Primed for a New Bull Market After Breaking 15+Year Trendline?

Author: Tim Sharp

Researcher: Jack Williams

Published: July 28, 2023

Developed economies have recently surprised on the upside following a long streak of losses causing Latin America to fall off the radar for many investors. However, these markets may be at a pivotal point and could be headed for brighter days ahead. The MSCI Emerging Markets Latin America ETF chart above depicts a sustained fall in price since its peak in 2008, declining from over $5200. Each candlestick in the chart represents one month’s worth of price action.

The blue trendline illustrates the “slow puncture” effect witnessed in these markets over the past 15+ years, as capital gradually withdraws from the region. We believe Latin American Equities may be at a significant turning point, as future catalysts, current conditions, and our global outlook aligns, creating what some investors may describe as the perfect storm for Latin America. This month, bulls have broken through the long-term negative trend, turning heads investors heads as the case for LatAM builds.

In this article, we delve into a few interesting reasons why particular attention is being paid to this region as of late.

Inflation:

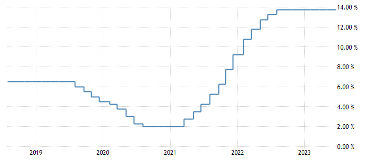

Inflation is a critical factor that cannot be ignored. Latin American countries have more experience in dealing with high and sticky inflation compared to most developed markets in recent history, having tackled numerous bouts of high level inflation. Learning from past experiences, central banks in the region took proactive measures to counteract its effects, aggressively hiking rates at a rapid pace. Brazil’s base rate rose from 2% in 2020 to the current level of 13.75%, which has been maintained for the seventh consecutive meeting (June 2023).

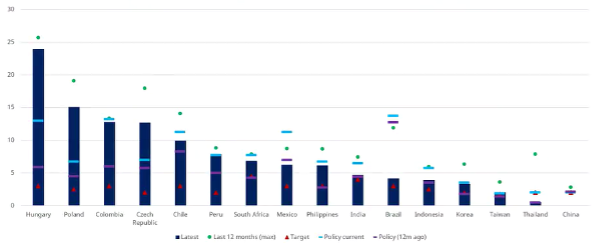

The chart above illustrates the easing of headline inflation while monetary policy has tightened across emerging market nations. The dark blue bar represents the current level of inflation, with the green dot showing peak inflation over the past 12 months. The cyan-coloured dash indicates the current level of monetary policy (e.g., Brazil at 13.75%), while the red triangle represents the target level of inflation. Additionally, a purple line shows monetary policy twelve months ago, revealing a push upwards and rapid decline in inflation well below peak levels for LatAM nations and in a much better place to cut rates sooner than most developed markets. At the current time of writing, Chile is expected to cut rates by 75bps following a 9 month hold at a rate of 11.25%, other nations are expected to follow suit in the coming months.

The US Dollar has shown notable weakness in recent months, as depicted in the sterling USD pairing chart below, showing that since October’s mini-budget debacle, sterling has outpaced the greenback.

A similar story can be observed when looking at Latin American currencies, such as the Brazilian Real, charted against the MSCI Latin America Index. The USD/Real chart shows that as the USD peaked, the Brazilian Real’s strength took over, leading to an upward march in the MSCI Latin America Index.

Onshoring:

Onshoring or reshoring is a relatively new concept that has gained traction due to global tensions. It involves moving key components, materials, manufacturing hubs, and business infrastructure closer to home for businesses. The move towards onshoring has been driven by growing tensions with manufacturing nations like China, as well as uncertainties about Taiwan, further exacerbated by the COVID supply chain disruptions and the Russia-Ukraine war.

Countries like Mexico are poised to be major beneficiaries of this onshoring trend, potentially leading to increased GDP growth. Developments of factories, infrastructure, and higher-paying jobs may follow as states look to secure supply and manufacturing of crucial industries, such as semiconductors, closer to home.

In conclusion, Latin American equities appear to be at a turning point, with favourable conditions and global trends aligning in their favour. The region’s experience in managing inflation, the weakening US Dollar, and the added element of onshoring could potentially contribute to brighter horizons ahead for Latin American Equities

Sources:

Benedito, L.M. and Burin, G. (2023). Brazil central bank to keep rates steady on June 21, cuts coming soon. Reuters. [online] 16 Jun. Available at: https://www.reuters.com/markets/rates-bonds/brazil-cbank-keep-rates-steady-june-21-cuts-coming-soon-2023-06-16/

Uddin, R. and McDougall, M. (2023). Latin America’s bonds and currencies lure yield-hungry investors. Financial Times. [online] 6 Jul. Available at: https://www.ft.com/content/c04c3a04-8c36-4822-813b-28f25e2ba067

Uddin, R. and McDougall, M. (2023). Latin America’s bonds and currencies lure yield-hungry investors. Financial Times. [online] 6 Jul. Available at: https://www.ft.com/content/c04c3a04-8c36-4822-813b-28f25e2ba067.

Cambero, F. (2023). Chile to start rate cuts, signaling more across the region. Reuters. [online] 27 Jul. Available at: https://www.reuters.com/markets/rates-bonds/chile-start-rate-cuts-signaling-more-across-region-2023-07-27/

Nair, D. (2023). US dollar weakness expected to continue as inflation cools. [online] The National. Available at: https://www.thenationalnews.com/business/money/2023/07/13/us-dollar-weakness-expected-to-continue-as-inflation-cools/#:~:text=The%20currency%20slumps%20to%20a

Goodkind, N. (2023). Why the Fed paused its rate hikes: It’s tired of playing a giant guessing game | CNN Business. [online] CNN. Available at: https://edition.cnn.com/2023/06/16/investing/premarket-stocks-trading/index.html#:~:text=After%2010%20consecutive%20interest%20rate

For Swaps Traders, Latin America’s Rate-Cut Cycle Comes Too Late. (2023). Bloomberg.com. [online] 27 Jul. Available at: https://www.bloomberg.com/news/articles/2023-07-27/for-swaps-traders-latin-america-s-rate-cut-cycle-comes-too-late

US Says It Must Work With Latin America More on Key Minerals. (2023). Bloomberg.com. [online] 26 Jul. Available at: https://www.bloomberg.com/news/articles/2023-07-26/us-must-step-up-latam-work-on-critical-minerals-state-aide-says

Our investment strategy committee, which consists of seasoned strategists and investment managers, meets regularly to review asset allocation, geographical spread, sector preferences and key global market drivers and our economist produces research and views on global economies which complement this process.

Our quarterly report presents our views on the world economic outlook and equity, fixed income and foreign exchange markets. Please click the link to download.