by Tim Sharp

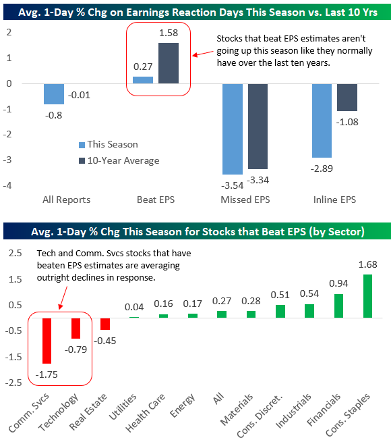

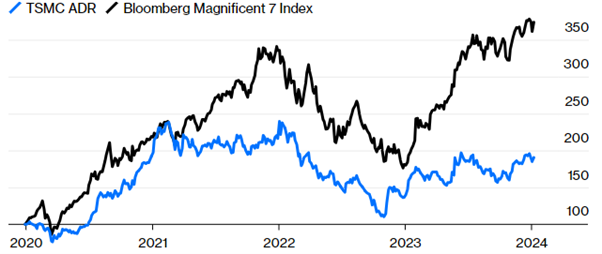

Following a strong December “Santa Rally” in equities and a high level of positive correlation between asset classes, financial markets started the year priced for perfection in central banks execution of a perfect soft landing. Q4 earnings season is proving to be generally positive with disappointments harshly treated as the differing fortunes of the “Magnificent Seven” reporting again testifies to a market that needs to justify its current position. Japan was the best performing major market gaining 7.8% in Yen terms while China and Hong Kong were still deep in negative territory. A market perception of strength surrounding large global technology companies persists with the sector leading gains (3.0%), however, the main US indices, S&P500 (+1.6%) and the NASDAQ (+1.0%) performed inline with global equities (+1.2%) following comments from central bankers in the last days of the month. In the UK major equity indices fell 1.3% one of the weaker performances of major markets, as signs of inflation lingering, better flash composite PMI reading of 52.5 but a weaker consumer – retail sales fell 3.2% month-on-month, and no signs of an early rate cut weighed on sentiment. Incidentally, 2 members of the monetary policy committee still voted for another rate increase.

The month started strongly in the US with a robust December jobs report of 216,000 and a 4th quarter GDP figure of 3.3% annualised that solidly beat expectations. This led quite nicely into an FOMC meeting in the last days of the month where Chair Powell confirmed that a March rate cut was unlikely followed closely by Bank of England Governor Bailey saying likewise in the UK. As we have been saying, we believed that there was a disconnect between the robustness of the US economy, strength in financial markets, and the market forecasts for the future path of interest rates which was laid bare during central bank press conferences. This clearly had effects on government bond markets (-1.8%) that began to price out early moves in rate cuts leaving US 10-year Treasury yields sitting at 3.9% while the dollars fortunes turned positive with the dollar index gaining 1.9%.

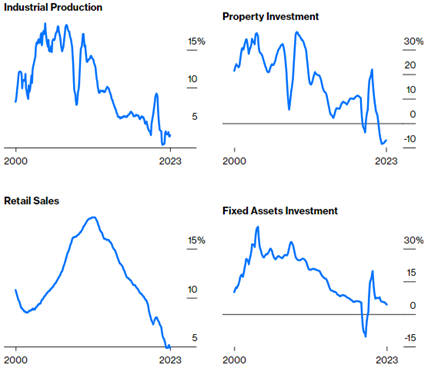

The ongoing concerns regarding the outlook for China affected its equity market (-6.3%) and that of Hong Kong (-9.2%) not helped by the news that 2nd largest Chinese property developer Evergrande was ordered into liquidation following an 18-month Hong Kong court hearing where it failed to convince the court that it had a viable restructuring plan. Chinese 4th quarter GDP came in at 5.2% year-on-year in line with expectations which is still low by historical comparisons, and Central Bank attempts to add stimulus were considered ineffective. This performance had a telling effect on Emerging Market indices (-4.6%) and the wider Asia Pacific region dominated by the size of the Chinese economy.

We started the year observing that the number of potential holes in the road from geo-political risks were high this year and reports in January have not decreased the potential for macroeconomic surprises. Despite the targeted strikes on Houthi bases in Yemen, the attacks on shipping continue driving a major proportion of Red Sea traffic around the horn of Africa causing supply delays and significant increase in shipping costs. Rising tensions between the US and Iran, and the US and Israel are also concerning escalations in the continuing Gaza conflict that might threaten the wider global economy.

The potential for a soft landing in the US and the positive impact of implied rate cuts in 2024 we feel has been fairly reflected in financial markets and as such we remain mildly defensive. We believe that this would favour, amongst others, Industrials, Technology Software, and Consumer Staples and so it was notable that the worst performing sectors in January were Auto’s, Energy, Basic Resources and Real Estate. Although we remain slightly sceptical of valuations, and feel an element of caution creeping into markets, we continue to believe that attractive returns are available for long term investors through diversified, active management.

References

Nokes, Zara _ JPMorgan Asset Management _ Review of markets over January 2024

Ward-Murphy, Zara _ Absolute Strategy Research _ Investment Committee Briefing

Market statistics verified on Refinitiv Workstation

Figure 2-6M Moving Average of YoY Growth Metrics (Bloomberg Data/Bloomberg.com)

Figure 2-6M Moving Average of YoY Growth Metrics (Bloomberg Data/Bloomberg.com)