by Rob Cloete

Halfway through the second quarter, ongoing geopolitical uncertainty, institutional mistrust, and elongated rate cut expectations have contributed to an unusual combination of a high nominal risk-free rate, gold and Dollar strength, buoyant oil prices and government bond market weakness. Against this fragile backdrop, underpinned by rising global liquidity and despite further but moderating weakness in leading economic indicators, risky asset classes have rallied: equity risk premia and credit spreads have compressed, especially in developed markets.

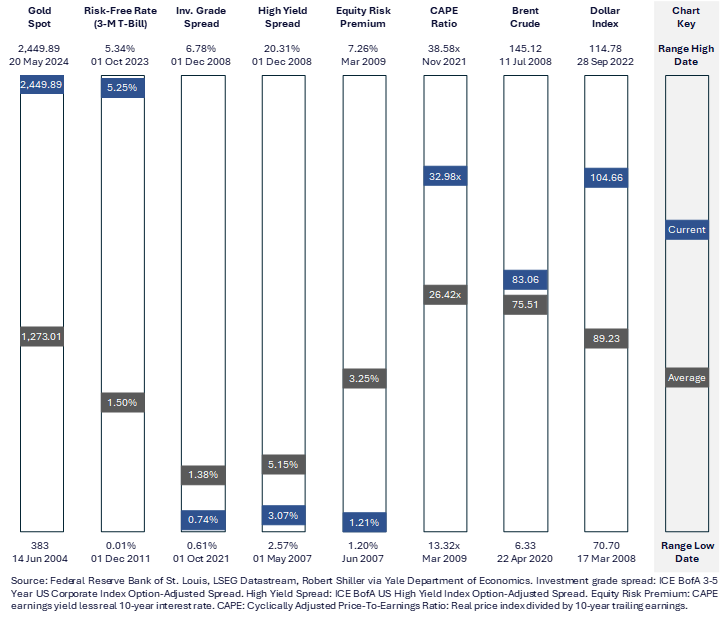

Figure 1: Market Landscape – Gold, Rates, Spreads and Valuations at 20 Year Extremes. Is this sustainable?

With the Federal-Funds rate close to a 20-year high at the time of writing and the three month T-Bill representing gold’s opportunity cost – in the form of yield foregone – it’s unusual to see the gold price near a 20 year-high as well, especially with rate cut expectations moderating (currently two expected by year end, down from five as we entered 2024). Gold’s robust performance is partly attributable to relentless central bank buying: global official gold reserves rose by 290t in 1Q24, a record, with the People’s Bank of China accounting for 27t of this as gold now represents 4.6% or c.$160bn of China’s total reserves (2014: 1.1%). Over the past decade, China’s official holdings of US Treasury Securities have declined by almost 40%, from c.$1.3tr to less than $800bn, as sustained de-dollarisation continues. Over the past decade, the proportion of federal debt held by foreign and international investors has declined from 34% to 24% now, while central bank holdings of gold have grown from 32t to 36t. Going forward, these trends represent a structural, price insensitive bid for gold, and a headwind for treasuries.

While policy rate forecasts have dominated the headlines, liquidity provision has expanded behind the scenes, increasing monetary flows into financial markets, and supporting asset price appreciation. Michael Howell of Crossborder Capital estimates global liquidity, underpinned by central banks, collateralised lending, and cross-border flows, at c.$173tr (vs. 2023 global GDP at $101tr, per the World Bank). The current upward cycle commenced in October 2022 (troughing at c.$160tr) and is expected to peak in late 20251. Following a contraction in April – coinciding with a challenging period for risky assets – conditions are again supportive, with the latest weekly reading at +0.6% m/m. However, recent multiple expansion in the equity markets has compressed the equity risk premium to 20-year lows, elevated the CAPE ratio to within the top 4% of all readings back to 1881 (surpassed only by 2021, 2000 and 1929), and outpaced global liquidity. This has historically presaged a near-term correction.

Going forward, we believe that policymakers will continue to be accommodative where possible, although the US fiscal situation continues to deteriorate: gross federal debt of $34tr as of March 2024 represents 120% of GDP, a federal deficit of -6.2% to GDP, and annualised debt service costs of $1.1tr against federal receipts of $4.4tr (more than half of which comprises politically-sensitive individual income taxes). This burgeoning indebtedness is further exacerbated by the escalating monthly effective interest rate, which has almost doubled from 1.7% to 3.2% since in April 2022, as recent issuance has been dominated by short-dated T-bills and more frequently rolled in a rising rate regime. While the benign inflation environment and rate hikes implemented thus far afford the policymakers some flexibility, cutting rates too soon risks stoking inflation, prompting reactionary rate hikes and, critically, imperilling the Federal Reserve’s ability to service and rollover its debt. In the meantime, growing liquidity provision drives fiat currency debasement, debt monetisation and asset price – as opposed to economic – inflation, while underpinning demand for gold as a store of value.

Putting all of this together, our current view is that the ongoing combination of increasing liquidity, moderating inflation, modest economic and corporate earnings growth, and policy inertia stateside as the elections approach, should continue to broadly support asset prices. Given valuations, however, we remain modestly underweight equities (prioritising quality companies that have the potential to perform robustly in a range of economic environments) and overweight bonds, prioritising short-dated high-quality liquid assets while limiting duration and credit exposure. We maintain positions in commodity-exposed equities and gold, as hedges against a resurgence in inflation and further sustained monetary debasement, respectively.

Sources:

1 Howell, M. (14 May 2024 and 21 May 2024). Global Liquidity Watch: Weekly Update. [online].

Available at: https://capitalwars.substack.com/

Our investment strategy committee, which consists of seasoned strategists and investment managers, meets regularly to review asset allocation, geographical spread, sector preferences and key global market drivers and our economist produces research and views on global economies which complement this process.

Our quarterly report presents our views on the world economic outlook and equity, fixed income and foreign exchange markets. Please click the link to download.