Author: Tim Sharp

Researcher: Jack Williams

Published: May 18, 2023

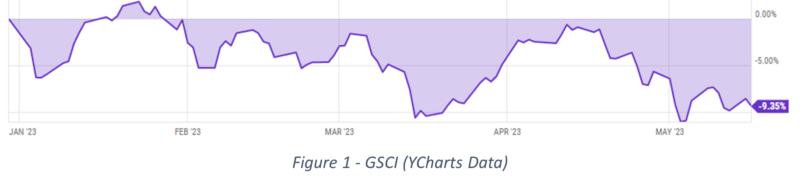

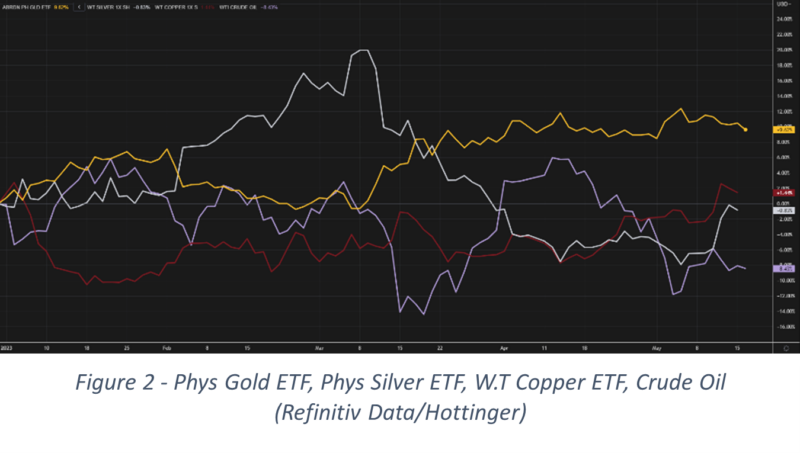

In this week’s Chart of the Week, we examine the recent performance disparity between copper and gold, two key commodities, within the context of the current global economic environment. While the overall Goldman Sachs Commodity Index (GSCI) has experienced losses of approximately 30% over the past year, certain commodities within the index have demonstrated strong returns, fuelled by the prevailing high inflation and uncertainty. This study aims to elucidate the drivers behind the contrasting performance of copper and gold by delving into the factors that influence their respective prices.

Copper’s Underperformance

Despite the positive economic growth forecasts, particularly those for China, which exceed 5% in terms of economic expansion, copper’s performance has surprised many investors. Given copper’s extensive use in construction, electrical equipment, wiring, and manufacturing, its price movements are closely tied to global economic growth and investor sentiment. However, the present climate of heightened global uncertainty surrounding economic growth in the US, Eurozone, and UK does not bode well for copper. As a result, the anticipated rise in copper usage, which would tip the supply/demand balance in favour of investors, has not materialized. Consequently, copper has lagged gold in terms of returns.

Copper vs. Gold: The Role of Cyclical Stocks

The performance of copper and gold is intricately linked to cyclical stocks, exhibiting a correlation of 76%. Cyclical industries, such as manufacturing, construction, automotive, heavy machinery, and infrastructure development, are heavily influenced by the overall economic cycle. During periods of economic prosperity, these industries thrive, while economic downturns pose challenges for them. Copper, being closely associated with economic growth, is often used as a leading indicator of economic health. An increase in copper prices and demand signals optimism regarding future economic growth. Conversely, gold’s performance is driven by factors such as central bank policies, inflation and currency fluctuations (particularly in the context of a weak dollar), economic and political instability, and investor sentiment.

Gold’s Strengths

Gold, traditionally regarded as an inflation and war hedge amongst investors, has regained its appeal as such due to recent developments. Central banks, grappling with historically high and persistently sticky inflation, have raised interest rates to curb rising prices. Additionally, ongoing geopolitical tensions, including the war in Ukraine, escalating China-Taiwan tensions, and deteriorating relations with Western nations, have heightened economic and political instability to levels not witnessed in recent times. These factors have significantly favoured gold investors, as the precious metal is perceived as a ‘safe haven’ in times of uncertainty.

Summary

In brief conclusion, the substantial underperformance of copper compared to gold can be attributed to the global economic climate and the nature of the commodities themselves. Copper’s price movements are closely tied to economic growth and investor sentiment, making it susceptible to the prevailing uncertainties. On the other hand, gold’s performance is driven by a range of factors, including central bank policies, inflation, geopolitical tensions, and investor sentiment. Given the present economic landscape characterized by uncertainty, high inflation, and geopolitical risks, gold has outperformed copper and lived up to its status as an inflation and war hedge, at least for the time being. These findings highlight the importance of analysing the drivers behind commodity price movements and considering the broader economic and geopolitical context when making investment decisions.

Sources:

S&P GSCI Total Return Performance & Stats (ycharts.com)

https://ycharts.com/indicators/gold_price_london

RefinitvData/Hottinger (ABRDN Physical Gold x WisdomTree Copper x Wisdomtree Silver x Crude Spot Price)

RefinitivData/Hottinger Gold Spot Price – 5yr

S&P GSCI Total Return Performance & Stats (ycharts.com)

https://www.bullionbypost.co.uk/price-ratio/gold/silver/10year/

https://www.xe.com/currencyconverter/convert/?Amount=1&From=USD&To=GBP

LME Copper | London Metal Exchange

Our investment strategy committee, which consists of seasoned strategists and investment managers, meets regularly to review asset allocation, geographical spread, sector preferences and key global market drivers and our economist produces research and views on global economies which complement this process.

Our quarterly report presents our views on the world economic outlook and equity, fixed income and foreign exchange markets. Please click the link to download.