by Haith Nori

July saw global markets deliver positive returns. The encouraging news of inflation reducing in the US, Eurozone and the UK has rippled through global equity markets leaving a progressive outcome. Despite the good news, Central Banks have continued to increase interest rates, factoring the latest data into their plans, with the exception being the Bank of Japan who have maintained their stance on ultra-low interest rates. Half-way through the year, second quarter earnings have so far been encouraging and fears of a recession are slowly fading with the idea of a soft landing seeming to be more plausible. Ukraine has, for the time being, not been allowed to join NATO while the war is still active. The trade war between the US and China is levelling up once more and Russia has pulled out of the UN Grain Deal brokered by Turkey last year in retaliation to what they believed to be an attack from Ukraine.

At the beginning of July, China announced that from August they would impose export restrictions on gallium and geranium to US, which are crucial elements for semiconductors and computer chips used in electric vehicles and military equipment. The news came just before Independence Day. China’s decision was ‘widely seen as retaliation for U.S. curbs on sales of technologies to China’[i]. The US announced that they would stop sales to China of high-tech micro-chips in July, as they feel these should not be used by Chinese Military. The retaliation from China could be the beginning of increased tensions between the two countries. Janet Yellen, US Secretary of the Treasury, travelled to China to meet with Premier Li Qiang, in an attempt to repair economic relations between the two countries, stating China had unfair economic practices but China wanted her to meet them in the middle with the development of trade ties. However, whilst Yellen achieved some success talking with some of China’s main economic policymakers, no trade, investment or technology matters have been agreed.

Russia pulled out of UN Grain deal brokered last year by Turkey called “The Black Sea Grain Deal” set up last year after blasts to the Russian bridge connecting to the occupied Crimean Peninsula by what Russia thought to be Ukrainian Seaborn drones. Their decision ‘raised concern primarily in Africa and Asia of rising food prices and hunger’[ii]. Russia has retaliated by targeting grain infrastructure striking the Ukraine grain port of Odesa.

A NATO summit was held in Vilnius, Lithuania on 11-12th July where the idea of Ukraine joining the NATO was raised. Whilst the thirty-one members of NATO are supportive of Ukraine being part of the alliance, the US has posed strong opinions that they will not ‘let a warring country into NATO and give too firm a timeline commitment’[iii]. It was indicated that Ukraine would be able to join NATO once the war was over. The leaders of NATO have also declared that the future of Ukraine laid in the hands of NATO’s military relationship. Neither Zelenskyy nor Putin were happy with the outcome.

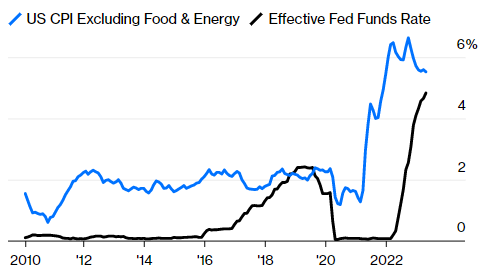

On 12th July US CPI data was released for the 12 months ending in June of 3% beating expectations of 3.1%. This has come a long way since its level of 9.1% in June 2022! On Wednesday 19th June UK CPI data was released for the 12 months ending in June was 7.9%, beating expectations of 8.2% and marking a steady reduction. The positive news gave a boost to UK Equities, with housebuilders benefiting the most as market participants believe that upward pressures on interest rates (and thus mortgages) could be abating. In the Eurozone CPI figures were 5.5% for the 12 months ending in June, down from 6.1% in May. Whilst these figures have been promising, Central Banks are still attempting to control inflation.

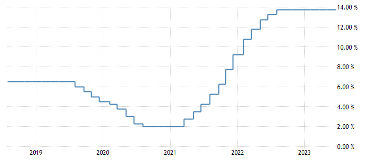

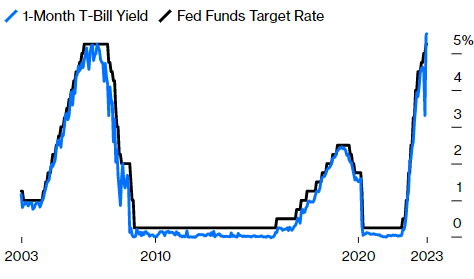

On 26th July the US Federal Reserve made the decision to hike interest rates by 0.25% (as expected) to 5.25%-5.50%, the eleventh time in the last 12 meetings. The last time the Federal Reserve had raised rates this high was in 2007 when there was a housing market crash. Jerome Powell has suggested that this is perhaps not the end and will review if rates are to be raised again in September stating ‘We’ll be comfortable cutting rates when we’re comfortable cutting rates, and that won’t be this year’[iv]. Powell still believes there is a pathway towards a soft landing, which is where inflation falls without a recession being caused as a result. On 27th July the European Central Bank continued their path by increasing interest rates by 0.25% to 3.75%, this being the ninth consecutive hike in a row and has taken them to twenty-three-year highs.

On 28th July the Bank of Japan’s Governor Kazuo Ueda decided not to change their ultra-low interest rate policy, maintaining overnight interest rates at -0.1%. He also made the choice to marginally loosen their yield curve control (YCC) by buying 10-year Japanese Government Bonds at a rate of 1.0% in fixed-rate operations, rather than the previous 0.5% rate, shocking markets. By promising more flexibility in the YCC, this is their method for controlling long-term interest rates as ‘This effectively expands its tolerance by a further 50 basis points, signalling the BOJ would let the 10-year yield rise to as much as 1.0%.’ [v] The next meeting for the Bank of England will be at the beginning of August where markets are expecting a 25 basis point hike.

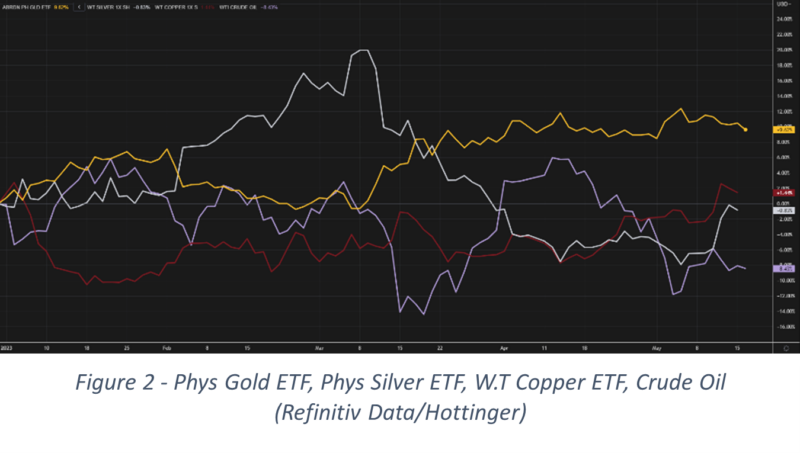

Overall, July saw a positive performance across asset classes. Brent Crude, after starting the month at levels of c.$74 per barrel, increased to over c.85 during the month. UK 2year Gilts have reached a yield of over 5%, with the 10-year yield reaching highs of c.4.65% and US 10-year Treasury note c.4.048%. During July Sterling continued to hit its highest levels over this past year, reaching over c.1.31 against the US Dollar. Gold also regained some of its lost value in June.

[i] https://www.reuters.com/markets/commodities/chinas-rare-earths-dominance-focus-after-mineral-export-curbs-2023-07-05/

[ii] https://www.reuters.com/world/europe/russia-carries-out-air-strikes-second-night-ukraines-odesa-port-governor-2023-07-18/

[iii] https://www.cnbc.com/2023/07/14/zelenskyy-absurd-comment-how-nato-pressured-ukraine-to-show-more-gratitude.html

[iv] https://www.reuters.com/markets/rates-bonds/fed-poised-hike-rates-markets-anticipate-inflation-endgame-2023-07-26/

[v] https://www.cnbc.com/2023/07/31/strategist-boj-should-move-to-new-normal-sooner-current-policy-is-very-harmful.html

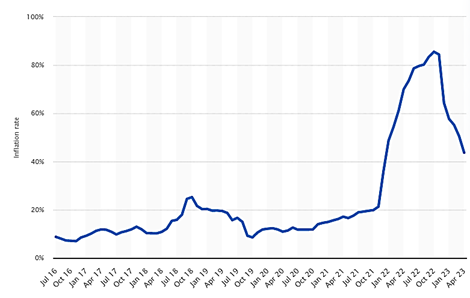

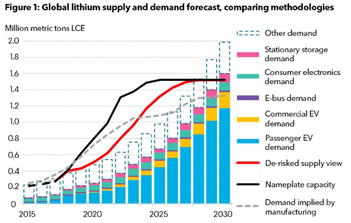

The question in many investors are pondering is with such a structural change emerging with Lithium and it’s strong future prospects, will these pockets of uncovered supply really put a dampening on the long term spot price or has the negativity amongst investors perhaps been overdone, with more use cases coming forward, can the scales of supply and demand equalise once again for Lithium as EV’s, Battery Storage and green energy increase in popularity and availability.

The question in many investors are pondering is with such a structural change emerging with Lithium and it’s strong future prospects, will these pockets of uncovered supply really put a dampening on the long term spot price or has the negativity amongst investors perhaps been overdone, with more use cases coming forward, can the scales of supply and demand equalise once again for Lithium as EV’s, Battery Storage and green energy increase in popularity and availability.