidia, the stock gained 7.8% in after hours trading which equates to an increase in market capitalisation of approximately $182 billion[ii]. At a capitalisation of $2.7 trillion it remains marginally smaller than Apple and Microsoft and represents 5.8% of the S&P500. In recent history Nvidia has led the market direction, however, its good fortune failed to lift the wider market on this occasion. There is a disconnect between the reported results of the big seven and the wider market leading to total index earnings rising 7% in the US and falling 5% in Europe although earnings were actually expected to fall 10%.[iii]

The correlation between stocks and bonds turned positive in the month with global bonds gaining 0.9% in dollar termsiii. Gilts were buoyed by weaker inflation due to the changes in the energy bill price cap and positive comments for the prospect of lower rates in late summer. Despite, guidance from European Central Bankers that policy rates were likely to be cut in June, this likely move has been well flaggedi, and we believe largely priced in to markets thereby leaving European government bonds flat on the month. In line with “risk-on” credit markets were positive and spreads tightened marginally with many investors we see attracted to the overall yield on bonds instead of being put off by historically tight spreads available in main markets.

The prospect that developed economies have reached peak rates and most will be looking to cut this year has added a tailwind to listed property (+3%) and infrastructure (+6%) where we feel valuations have reached very attractive levels in certain sectors.

Central bankers and, therefore, investors continue to be data dependent as they look to forecast the future path of interest rates. The US Personal Consumption Expenditure Report (PCE) is the Fed’s preferred inflation gauge, and it reported a 0.3% gain in April as expected while the core rate was +0.2%. This will do little to guide markets so we will look towards the next round of central bank meetings in June to provide any change to perceptions. Currently the ECB is likely to move in June, we see markets currently pricing in a move in the UK in August and only 2 cuts in the US later in the year. Investors will scrutinize the press releases following the June FOMC meeting for clues as to the Feds views on inflation and the economy with some economists predicting the first cut in September.

After much speculation, UK Prime Minister Rishi Sunak called the date of the UK General Election as July 4, 2024, even though the Labour Party looks to have a 20-point lead leaving the Conservatives with an uphill task to win a majority. Both the major parties are looking to convince financial markets of their fiscal prudence with commitments not to raise income tax, corporation tax, or National Insurance which will severely limit any new government’s flexibility to tackle problems seen within the NHS or immigration. The UK still has a very tight labour market and a low participation rate since the pandemic compared to other developed economies and plans to increase competitiveness and convince markets that they are pro-business will be an important policy exchange during campaigning. Consumer and business confidence remains low despite high savings rates perhaps pointing to a lack of stability in recent times with five changes of primes minister during the last fourteen years. Perhaps a prolonged period of stability following the election result will support a recovery in the UK economy and UK financial markets.

[i] Ward_Murphy _ Zara _ Absolute Strategy Research _ Investment Committee Briefing _ June 3, 2024

[ii] Authers _ John _ Bloomberg Opinion _ Points of Return _ May 23, 2024

[iii] CIO Office _ Edmond de Rothschild _ Monthly Market review _ May 2024

May Strategy Meeting: Financial Economy Strong, Real Economy Sluggish

by Rob Cloete

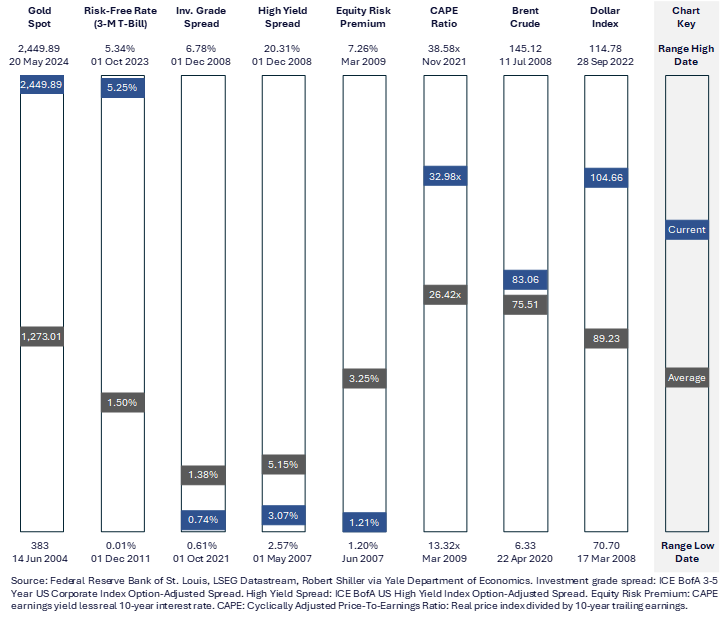

Halfway through the second quarter, ongoing geopolitical uncertainty, institutional mistrust, and elongated rate cut expectations have contributed to an unusual combination of a high nominal risk-free rate, gold and Dollar strength, buoyant oil prices and government bond market weakness. Against this fragile backdrop, underpinned by rising global liquidity and despite further but moderating weakness in leading economic indicators, risky asset classes have rallied: equity risk premia and credit spreads have compressed, especially in developed markets.

Figure 1: Market Landscape – Gold, Rates, Spreads and Valuations at 20 Year Extremes. Is this sustainable?

With the Federal-Funds rate close to a 20-year high at the time of writing and the three month T-Bill representing gold’s opportunity cost – in the form of yield foregone – it’s unusual to see the gold price near a 20 year-high as well, especially with rate cut expectations moderating (currently two expected by year end, down from five as we entered 2024). Gold’s robust performance is partly attributable to relentless central bank buying: global official gold reserves rose by 290t in 1Q24, a record, with the People’s Bank of China accounting for 27t of this as gold now represents 4.6% or c.$160bn of China’s total reserves (2014: 1.1%). Over the past decade, China’s official holdings of US Treasury Securities have declined by almost 40%, from c.$1.3tr to less than $800bn, as sustained de-dollarisation continues. Over the past decade, the proportion of federal debt held by foreign and international investors has declined from 34% to 24% now, while central bank holdings of gold have grown from 32t to 36t. Going forward, these trends represent a structural, price insensitive bid for gold, and a headwind for treasuries.

While policy rate forecasts have dominated the headlines, liquidity provision has expanded behind the scenes, increasing monetary flows into financial markets, and supporting asset price appreciation. Michael Howell of Crossborder Capital estimates global liquidity, underpinned by central banks, collateralised lending, and cross-border flows, at c.$173tr (vs. 2023 global GDP at $101tr, per the World Bank). The current upward cycle commenced in October 2022 (troughing at c.$160tr) and is expected to peak in late 20251. Following a contraction in April – coinciding with a challenging period for risky assets – conditions are again supportive, with the latest weekly reading at +0.6% m/m. However, recent multiple expansion in the equity markets has compressed the equity risk premium to 20-year lows, elevated the CAPE ratio to within the top 4% of all readings back to 1881 (surpassed only by 2021, 2000 and 1929), and outpaced global liquidity. This has historically presaged a near-term correction.

Going forward, we believe that policymakers will continue to be accommodative where possible, although the US fiscal situation continues to deteriorate: gross federal debt of $34tr as of March 2024 represents 120% of GDP, a federal deficit of -6.2% to GDP, and annualised debt service costs of $1.1tr against federal receipts of $4.4tr (more than half of which comprises politically-sensitive individual income taxes). This burgeoning indebtedness is further exacerbated by the escalating monthly effective interest rate, which has almost doubled from 1.7% to 3.2% since in April 2022, as recent issuance has been dominated by short-dated T-bills and more frequently rolled in a rising rate regime. While the benign inflation environment and rate hikes implemented thus far afford the policymakers some flexibility, cutting rates too soon risks stoking inflation, prompting reactionary rate hikes and, critically, imperilling the Federal Reserve’s ability to service and rollover its debt. In the meantime, growing liquidity provision drives fiat currency debasement, debt monetisation and asset price – as opposed to economic – inflation, while underpinning demand for gold as a store of value.

Putting all of this together, our current view is that the ongoing combination of increasing liquidity, moderating inflation, modest economic and corporate earnings growth, and policy inertia stateside as the elections approach, should continue to broadly support asset prices. Given valuations, however, we remain modestly underweight equities (prioritising quality companies that have the potential to perform robustly in a range of economic environments) and overweight bonds, prioritising short-dated high-quality liquid assets while limiting duration and credit exposure. We maintain positions in commodity-exposed equities and gold, as hedges against a resurgence in inflation and further sustained monetary debasement, respectively.

Sources:

1 Howell, M. (14 May 2024 and 21 May 2024). Global Liquidity Watch: Weekly Update. [online].

Available at: https://capitalwars.substack.com/

April Market Review

by Tim Sharp

Some of the froth was blown away in April as investors became more cautious about a plausible “no landing” in the US and US interest expectations were trimmed further to less than two cuts in 2024 causing the US Treasury yield to test 5% during the month once more. Global equities fell 3.85% over the course of the month in dollar terms, with the S&P 500 down -3.97%, Eurozone -3.22%, and the Nikkei 225 -3.51%.

We have suggested in previous publications that after the multiple expansion of 2023 companies would need to justify equity valuations with earnings during 1st quarter 2024. As we reached the end of April approximately 55% of the S&P 500 had reported with earnings beating expectations by 8.4% versus an historical average of 4.8% and 6.9% recorded last quarter[i]. Earnings surprises are not uncommon, with guidance usually tactically reduced ahead of reporting season. However, this has been less prevalent this quarter; leading to improving outlooks and positive adjustments to Earnings-Per-Share growth.

Our base case this year centred on a broadening out of returns, this began in March and continued into April. Although we think AI is an enduring theme, Meta Platforms results were accompanied by a warning from Mark Zuckerburg that to make the most of the opportunity, the company would need to spend significantly, and the benefits may take longer to reach fruition[ii]. Valuations amongst “Mega Tech” have reached stretched proportions and this might mark the point where a little realism takes hold. A broadening out of returns does not necessarily mean there has to be a downward adjustment in “Mega Tech” but perhaps a period of underperformance may release some pressure on valuations assuming earnings releases to come do not justify valuations.

The broadening out of returns has seen better performance for emerging markets and the UK. A value-based bias, along with a high proportion of overseas earnings has helped UK equities to an outlying position of +2.43% on the month. Rather surprisingly UK equities are now outperforming the NASDAQ Composite year-to-date in price terms 4.99% versus 4.31% as the valuation gap between the major indices narrows favouring markets in deep value territory such as the UK.

Central Banks remains a key focus for markets. It is widely expected that Federal Open Market Committee May meeting will leave rates unchanged. However, signalling around the future trajectory of rates will be closely followed as markets re-calibrate rate cut expectations. The outlook for rates was dealt a blow by the US Employment Cost Index Report for Q1 on the last day of the month which rose 1.2% versus 0.90% in Q423. Private industry saw compensation rise 1.1% and state workers 1.3% suggesting that although job openings are stabilising, wages are still running hot in the US. The importance of a more hawkish stance from the Fed, and the increased risk of inflation rising to financial markets was reflected in equity markets which saw the S&P 500 fall 1.57% and the NASDAQ 2.04%. on the day. We note US headline and core consumer price index inflation were hotter than expected for the third consecutive month at 3.8% and 3.5% respectively despite PMI’s missing expectations to the downside.

Further proof of a global pickup in economic activity saw European, UK, and Japanese PMI’s beat expectations. European GDP has turned a corner after weakness in Germany for most of last year. 1st quarter GDP in Germany and France grew 0.8% on top of growth of 1.2% and 2.8% in Italy and Spain. The European Central Bank (ECB) has been guiding towards a first rate cut in June, and we believe the case for rate cuts in Europe and the UK is stronger than it is in the US although such a move is often constrained by foreign exchange considerations. The Dollar Index continued to build on a stronger 1st quarter to gain another 1.6% against a basket of its largest trading partners in April, a situation that will certainly be considered at the May meetings of the ECB and Bank of England.

Additionally, The Bank of Japan’s decision to leave rates on hold at 0.00% in April coincided with the Japanese Golden Week holiday and in less liquid markets the Yen fell to ¥160 versus the dollar. This is likely a function of pressure created by the interest rate differential to the US. The weakness was short lived, with the currency rapidly strengthening back to ¥154.50 in an unconfirmed sign that the Japanese authorities had intervened. Intervening when volumes are low is a tactic that has been used in the past to maximum effect with signs that $20bn – $35bn of dollar reserves had been utilized, as reported by the Financial Times, although the Ministry of Finance declined to comment. This would suggest that the Japanese authorities may have decided to draw a line at ¥160 versus the dollar but it remains to be seen if they defend this level, if necessary, in the future. Although a weaker currency is good for tourism and overseas profits, it clearly affects the cost of living, and domestic consumption when the BoJ is attempting to reflate the economy and boost economic activity.

In summary, developed equity markets have paused, reacting to quarterly earnings as they are reported, while inflation pressures build, and interest rate cuts are paired back by markets with the inevitable move higher in bond yields. There is little doubt that global economic activity has rebounded, and the US economy is still running hot, which should be supportive of risk assets. Against this backdrop the disinflationary path seems less certain and investors are adjusting expectations accordingly.

[i] Golub_Jonathan _ UBS _ US Equity Strategy _ Earnings Season: Half Time Report _ April 29, 2024

[ii] Murphy_Hannah_Financial Times_April 25, 2024 [Online]

Mark Zuckerberg defends Meta’s AI spending spree as shares tumble (ft.com)

GLOBAL INSIGHT Q2 2024

February Investment Review: Good Results Excite Investors

by Tim Sharp

A strong finish to the earnings season particularly mega tech, and especially Nvidia and Meta Platforms whose reporting took on almost macro-economic event proportions, saw equity markets continue generally higher in February. Sticky inflation continued to vex investors as markets pared interest rate cut expectations back further to only three cuts in the US this year which has caused further adjustment in bond markets. Despite a slightly stronger dollar Emerging Markets rallied 4.6% outperforming the developed world as China bounced strongly following central bank easing of lending rates. Japan remained a dominant force up 5.7% on the back of a weak Yen that finished the month at 150 vs. the dollar. The laggard amongst the major markets was the UK where equities were flat on the month despite resilient data although unable to avoid a technical recession in the latter part of 2023, while Europe which continues to flatline saw equities boosted by China to finish up 3.4%.

Nvidia once more reported earnings that were ahead of expectations in the 4th quarter with revenues up 265% to $22.1 billion vs. $20.4 billion expected guiding even higher for first quarter to rise to $24 billion vs. $22 billion consensus. The markets were unashamedly enthused pushing the shares up 16.4% the next day which was recorded as the largest change in market capitalisation of any stock, anywhere, ever, leaving the shares up 28.6% on the month, 59.7% year-to-date, while the wider S&P500 gained 5.2% in February. The CEO stated a surging global demand for accelerated computing and generative AI had hit a “tipping point” although there are some that believe that many Nvidia customers are over-stocking for fear of demand outstripping supply which may leave an inventory overhang later in the year. In any case the focus on the big 6 technology stocks continues to dominate returns with Meta Platforms also starting the month with bumper earnings. The performance of Meta Platforms following its results when it announced a 3% new dividend added $200bn to its market cap in one session, the equivalent of a gain in the total market cap of Cisco Systems – the darling of the 1999 technology stock boom.

Many active investment managers, including us, run strategies that include exposure to a diverse range of assets and asset classes quite often starting with an equally weighted positioning rather than concentrated in a small number of large positions. This kind of strategy would continue to lag headline indices while they are dominated by a small number of heavy weights even if we had exposure to these main stocks. This means that we must have a view on Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, and Nvidia, even if we do not intend to invest in them because of their ability to influence returns. There is a diverse range of forecasts for forward earnings for mega tech depending on the level of conviction which means that investors can view them as expensive, or fairy valued at today’s prices.

We have been adding to our software exposure this year viewing the mixture of innovation, cash flow generation, and low levels of debt as quality defensive in nature. Absolute Strategy Research (ASR) point out that Global Software has the best earnings momentum of any sector and a strong 4th quarter earnings season. The sector has the highest delivered EBITDA margins, seeing a rise of 4% over the last 12 months, sales outgrowing costs, strong profitability, and fast growth on a valuation of 28x forward earnings[i]. Elsewhere, the emphasis on quality defensives sees us continuing to favour Industrials, Energy, and Consumer Staples.

In terms of fixed income, it was reassuring in some ways to see the negative correlation between bonds and equities return as bond markets priced out aggressive easing of rates particularly in the US where Fed Governor Powell ruled out a cut at the March meeting during the post FOMC press conference. During the month US Treasuries fell 1.4% and the speculation spread to Gilts (-1.3%) and European Government Bonds (-1.2%) where the likelihood of a summer cut is perceived more likely due to the current negative growth environment. Whilst Eurozone Services PMI’s were stronger than expected, manufacturing was weaker, and services continue to outperform manufacturing in the UK too. UK inflation remains higher than other developed countries where headline and core CPI were 4% and 5.1% although lower than anticipated, while US inflation surprised on the upside at 3.1% and 3.9%. Japan and China complete the picture with Japanese Q4 GDP reporting a 2nd negative quarter to join the UK in technical recession while inflation continues to strengthen to 2%, and Chinese disinflation came in weaker than expected at -0.8% yoy[ii]. In summary, the resilience of the US economy is one of the reasons why global growth remains in positive territory presenting the Fed with a dilemma when it comes to the right time to ease monetary conditions.

Although the UK is in a technical recession i.e. back-to-back quarters of negative growth there are tentative signs of a pickup in activity as falling mortgage rates bring buyers back to the housing market pushing prices in January 1.3%, 2.5% yoy which is the strongest rate since 2022. The Business Activity Growth PMI rose to 54.3 vs. 53.4 in December in contrast to the manufacturing index which is affected by Red Sea traffic restrictions. Retail sales rebounded 3.4% in January after a record fall of 3.3% in December although volume of sales remains 1.3% below pre-pandemic levels of February 2020[iii]. Furthermore, the unemployment rate continues to fall, now showing 3.9% to November 2023. The BoE will be watching the path of inflation to try and balance growth and inflation with rate cuts. However, a flat stock market in contrast to the positivity in other developed markets is an indication of the hangover still being felt from Brexit trade restrictions, and the lack of growth stocks within the main indices leaving the UK unloved at present.

Overall, our reasons for caution have not diminished, and the markets readjustment of future rate moves while welcome are still optimistic compared to feedback from the Fed. The possibility of a soft landing is still on the cards although unprecedented in recent market history. The US consumer should not be underestimated, however, there are signs in data and delinquencies that higher rates may be affecting areas of consumer credit notably auto loans and credit cards. US equities appear at a stretched valuation relative to the UK, Europe, and Emerging Markets, but the drive in technological innovation is likely to be reflected in US indices where weightings to growth sectors are higher than elsewhere meaning that US exposure may remain key to future returns.

[i] Nelson, Nick _ Absolute Strategy Research _ Equity Strategy _ Upgrade Software and Telecoms_ 29/02/2024

[ii] Ward-Murphy, Zara _ ASR Investment Committee Briefing _ 01/03/2024

[iii] Razi Salman _ Barclays Private Bank Daily Talking Points _ 16/02/2024

January Investment Review – Priced for Perfection

by Tim Sharp

Following a strong December “Santa Rally” in equities and a high level of positive correlation between asset classes, financial markets started the year priced for perfection in central banks execution of a perfect soft landing. Q4 earnings season is proving to be generally positive with disappointments harshly treated as the differing fortunes of the “Magnificent Seven” reporting again testifies to a market that needs to justify its current position. Japan was the best performing major market gaining 7.8% in Yen terms while China and Hong Kong were still deep in negative territory. A market perception of strength surrounding large global technology companies persists with the sector leading gains (3.0%), however, the main US indices, S&P500 (+1.6%) and the NASDAQ (+1.0%) performed inline with global equities (+1.2%) following comments from central bankers in the last days of the month. In the UK major equity indices fell 1.3% one of the weaker performances of major markets, as signs of inflation lingering, better flash composite PMI reading of 52.5 but a weaker consumer – retail sales fell 3.2% month-on-month, and no signs of an early rate cut weighed on sentiment. Incidentally, 2 members of the monetary policy committee still voted for another rate increase.

The month started strongly in the US with a robust December jobs report of 216,000 and a 4th quarter GDP figure of 3.3% annualised that solidly beat expectations. This led quite nicely into an FOMC meeting in the last days of the month where Chair Powell confirmed that a March rate cut was unlikely followed closely by Bank of England Governor Bailey saying likewise in the UK. As we have been saying, we believed that there was a disconnect between the robustness of the US economy, strength in financial markets, and the market forecasts for the future path of interest rates which was laid bare during central bank press conferences. This clearly had effects on government bond markets (-1.8%) that began to price out early moves in rate cuts leaving US 10-year Treasury yields sitting at 3.9% while the dollars fortunes turned positive with the dollar index gaining 1.9%.

The ongoing concerns regarding the outlook for China affected its equity market (-6.3%) and that of Hong Kong (-9.2%) not helped by the news that 2nd largest Chinese property developer Evergrande was ordered into liquidation following an 18-month Hong Kong court hearing where it failed to convince the court that it had a viable restructuring plan. Chinese 4th quarter GDP came in at 5.2% year-on-year in line with expectations which is still low by historical comparisons, and Central Bank attempts to add stimulus were considered ineffective. This performance had a telling effect on Emerging Market indices (-4.6%) and the wider Asia Pacific region dominated by the size of the Chinese economy.

We started the year observing that the number of potential holes in the road from geo-political risks were high this year and reports in January have not decreased the potential for macroeconomic surprises. Despite the targeted strikes on Houthi bases in Yemen, the attacks on shipping continue driving a major proportion of Red Sea traffic around the horn of Africa causing supply delays and significant increase in shipping costs. Rising tensions between the US and Iran, and the US and Israel are also concerning escalations in the continuing Gaza conflict that might threaten the wider global economy.

The potential for a soft landing in the US and the positive impact of implied rate cuts in 2024 we feel has been fairly reflected in financial markets and as such we remain mildly defensive. We believe that this would favour, amongst others, Industrials, Technology Software, and Consumer Staples and so it was notable that the worst performing sectors in January were Auto’s, Energy, Basic Resources and Real Estate. Although we remain slightly sceptical of valuations, and feel an element of caution creeping into markets, we continue to believe that attractive returns are available for long term investors through diversified, active management.

References

Nokes, Zara _ JPMorgan Asset Management _ Review of markets over January 2024

Ward-Murphy, Zara _ Absolute Strategy Research _ Investment Committee Briefing

Market statistics verified on Refinitiv Workstation

GLOBAL INSIGHT Q1 2024

Chart of the Week – One Major Positive & One Almighty Risk to Watch Out For in 2024

by Tim Sharp, researched by Jack Williams

One of the first events past the post of 2024 is the upcoming election in Taiwan which could have huge knock on effects for markets, the Magnificent Seven in particular…

With Taiwan heading to the polling booths on Saturday 13th January 2024, perhaps the main question for inhabitants of the small independent island is how they will choose to deal with China moving forward following heightened tensions between the democratic island and those whom have laid claim to the territory.

Lai Ching-Te from the pro sovereignty party is currently the favourite amongst voters, however the opposite could be said for how he is viewed by the Chinese Communist Party (CCP) who have laid claim to Taiwan and increased both tension and activity in the straight bordering of the island in recent years.

It is worthy to note, we do not foresee an immediate military response similar to some of the nightmare scenarios being peddled by various media outlets and on social platforms, however it could have an interesting consequence for developed markets such as the US, and particularly the Magnificent Seven.

Bank of America issued a report on the 9th of January 2024 where the firm detailed its ‘Biggest Surprises to Brace for this Year’, saving the pole position for geopolitical risks to Magnificent Seven stocks and US equity markets.

The Magnificent Seven have dominated markets this year, ultimately responsible for nearly two thirds of US500 Index gains in 2023 and helping propel the Nasdaq higher by 43.4% to close out its biggest annual rise since 2020.

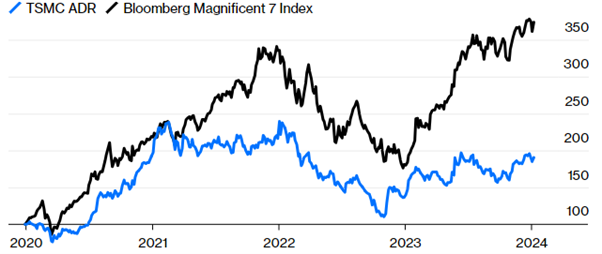

These well performing names are not without risk, and it is their concentration and correlation which becomes problematic. All of the Magnificent Seven names rely heavily on Taiwan for it’s business. Companies such as Amazon, Apple, and star of the market last year, Nvidia (+234% LTM) are all super exposed to Taiwanese Semiconductor manufacturing companies such as TSMC whom build their next generation chips needed.

This overdependence has seen stock concentration between the Magnificent Seven and Taiwanese manufacturers such as TSMC rise to an all-time high of 66%. This concentration poses significant risks, amplifying vulnerabilities in the supply chain and potentially impacting wider technology markets.

Figure 1 – Correlation of MAG7 to TSMC Reaches ATH of 66% (Bloomberg)

With the Magnificent Seven also currently holding a record share of the US market (not helped by market cap weighted indices) this leaves the entire US stock marker severely responsive to any complications to the supply of semiconductors

Figure 2-Mag Seven MCap Compared to Nations (Source: Factset)

To emphasise the scale of this concentration within markets the Magnificent Seven’s combined Market Cap eclipses the stock market capitalisation of Canada, Japan and the U.K….Combined!

But it is not all doom and gloom! Over the past 90 days Wall St analysts have cut their targets for Q4 2023 earning estimates by far more than usual for this period, meaning a lower bar than expected could be in place and a potential surprise to markets further down the line.

With wider acceptance that the rally towards the end of last year resulted from premature excitement surrounding rate cuts in 2024, not as a result of accelerating corporate fundamentals, this leaves the prospect of a corporate recovery still on the table.

With analysts having cut earnings estimates for the US500 Blue Chip index by around 6% since early October, Edward Yardeni of Yardeni Research sees it as perhaps overdone and sees corporates in much healthier positions, setting his EPS estimate for 2024 US500 at $270, up $26.40 from the $244.60 EPS from last year.

Table 3-US 500 Returns Around End Of Fed Hiking Cycles (Goldman Sachs)

References:

www.zerohedge.com. (2024.) The Market Ear. Front running the ‘low bar’ | Zero Hedge. 09/01/2024 [online] Available at: https://www.zerohedge.com/the-market-ear/front-running-low-bar

Authers, J. (2024). Bloomberg News Magnificent Seven Risk Runs Through TSMC. [online] www.bloomberg.com. Available at: https://www.bloomberg.com/opinion/articles/2024-01-10/magnificent-seven-risk-runs-through-tsmc-and-taiwan-s-election

Lee, I. (n.d.). Bloomberg – Magnificent Seven’ Warning, IPO Return Among BofA’s 10 Surprises on Wall Street. [online] www.bloomberg.com. Available at: https://www.bloomberg.com/news/articles/2024-01-09/bofa-warns-on-magnificent-seven-in-10-surprises-on-wall-street?srnd=undefined

Liu, E. (n.d.). The Magnificent 7 Are Larger Than Entire Countries’ Stock Market. [online] www.barrons.com. Available at: https://www.barrons.com/amp/articles/apple-tesla-nvidia-magnificent-seven-stock-market-8d355cb3

Fox, M. (n.d.). Here’s a complete rundown of Wall Street’s 2024 stock market predictions. [online] Markets Insider. Available at: https://markets.businessinsider.com/news/stocks/2024-stock-market-investment-outlooks-wall-street-prediction-roundup-sp500-2023-11

December Strategy Meeting: Stocking Up on Returns: Riding the Santa Rally Into 2024

by Tim Sharp, Research by Jack Williams

Following three consecutive months of declines, November caught investors by surprise, delivering a notable rally in excess of 9% within global equity markets. This has primarily driven by a belief that the path of interest rates will be lower rather than higher going forward.

Technology related stocks have continued to lead the market higher, with the sector gaining 14% as the impact of falling interest rates is discounted. Energy was the market laggard, tracking underlying weakness in the oil price and souring economic sentiment.

The US took pole position in this push higher in markets, outperforming the rest of world in USD terms, while the U.K was the region with weakest performance with a question mark hanging over themselves as investors look to assess the viability and health of its economy.

Further demonstrating the impact interest rate expectations are having on the market, correlations amongst asset classes remains broadly elevated, with global fixed income rising 2.8%. In terms of global yields, the US and European curves saw a bull flattener and in line with the risk on mentality, credit spreads tightened. A bull flattener occurs when longer term rates fall faster than shorter term rates.

Having underwhelmed this year, real assets saw a rally as a result of low valuations and being highly sensitive to interest rates. Copper led industrial metals higher as sentiment warms ever so slightly towards China. The most outsized returns came from the areas that have been most punished over the past year, with real estate being the notable standout as investors seek to capitalise on the deep discounts available within the space. The strongest performing indices of the period (Brazil, Spain, Korea, and the Dax) are all closely linked to Chinese Demand. This may be a signal of growing investor appetite at the margins.

Inflation was the main narrative of the month with developed markets showing a sustained fall in inflation, with both US core and headline CPI coming in below analysts’ expectations at 3.2% rather than the 4% predicted. In the Eurozone CPI fell to 3.6% and 2.4% respectively, UK CPI fell to 5.7% and 4.6%, which while still falling at a fair pace, is behind the inflation curve seen in the US and EU.

In the US, robust consumers saw Q3 GDP revised higher, while eurozone PMI’s remained in contraction territory at 43.8 on the manufacturing side and services of 48.2. U.K composites surprised investors by moving into expansion territory (albeit ever so slightly) surpassing contractionary expectations with a reading of 50.1 compared to 48.7 expected.

While the debate between soft landing and mild recessionary outcomes continues, policy makers have struck a less hawkish tone in recent weeks. Our core view remains that we are likely to see an earnings recession in the US during 2024, although given the surprising resilience exhibited over the past 12 months, have modest conviction.

Companies do seem to be holding up fairly well considering the sheer pace of these rate hikes with balance sheets still looking robust, especially so in the large cap space however we note that smaller capitalised firms relying more heavily on bank finance may be prone to higher levels of risk.

Europe has been skating around recession throughout this year as it has faced significant headwinds. Combating energy security risks, high inflation brought on by the Ukraine conflict along with weaker Chinese demand. Our research partners A.S.R (Absolute Strategy Research) point out that structural issues could persist within the Eurozone region for a longer period with no solution on the table for Europe’s fiscal framework, furthermore the number of cyclical headwinds being experienced by the region could flatten growth over the coming year which would further complicate their current situation.

As a historically more cyclical market, Europe has been impacted by the ongoing weakness in China. The country’s shift from real estate led investment, to growth in manufacturing has proven more difficult than originally envisioned. This will have a knock on in terms of infrastructure spend, with reduced investment in construction through 2024. This could have implications for China’s medium term growth outlook.

Other emerging market nations have shown fierce resiliency in the face of a strong dollar and heightened US interest rates. We are still confident our that emerging market thesis holds and complements our existing Asia positions. GDP growth in Brazil, India, Indonesia, South Africa, and Turkey has been around pre pandemic levels due to them being further within the cycle than developed market peers. Due to being later in the cycle, this allows these nations who moved to combat rising inflation first, the earliest opportunity to emerge out the other side of this tightening cycle whilst still maintaining good levels of financial health and stability. We saw the weak US dollar through the summer capture the interest of investors towards Emerging Market nations, a return to a weak dollar as markets look forward to rates moving lower may well provide some strength to the sector.

US fiscal policy had been receiving closer attention in recent months. Significant budget deficits at a time of low unemployment, along with the impact of the Federal reserve becoming a net seller through quantitative tightening had been cause for concern. However, there is surprisingly no historical relationship between yields and supply. Current net new issuance of $750bn is in line with historical averages and there is nothing to suggest that when facing recession, the level of quantitative tightening is not amended. It would seem the anxiety was short lived, as the recent potential for the Federal reserve to pivot has dominated fixed income markets.

Gold has continued to perform well, despite a recent backdrop that would historically would have been unfavourable. Greater than anticipated declines in inflation have meant real rates – interest rates less the level of inflation – have been rising. One potential explanation is the uptick in central bank purchases of gold who are price insensitive. Additionally, heightened geopolitical tensions are likely to have driven a flight to safety. The positive trend could still yet continue for gold, if we see falling interest rates coupled with dollar weakness.

To the surprise of many – including us – the global economy has remained exceptionally resilient, despite the coordinated effort of central banks to cool inflation and temper demand. However, as the year draws to a close, our views on markets remain broadly unchanged. We continue to believe certain areas of the market are exhibiting exuberance and potentially vulnerable if the economic environment deteriorates materially.

In keeping with this, we continue to be positioned defensively, with a preference for higher quality companies, whose revenues, and earnings we believe to be far more resilient. Whilst we completely understand markets are forward looking, a significant positive impact from falling interest rates in 2024 has been reflected in the prices of both bonds and equities. A healthy dose of scepticism may be appropriate…!

Although our outlook remains cautious, we continue to believe attractive returns are available for long term investors through a disciplined and risk-controlled approach.

Hottinger Appoints New Chair

Hottinger Group is delighted to announce the appointment of its new Chair, Sarah Deaves.

Drawing upon her extensive background in the wealth management industry, Sarah brings a breadth of experience and a clear vision to Hottinger group. Currently MD of abrdn Financial Planning, Sarah previously served as CEO of Coutts and a wide range of other executive leadership roles across financial planning and wealth management. Sarah is well-positioned to steer our company towards continued excellence. Her strategic insights, coupled with her commitment to fostering collaboration and driving innovation, will undoubtedly increase our organization’s capabilities and market presence.

Mark Robertson CEO Hottinger Group said “With a proven track record of dynamic leadership and innovation, Sarah is poised to support our strategic objectives as we embark on an exciting new chapter in the group’s history.”

Sarah Deaves said “I am excited to be joining Hottinger Group as its first independent chair and to be working with the Board on this next important growth phase”.

Hottinger Group warmly welcomes Sarah to this important new role as its Chair.

October Investment Review: The Paradox of Irresistible Force

by Adam Jones, Researched by Alex Hulkhory

As a foreword to this month’s investment commentary, we wanted to acknowledge the ongoing crisis in Israel and Gaza. Whilst we would never want to downplay the immeasurable social and humanitarian costs of the hugely tragic events over the past month, this is not our area of expertise. In our role as custodians of our clients’ assets, our focus is always through the lens of how any events are likely to impact global asset markets.

Much of last month’s blog centred around inflation, and the ongoing risks this presents to asset prices. Although this remains an important issue, as with markets, our attention this month is focused on the ongoing strength of the US economy. In our view, consumers globally have faced increasing headwinds as extreme inflation and rising interest rates have – in theory – reduced their spending ability.

Unstoppable force, meet immovable object.

Post the Global Financial Crisis in the era of ultra-loose monetary policy and quantitative easing, the old edict “don’t fight the fed” became almost gospel to many market participants. In short, the path of monetary policy drives the overall performance of risk assets. Indeed, against a backdrop of significant tightening in 2022 this adage rang especially true. Asset prices – not just equities – suffered significantly.

Investment markets are forward looking and beyond the impact of changing discount rates, we saw the idea of an impending recession in 2023 creeping into the minds of investors. In our view, this was one of the most widely anticipated recessions in modern history. [i]Bloomberg economics had predicted a 100% percent probability of a US recession by October 2023. Comparing this to the latest figures released by the [ii]Bureau of Economic Analysis, which showed US GDP accelerated to an annual rate of 4.9% in the third quarter of 2023, something doesn’t quite add up…

The investment truism “never bet against the American consumer” has returned to the fore with a bang. We can certainly include ourselves in the list of market participants that have been surprised by the ongoing resilience of US consumer spending. In our view, this strength has been the backbone that has propelled equity markets and US GDP this year. One potential explanation has been the level of COVID savings that were accrued whilst we were all in lockdown. However, we feel this is finite and there are clear signs the US consumer is beginning to feel the pinch. The personal savings rate [iii] continued to decline through September, falling to a rate of 3.4%. Whilst we are inclined to side with the Fed, only time will tell who will win out in this battle.

What’s been happening in markets?

October heralded Q3 earnings season, an eagerly anticipated look into many of the big tech names that have propelled markets. Touching on the colloquially named ‘Magnificent 7 (The tech-focused, seven largest constituents of the S&P500), we felt that broadly their earnings were impressive. However, it was perhaps an insight into just how high expectations – and valuations – have become!

Alphabet, the parent company of Google, was an excellent example of this. Despite delivering a meaningful [iv]beat on both earnings and revenue, the stock was punished with a bruising 9.5% fall on the day of results. This was also evident for the companies delivering exceptional results with, at best, anaemic upward movements.

This weakness was also reflected in the broader markets with the [v]S&P500 joining the Nasdaq in official correction territory from the highs reached earlier this year. October was a difficult month for markets generally, with most asset classes delivering negative returns. One particular standout was [vi]gold, up 7.4% over October. As a safe-haven asset this reflects recent increases in geo-political tension.

Looking slightly closer to home it was difficult month for the UK market, which was down more than 3% over October. This may in part be driven by sector composition. Energy is not an insignificant component of the UK market and the sector fell by 8.7% over the month. The economic back drop also remains challenging with [vii]ASR’s Nowcast showing continued deceleration along with PMI’s firmly below 50. In our view, one saving grace is that equity valuations here in the UK remain among the most compelling in the global equity universe.

Return of the bond vigilantes…

Another interesting development has been taking shape in bond markets over the past month. Longer dated bond yields have continued to climb, with US 10-year treasuries almost touching 5% on the October 19th. Despite the implied equity risk premium – the extra return investors demand for holding risk assets relative to government bonds – being at near [viii]historic lows of only 30bps, markets have been unwilling to purchase treasuries en masse. This has no doubt been exacerbated by the current Fiscal position in the US where significant deficits exist alongside exceptionally low levels of unemployment, which we believe to be an unsustainable aberration over the long term.

Given significant levels of indebtedness, large fiscal deficits and an apparent desire to reduce the scale of public sector balance sheets an important question is being asked by markets. Who, ultimately, is going to buy the bonds that DM governments so clearly need to issue? With the need for issuance to cover significant government spending over the coming years, in our view there have been growing fears that yields may have to move meaningfully higher for demand to meet supply. This could partly explain why investors’ appetite for bonds has been lacklustre despite their apparent attractiveness relative to riskier assets such as equities.

Whilst we have seen yields come down at the margin, we expect investors to be more sensitive to changes in fiscal policy and the resulting issuance as we move forward. The “Bond vigilantes” – a term famously coined by Economist Ed Yardeni to describe fiscal hawkishness by markets – are back!

How have central banks responded?

In a break from the new normal, central banks broadly left rates unchanged this month. Much of this is wanting to assess the impact of the rises we have seen over the past two years. However, the previously highlighted [ix]rise in bond yields will also have a meaningful impact in tightening financial conditions, doing a lot of work on behalf of the major central banks.

In what was largely seen as a sleepy month for policy makers, the Bank of Japan provided a point of interest. With the Japanese Yen trading below ¥150 to the dollar – the historic level at which the BoJ has intervened – many had speculated that we could see a shift in policy. [x]Given its influence on global bond markets this could have especially meaningful consequences, particularly if this drew significant levels of liquidity out of bond markets!

References:

[i] https://www.bloomberg.com/news/articles/2022-10-17/forecast-for-us-recession-within-year-hits-100-in-blow-to-biden?leadSource=uverify%20wall

[ii] https://www.bea.gov/news/2023/gross-domestic-product-third-quarter-2023-advance-estimate

[iii] https://www.bea.gov/data/income-saving/personal-saving-rate

[iv] https://www.barrons.com/articles/alphabet-google-earnings-stock-price-4890483f?mod=md_stockoverview_news

[v] https://www.ft.com/content/839d42e1-53ce-4f24-8b22-342ab761c0e4

[vi] Absolute Strategy Research Investment Committee Briefing – October 2023

[vii] Absolute Strategy Research Investment Committee Briefing – October 2023

[viii] https://www.reuters.com/markets/rates-bonds/soaring-treasury-yields-threaten-long-term-performance-us-stocks-2023-10-26/

[ix] https://www.reuters.com/markets/us/fed-poised-hold-rates-steady-despite-economys-bullish-tone-2023-11-01/

[x] John Authers – points of return 31/10/2023

Chart of the Week – The Widening Dispersion Between Big Tech and the Wider Tech Sector

by Tim Sharp, researched by Jack Williams

In the backdrop of this year’s notably narrow equity market performance, investors are meticulously scrutinising the latest earnings per share (EPS) estimates and revisions from analysts. This heightened vigilance stems from the increasing confluence of contradictory data, further exacerbating the intricacies of an already complex market backdrop. Even seasoned investors find themselves unsettled by these developments as underscored by the recent remarks of prominent investor and trader, Paul Tudor Jones. In a recent interview with CNBC, Jones said that the current geopolitical landscape presents an unprecedented and formidable challenge, characterizing it as potentially the most threatening and challenging environment he has ever encountered.

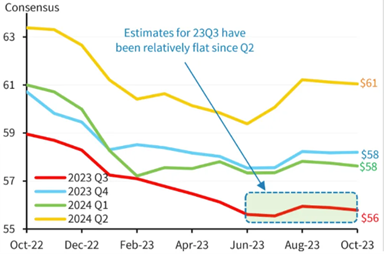

However, following a series of negative revisions earlier in the year, EPS estimates for Q3 2023 have remained relatively flat since august, holding steady into the print. The wider US market has fallen 4% over the same period.

Figure 1: Refinitv Data, Bloomberg, Barclays Research

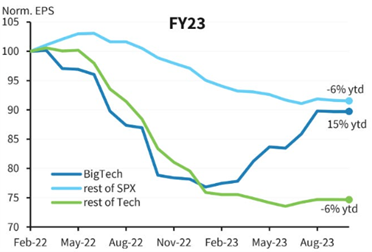

When looking at revisions, there is a widening disparity between big cap technology stocks and the rest of the market. Big cap technology EPS has been revised up 15% YTD while the remainder of the US500 blue chip index showing downward revisions of -6% YTD. In a particularly confusing fashion, there is a vast difference between Big Tech EPS revisions and those seen in the wider tech sector, of which are expected to decline by -6% alike the US500 index.

Figure 2: EPS Revisions 2024, Barclays

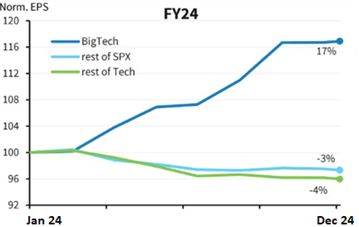

This gap in outlook continues into 2023 where big cap tech earnings are expected to rise by 17% compared to -3% for the wider US500 index and -4% for the wider technology sector.

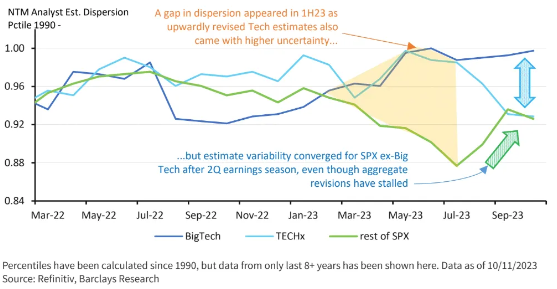

As shown in the chart below, dispersion of analyst forecasts remains high for big tech, but has converged for the rest of the US500.

Figure 3:EPS Revisions 2023, Barclays

Depicted in the chart below, you can see the dispersion of analyst forecasts over the past 18 months. A gap in dispersion emerged, albeit narrow, in H1 23’. This was caused by a convergence of macro uncertainties, combined with upwardly revised tech estimates leading to the AI/Tech fuelled rally which pushed indices higher as companies like Nvidia upgraded their outlook. The rest of the market did not enjoy such an uplift, instead seeing downward revisions. Although the wider technology sector enjoyed positive revisions till May of 2023, the sector (ex-big tech) has seen revisions since, leading to the widened gap shown below.

Figure 4:Dispersion of Analyst Forecasts (US500) Barclays

Bibliography

Chartbook, D. (2023). Daily Chartbook #303. [online] www.dailychartbook.com. Available at: https://www.dailychartbook.com/p/daily-chartbook-303

Squawk Box, C. (2023). CNBC Transcript: Tudor Investment Corporation Founder & CIO Paul Tudor Jones Speaks with CNBC’s ‘Squawk Box’ Today. [online] CNBC. Available at: https://www.cnbc.com/2023/10/10/cnbc-transcript-tudor-investment-corporation-founder-cio-paul-tudor-jones-speaks-with-cnbcs-squawk-box-today.html.

Research, B. (2023). Barclays Research – Food for Thought: A Convergence in Dispersion. [online] live.barcap.com. Available at: https://live.barcap.com/PRC/publication/CL_TEJ-IH4gfiB-IH4g_652824d5cc762f71f409aaee.

Research, B. (2023). Barclays US Equity Research – Food for Thought: A Divergence in Dispersion. [online] live.barcap.com. Available at: https://live.barcap.com/PRC/publication/CL_TEJ-IH4gfiB-IH4g_64b07d22a652195b94c79464.