Blog

December Investment Review: Central Banks Attempting to Restore Calm

by Haith Nori

Global equity markets in December saw a slight decline from their November highs in the run up to the holidays. Central Banks have hinted at slowing their interest rate hiking programme with the FOMC, BOE and ECB all raising interest rates by 50 basis points, lower than previous interest rate hikes of 75 basis points. This may pave the way for a potential end in sight. China has been easing lockdowns, re-opening areas around the country and lifting international travel restrictions. China’s re-opening should be better for business globally. The Bank of Japan also made a surprise announcement to change its bond yield control policy.

The US Federal Reserve made the decision to increase interest rates by 0.50% on 14th December 2022 which confirmed what the markets were expecting. This is the first 0.50% increase as the past four consecutive meetings, the US Federal Reserve have increased by 0.75%. Promising data has presented itself for US inflation for the 12 months ending in November 2022 of 7.3%, continuing its gradual decline since June. The decision to opt for a 50 basis point hike shows positive signs that inflation is reducing and confirmed that the beginning of a reduction in the pace of policy tightening has started. For the first time UK CPI data was encouraging, releasing a figure of 10.7% for the 12 months ending in November. Whilst this figure is still very high, we have seen a reduction from October’s figure of 11.1%. On 15th December 2022, The Bank of England also decided to raise interest rates by 0.50% to 3.5%, as analysts had been expecting, which, like the US, was also a reduction from the previous hike of 0.75%. On the same day the ECB made the decision to join the interest rate train by also increasing interest rates by 0.50%, pledging ‘further hikes and laid out plans to drain cash from the financial system as part of its fight against runaway inflation’[i]. Global Equity Markets reacted negatively to the interest rate news, which was all released in two consecutive days. The UK 10 year Gilt yield, the US 10 year Treasury Note yield and the 10 Year Bond yield all increased after the news was released and ended the month higher than at the beginning of the month. Global Markets reacted negatively to the Central Bank announcements in December 2022 but had a late surge, or Santa Rally, in the run up to the Christmas holidays. Sterling continued to decrease for the latter half of December against the dollar following the interest rate decisions, whereas the euro, after an initial decline, recovered to the end of December. Reaching the end of 2022, the US equity markets have had their worst year since the financial crash in 2008.

Elon Musk made an astonishing announcement that he would generate a survey amongst his 122 million followers as to whether he should step down as CEO of Twitter and pledged he would honour the decision of the results of the poll, be it negative or positive. A total of c.57% voted yes and Musk has since stated that he will step down once a suitable replacement is ready to take the reins.

On 20th December 2022, The Bank of Japan shocked markets ‘with a surprise tweak to its bond yield control that allows long-term interest rates to rise more, a move aimed at easing some of the costs of prolonged monetary stimulus’[ii]. Following the unexpected news, Japanese shares reacted negatively whilst both Japanese bond yields and the Yen increased. This caught many investors off guard given that analysts widely expected no change to yield curve control, especially in the run up to Governor Haruhiko Kuroda stepping down in April 2023. The decision was meant to ignite the dormant bond market. Hopefully, stability will be restored.

In the UK, manufacturing has seen a decline as there is less demand for new business. December saw the fifth consecutive month of contraction, as ‘British manufacturers are starting 2023 on the back foot, after they reported one of their sharpest falls in activity since the 2008-09 recession last month, reflecting a sharp fall in new orders and ongoing job cuts’[iii]. Unemployment rates have also risen in the UK as there are less vacancies available.

With China coming out of lockdown and ending their Zero-Policy Covid restrictions the country is seeing stocks improve in price on the basis that business, both domestic and international, will hopefully resume. Travel restrictions have been lifted allowing international travel from China but many countries including the US, the UK, Italy, India, Israel, Spain, Canada, South Korea, and France are all imposing the need to have a negative Covid Test and in Spain’s case, proof of vaccination. This is a positive step forward as ‘China may finally return to normal as the nation joins the rest of the world in learning to live with the virus’[iv]. There is still a long road to recovery ahead for China, but Global Markets will benefit from the good news and the new opportunities it will present.

Overall, December has still been slightly volatile for Global Markets but did not experience too many significant market shocks. Brent Crude continues to trade below $85 having dipped to a low of c.$76.10. The Federal Reserve has hinted at maintaining lower levels of interest rate hikes whilst the ECB stated there is still a large fight against inflation to go. Central Banks are continuing action to bring inflation down but at a calmer pace. The re-opening of China brings positive news to Global Markets. Japan has made a surprise move in its control of bond yields causing a shock. Bond yields have increased since the start of the month following the interest rate decision release.

[i] www.reuters.com/markets/europe/ecb-slow-rate-hikes-lay-out-plans-drain-cash-2022-12-14/

[ii] https://www.reuters.com/markets/rates-bonds/japan-set-keep-ultra-low-rates-doubts-over-yield-cap-grow-2022-12-19/

[iii] www.reuters.com/markets/europe/uk-manufacturing-ends-2022-low-orders-shrink-pmi-2023-01-03/#:~:text=LONDON%2C%20Jan%203%20(Reuters),orders%20and%20ongoing%20job%20cuts.

[iv] https://edition.cnn.com/2023/01/02/china/china-2023-lookahead-intl-hnk-mic/index.html

End of Year Investment Review: In Search of Optimism

by Adam Jones

As 2022 draws to a close we wanted to briefly highlight the exceptional uncertainty in investment markets as we head into 2023. We retain a cautious stance in portfolios overall but also see compelling arguments as to why things might turn out to be far less gloomy than seems widely expected.

Despite global PMI’s stabilising but still being in contractionary territory in November, December ISM Services data pointed to a very robust US consumer, whose confidence in spending has apparently yet to be curtailed by tighter monetary policy. Except for housing there appear few signs of restraint in broader US activity, giving rise to suggestions that the lag in monetary policy effectiveness may be longer than originally thought (and may not be evident until the end of H1’23). Recent declines in both oil prices and headline inflation data might also provide additional support for ongoing strength in consumption trends.

Source: Hottinger Investment Management / Refinitiv Datastream

Source: Hottinger Investment Management / Refinitiv Datastream

In China, zero-covid policies have weighed on economic sentiment so much that recent street protests have led to a relaxation in policy that saw the Hang Seng index in Hong Kong become the strongest performing equity market in November, although most of these gains have since been erased given the recent uptick in new cases. On the economic front, one of the metrics we follow closely is known as the ‘credit impulse’ which simply measures the growth in new credit being provided to an economy relative to its GDP. In China the credit impulse has risen materially over the past few months and has historically led expansions in the global monetary base as defined by M2 (a measure of money supply which includes both cash deposits and instruments which are easily convertible into cash). While we do not consider ourselves to be explicit monetarists, it is interesting to note that expansions in global M2 have themselves tended to lead many of the major business cycle indicators such as manufacturing and output.

Should inflation continue to dissipate as global economies stabilise, this dynamic could turn out to be very supportive for risk assets in general. In this scenario investors, whose perspectives are almost universally bearish according to some measures of sentiment, are potentially at risk in being under-allocated to global equities.

This is the period when strategists and economists publish their forecasts for 2023 and Absolute Strategy Research (one of Hottinger’s key research partners) are not alone in believing that core inflation in US and Europe will be below 3% by the end of next year. Supply chains have generally normalised, the tightness of the labour market has not led to a wage spiral, falling commodity prices, and falling housing costs all combine to create a disinflationary trend. Central banks tend to be slow to cut rates, preferring to see consistently worse data and we believe there is a possibility that there are demographic changes involving retiring baby-boomers that could keep the labour market tighter than expected and over a longer transition period.

Source: Hottinger Investment Management / Refinitiv Datastream

Looking at corporate bond markets we also note that despite US high yield credit outperforming investment grade credit this year (even while lower-rated credit spreads have doubled), overall spreads remain well below levels witnessed in prior periods of forthcoming recession. We believe part of the explanation for this dynamic is that many businesses took advantage of exceptionally low refinancing rates post-Covid in 2020 to lock in lower rates over longer time frames (and hence significantly extended the maturity profile of their debt). If this is the case, then it stands to reason that a tighter monetary policy environment is likely to exert less of an effect on the corporate sector than it may have done historically.

The counterargument to this more optimistic view of 2023 is that savings rates in the developed world have now fallen back to (and in some cases below) pre-Covid levels in many countries. When coupled with recent witnessed spikes in credit card spending data this suggests a growing need for consumers to supplement the cost of living through short term finance. This is not typically a sustainable trend over any reasonable period, and we speculate may be a contributing factor to the weakness in US November retail sales last week.

Source: Hottinger Investment Management / Refinitiv Datastream

Source: Hottinger Investment Management / Refinitiv Datastream

So, while global equities may have rallied approximately 10% over the last 2 months our baseline view remains that this represents a bear market rally. Equity and credit markets appear unwilling to price a more recessionary earnings outlook and cyclical sectors have barely underperformed more defensive sectors. It is only government bond markets which strongly suggest a forthcoming recession, with the yield curve having now inverted by more than 70bps (that is to say that 2yr bond yields are now greater than 70bps lower than 10y yields). In our opinion there are inconsistencies in 2023 forecasting based on the idea that investors have no reliable evidence of the monetary policy lag that will likely catalyse recession.

At the crossroads there are several scenarios, ranging from a soft landing to long and variable monetary policy lags causing a deep recession in 2023. The distribution of potential outcomes remains exceptionally wide due to high levels of prevailing uncertainty. Indeed, the last time an inflationary environment required so decisive a tightening cycle as that we have recently witnessed was back in the early eighties. We would argue that the global economy has evolved markedly since then in terms of demographics, labour market structure, global trade, technology, information dissemination and the implementation of monetary policy itself (forward guidance as an example). Such comparisons are therefore difficult and potentially misleading.

We remain cautious at this point, with an asset mix in favour of quality over cyclical growth, a preference for strong balance sheets, high cash flow yields and low levels of gearing with an overweight position in cash and government fixed income, where rates have become attractive for the first time in many years. We believe that despite a level of prevailing pessimism the spectrum of potential outcomes may lead to increased volatility and swift market reactions that would make disengaging from markets in a meaningful way a risky strategy for the long-term investor.

Chart of the Week: Where in the world are we trading?

Author: Tim Sharp

Researcher: Jack Williams

Published: December 21, 2023

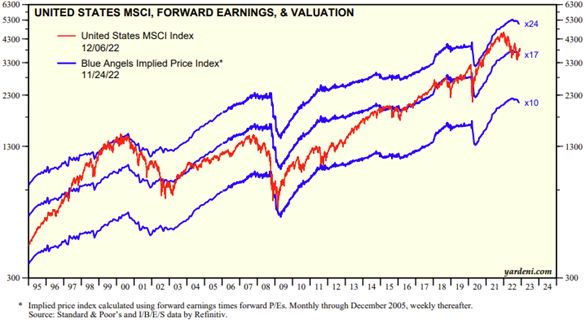

The charts published show three indices that represent markets on a global, U.S and U.K scale. The red line represents the current price of the index (MSCI), while the blue line is the Blue Angels Implied Price (calculated using forward earnings multiplied by forward P/Es).

Looking at the first chart, you can see on a global scale, the market trades around a 15.25x multiple compared to the USA which trades at a premium of over 17x.

The chart below shows the U.K trading at a steep discount in comparison to the general global market and even more so to the U.S market. UK MSCI currently trades around a 6x multiple, almost 300% lower than the USA and 250% below the general global market.

One of the main reasons for this has been the high percentage of cyclical companies that make up the index. With a large proportion of constituents in the Banking space or the Energy sector, traditionally with lower valuations than of those that comprise the likes of the US indices which include a wider range of growth names.

That being said, this can be both a positive and negative for investors as the market has grown at a slower rate. We have seen the U.K market much more resiliant to the kind of market volatility seen this year in the USA. Over the past year, the FTSE has returned a positive 2.06% compared to the S&P500 in the U.S which has seen declines of -15% over the past 12 months.

https://www.yardeni.com/pub/int-mscina.pdf

November Investment Review: Return of Confidence

by Haith Nori

November has welcomed back some much-needed positivity within the Global Equity Markets. In China, c.412 million people have further been affected by lockdown measures, due to their zero Covid policy, as cases have increased rapidly. There is civil unrest as people are protesting against President Xi Jinping and demanding that he resigns due to the handling of the current Covid situation. Russia continues to attack Ukraine, attempting to target their energy infrastructure, and has reportedly left Kyiv without running water or electricity. In the UK, the Autumn Budget was finally released announcing a number of significant changes. In the US, the FOMC have signalled a reduction in the pace of its aggressive interest rate hiking cycle. COP 27 has embraced world leaders once again who are attempting to act collaboratively to reduce climate change.

Since the start of November, sterling has strengthened against the dollar. The dollar has also weakened against both the euro and the yen as well ‘after U.S. economic data provided further evidence that inflation was starting to ease, improving investor appetite for riskier assets and reducing demand for the safe-haven greenback’[i]. Bond yields have begun to decrease with the US 10 year note, now offering a yield of c.3.6% and the UK 10-year Gilt offering c.3.1%. This is a dramatic change when just a few months ago, they were both yielding above 4%! Interest Rates are still increasing and in theory, the yield should increase but we are seeing an unusual correlation. The Federal Reserve is hinting at slowing the interest rate increases to reduce over tightening. After the minutes were released 23rd November from the Federal Reserve’s November meeting, European stocks went on to hit three-month highs. The US Federal Reserve increased interest rates by 0.75% for the fourth consecutive time which takes them to the highest levels since 2008. Jerome Powell has hinted at a change in policy at the next meeting or two. In the UK, the Monetary Policy Committee voted 7-2 to increase interest rates by 0.75% to 3%, the largest rate hike since 1989. On Thursday 10th November, the US released CPI data for the 12 months ending in October of 7.7%, which was lower than expectations and lower from September of 8.2%. This is positive news as, even though we are seeing small changes over the past 5 months, there has been a clear decrease: 9.1% in June, 8.5% in July, 8.3% in August, 8.2% September. There is still a long way to go for the CPI figure to reach the overall target of 2% but finally a positive trend has been witnessed. In the UK, the CPI data released November 16th for the 12 months ending in October was 11.1%, the most since October 1981, up from 10.1% in September, and 9.9% in August. The main driver of the headline figure has been ‘surging household energy bills and food prices pushed British inflation to a 41 year high’[ii]. The data was released one day before Jeremy Hunt released the Autumn Budget where the hope is that his tax hikes and plans to reduce spending will assist in reducing the CPI figure. The next meetings for the FOMC, BOE and ECB will all be held in mid-December where they will assess whether to increase interest rates once again.

The delayed UK Government’s Autumn budget, announced on 17th November, saw changes to the National Living Wage, several Tax changes and the cap on energy bills increasing to £3,000 from £2,500 for 12 months from April 2023. The key points that will have a significant impact in the new tax year (6th April 2023 to 5th April 2024) are the reduction in the Capital Gains Tax Allowance, Dividend Tax Allowance, and the Additional Rate Income Tax threshold. For individuals the Capital Gains Tax Allowance will be reduced from £12,300 to £6,000 and for most trusts from £6,000 to £3,000. The Dividend Tax Allowance will be reduced from £2,000 to £1,000 and, finally, the Additional Income Tax Rate threshold will reduce from £150,000 to £125,000. Effectively, these measures are an attempt at creating a budget tightening of £55 billion to restore the country’s credibility under new Prime Minister Rishi Sunak’s Government with Jeremy Hunt announcing these measures as being ’tough but necessary’[iii].

COP 27, which concluded on 20th November, saw a number of global leaders agreeing to work together once more to combat climate change. One key take away is that nations have, for the first time, agreed to establish a fund which is dedicated to providing pay-outs for developing countries that experience damage from issues relating to climate change, such as, storms, floods, and wildfire. China and the US have rekindled their relationship as China’s President Xi Jinping met with US President Joe Biden in Indonesia agreeing to ‘restart cooperation on climate change after a months-long hiatus due to tensions over Taiwan’[iv].

China has become a point of discussion around the globe. Over this past year China has been in and out of lockdowns both national and local due to its Zero Covid policy. After the latest surge in Covid cases and new lockdowns put in place, anti-lockdown protests rallied in multiple cities around China. Finally, at the end of November the Chinese Government have announced they are now attempting to ramp up their efforts to vaccinate the elderly. On the back of the announcement the Hang Seng closed 5% higher on Monday 28th November.

Overall, November delivered some positive returns for global equity markets, which are now up 11% from the October 12th lows. Brent Crude has returned to trade below $90 per barrel having fallen from c.$98 per barrel at the start of the month. Sterling has ended the month trading c1.21 against the dollar which is a significant rise since its tumble after Kwasi Kwarteng’s budget announcement at the end of September. Both the Yen and the Euro have also strengthened against the dollar since the beginning of November. Bond yields are decreasing whilst central banks hint at slowing the pace of interest rate hikes to hopefully give a soft landing at the beginning of 2023.

[i] www.cnbc.com/2022/11/15/forex-markets-federal-reserve-interest-rate-hikes-inflation-japan-yen.html

[ii] www.reuters.com/world/uk/uk-consumer-price-inflation-hits-111-october-ons-2022-11-16/

[iii] www.reuters.com/world/uk/uk-consumer-price-inflation-hits-111-october-ons-2022-11-16/

[iv] www.reuters.com/business/cop/key-takeaways-cop27-climate-summit-egypt-2022-11-20/

U.K Government Announces November Statement – What does it mean for Investors?

Author: Tim Sharp

Researcher: Jack Williams

Published: November 21, 2023

Millions more around the U.K will be paying more in tax come the new year as Jeremy Hunt, the latest appointed chancellor, tries his hand in taming inflation and calming the markets with his Autumn Statement.

On Thursday morning, Chancellor Jeremy Hunt embarked upon £55Bn of savings as he cuts public spending and attempts to raise funds through a round of “stealth” taxes that will likely affect millions the length and breadth of the United Kingdom.

Independent forecasts from the Office for Budget Responsibility (OBR) have revealed that the statement will see Britain face the biggest hit to living standards on record, with £30Bn of delayed spending cuts and £25Bn in backdated tax increases.

The announcement comes after inflation hit a new 41-month high, reaching 11.1% in the middle of the U.K.’s cost of living crisis.

While no one seems to be safe from the Chancellor’s sweeping plans, which touch everything from dividends to defence spending, many families and investors are probably wondering what this means for the markets, their finances and their families.

Key Announcements

45p Tax Rate

The 45% top rate of tax, recently poised to be scrapped by Truss’ government has been reinstated, while the threshold has been lowered from £150,000 to £125,140. This means those earning £150,000 or more will now pay around £1200 more per annum in tax.

Income allowance, National Insurance and Inheritance Tax

The Conservatives announced a freeze on income tax personal allowances, national insurance and inheritance tax until April 2028, while benefits and state pensions are set to rise in line with inflation.

Windfall Taxes

The government has pulled a 180-degree U-turn on its prior stance of opposing the uprating of the tax upon oil and gas producers’ excess profits, increasing the levy from 25% to 35% while imposing a further 45% rate on energy generators making “extraordinary profits”. This affects businesses where electricity is being sold above 1.5x the average 10Y electricity price, meaning a headline rate for affected businesses of 70% once corporation tax is factored into account.

Nuclear Energy

The Government has confirmed its plans for the Sizewell-C nuclear plant, calling Britain “a global leader in renewable energy” in the Chancellor’s statement. Hunt also spoke about furthering the green agenda, pointing towards offshore wind and carbon capture as future areas to explore while promoting nuclear as the solution to the U.K.’s energy mix.

Dividend Allowance

The past five years have seen a dividend allowance of £2000 in place, down from the prior £5000, which has now been halved from 2023 to just £1000, and from 2024 halves again to just £500. Although this is on top of the £12,500 personal income allowance which everyone gets, from 2024 it will be just 10% of where the allowance stood in April 2018.

Capital Gains Tax Allowance

Jeremy Hunt has decided to increase the tax on growth as well as income for investors by halving the current capital gains tax allowance from £12,000 to £6000 from April 2023, before being slashed again by 50% in 2024/25 to a £3000 p.a. allowance.

- The Chancellors statement has resulted in a United Kingdom with the highest tax burden since records began.

- On only three occasions in history have disposable incomes fallen, in real terms, for two consecutive years as they have over the past 24 months in the U.K.

- The economic decline is expected to return living standards back down to 2013/14 levels, with current rates not being recovered for an estimated six years.

What does this mean for U.K. investors and what can you do?

Investors in the U.K will likely see a notable difference coming into the new year from the governments statement on Thursday. Forecasts from the Institute for Fiscal Studies (IFS) identified middle income families to be the worst affected with the typical U.K household taking a permanent 3.7% income hit.

However, by utilising different strategies, investors may be able to mitigate some of the negative impacts from Jeremy Hunt’s statement last week.

Combining Capital Gains Tax (CGT) Allowances

Couples are reminded that, if married or in a civil partnership, they can combine their CGT allowance. Couples where only one of them is using their CGT allowance can merge with their partner to ensure maximum use of the lowered thresholds.

Using an ISA

ISAs offer an annual tax-free allowance of £20,000 and may be considered one of the most efficient ways to mitigate tax on investments. However, liquidating a portfolio to fund an ISA may trigger CGT if the gain is above the CGT allowance.

Start Ups to Mitigate Tax Impacts

Investing in start-ups, when done efficiently, might also mitigate some of the impact of the Chancellors statement.

Venture Capital Trusts (VCT’s) invest in emerging British businesses and offer a number of tax reliefs such as 30% upfront income tax relief, tax-free dividends, and an exception from capital gains tax on shares should they rise in value, provided they are held for a minimum qualifying period.

Enterprise Investment Scheme

The Enterprise Investment Scheme (EIS) is a governmental incentive that provides a source of funding to early-stage U.K companies while offering tax benefits to holders.

EIS is seen as one of the most tax-advantaged of government schemes, with opportunities to mitigate income tax, capital gains tax and inheritance tax; designed to support growth-focused, early-stage and unquoted companies to raise funding they may have otherwise struggled to attract due to their early stage and therefore higher risk status.

While early stage ventures come with a higher risk and growth potential, EIS can offer relief to investors in the form of tax and loss benefits such as income tax relief (Investors can claim up to 30%, £1m maximum p/a for a maximum of £300,000 worth of income relief), tax free growth (any growth in an EIS investment is 100% tax free), capital gains deferrals (a gain made on the sale of other assets can be reinvested in EIS and differed over the life of the investment) and loss relief (ability to offset the loss on an EIS investment against their Capital Gains or Income Tax).

Summary

While moves aimed at pushing the U.K back towards sustainable finances may be fit for the job at hand, the Bank of England, OBR, and government forecasters all agree that the U.K is now on the brink of a recession, with the normal counterbalance of fiscal stimulus remaining firmly off the table.

The question is, how do U.K investors protect themselves against a recessionary environment? There is no single solution, however while Hottinger does not offer tax advice, there are schemes, incentives, and avenues of opportunities available that may make the most of current allowances and bolster one’s finances looking forward depending on each investor’s risk tolerance.

https://commonslibrary.parliament.uk/research-briefings/cbp-9643/

https://www.gov.uk/guidance/venture-capital-schemes-tax-relief-for-investors

https://www.gov.uk/guidance/venture-capital-schemes-apply-for-the-enterprise-investment-scheme

https://www.bbc.co.uk/news/uk-england-suffolk-63664140

https://www.ft.com/content/8af720e0-1946-4c42-8dcb-ee6ea679bbb6

An Update on the AIM Portfolio Service

By Miguel Fraga

Launched in 1995, the Alternative Investment Market (AIM) is a sub-market of the London Stock Exchange which allows young fledgling companies to float their shares with a more flexible regulatory system than that applied to the main market. Since inception, the AIM market has grown substantially from just 10 to now 765 listed companies with a combined total market capitalisation of over £89bn, diversified across 40 different sectors and operating in more than 100 countries. Many of these companies operate in exciting and dynamic high-growth industries including those providing renewable energy solutions such as hydrogen power, software services to a myriad of end-markets, pioneering medical equipment manufacturers, business communication facilitators and smart metering services.

And with the market down 35% YTD and 37% from its recent peak, now may be a very good time to invest. Valuations are now approximately 50% cheaper compared to peak with prospective P/E and EV/EBITDA multiples at 18.2x and 12.5x respectively, well below long-term median levels of 23.9x and 19.6x, respectively. In addition, investments in the AIM market offer a powerful benefit in helping clients seek shelter from the impact of inheritance tax (IHT).

Inheritance Tax is a tax imposed on the estate of someone who has died including all property, possessions, and money when this is passed on to successors. The standard IHT tax rate in the UK is 40% and is usually charged on the part of the estate that’s above the tax-free threshold (nil rate band) which is currently £325,000. Many of the listed shares in the AIM market qualify for Business Property Relief (BPR), which if held for a minimum of 2 years, may provide up to 100% exemption from inheritance tax on transfers of value at death. To put this into perspective, the inheritance tax saving of 40% expected from an AIM portfolio that has been invested for at least two years would more than offset the steep market decline of 37% from peak witnessed to date.

The general rule for a company to qualify for Business Property Relief is that it must be running a business that benefits the economy rather than simply making money on investments. However, the ultimate assessment is made by HMRC at the time of death, and therefore there cannot be any guarantee that an AIM company that qualifies for BPR today will remain BPR-qualifying in future.

At Hottinger, we offer the AIM Portfolio Service. This is a discretionary managed investment service presented to clients, particularly those seeking to mitigate their IHT liability, which invests in a diverse portfolio of 25-35 AIM-listed companies that may qualify for BPR and thus, IHT exemption at the time of purchase. There is no definitive list of BPR qualifying shares issued by HMRC so the exemption is established at the time of death subject to the rules and regulations governing IHT at that point. We conduct extensive due diligence and in-depth research on target companies, identifying those having compelling and sustainable business models which we believe offer strong growth potential over the long-term.

Recent additions to our AIM portfolios have included Advanced Medical Solutions Group, a world-leading developer and manufacturer of advanced surgical and wound care products, as well as CVS Group, one of the largest vertically integrated veterinary services providers in the UK. Both companies maintain strong market share in sectors witnessing good secular growth, coupled with quality management, strong profitability and cashflow visibility as well as robust balance sheets to withstand even the harshest of expected recessionary headwinds.

While the benefits of AIM-listed investments are attractive, it should also be noted that shares in AIM companies generally carry higher risk than those of the main market, with less stringent regulations both for admission and reporting. The requirement that companies should have three years of trading history does not apply to AIM, shareholder approval is only needed for the largest transactions, and financial disclosure and reporting requirements are also less demanding. In addition, shares in AIM-listed companies may exhibit higher volatility and lower liquidity than other shares listed on the London Stock Exchange. This means that if you look to sell shares, you may not be able to sell them immediately and you may have to accept a price that is less than the real value of the companies. We would, therefore, recommend that investors considering an investment as part of their estate planning discuss its appropriateness with their advisers.

For further information on the Hottinger AIM Portfolio Service: https://hottingergroup.wpengine.com/services/investment-management/

October Investment Review: A Loss of Confidence

By Haith Nori

October has continued the volatile theme witnessed in September. The situation in Ukraine has continued to deteriorate with Russia having annexed certain areas of Ukraine. The explosion on the Crimean Bridge was crucial for deliveries of arms to Russian troops. Russia has since threatened nuclear warfare, which is seeing countries rally to Ukraine’s aid, especially the US. The Defence sector is seeing strong gains whilst the US, the UK and the EU are all increasing their budget on defence to ensure protection. With the world on the brink of nuclear warfare, companies are attempting to create armaments purely for the purpose of destroying missiles before they land, hence protecting lives. The Bank of England have continued to provide emergency support to gilt markets. The UK government have reversed their initial budget plan of cutting the 45% tax rate and Liz Truss has resigned as Prime Minister, and after a short period of time Rishi Sunak was appointed as the UK’s new Prime Minister. OPEC have had a meeting to cut production by 2 million barrels of oil a day. Germany has authorized 200 million Euros, the German Stabilisation Fund, to dedicate to energy during the current crises which is being unwelcomed by other members of the EU. 15 countries are urging the EU to introduce a price cap on energy. With the hyped activity surrounding Elon Musk and his takeover of Twitter this year, the $44 billion acquisition is now complete with Musk firing top executives in the business.

In the UK, there has been a lot of turmoil since the new government has taken office. Since the new budget was released, we have seen the value of the pound drop to ‘levels not seen since the 1980s’[i]. At the end of September, it hit its lowest point of $1.035 after the budget was announced. Later in October, the UK pound recovered to levels seen before the new finance minister, Kwasi Kwarteng took office. However, confidence in the UK is clearly feeling the pinch as the UK government has reversed its bold plans of axing the 45% tax rate. The Bank of England have stepped in to buy both long dated gilts and Inflation-Linked Gilts, stating this would end on 14th October, with Governor Andrew Bailey telling ‘pension fund managers to finish rebalancing their positions’[ii]. The aim of the fiscal policy from the new government is to support both households and businesses during the current period of increased energy prices. To add to the chaos, a new finance minister, Jeremy Hunt, was appointed who tore up almost of the original budget plans and Liz Truss announced her resignation on Thursday 20th October, making her the UK’s shortest serving Prime Minister. Following the resignation came a short period of uncertainty in the race for the new prime minister to be appointed in the hope that some levels of normality can be restored within UK Politics. The uncertainty has made the UK appear unstable which does not bode well for investor confidence. Rishi Sunak was appointed the new Prime Minister to lead the Conservative Party officially on Tuesday 25th October, where he has decided to keep a number of ministers in their existing posts in order to try to bring the party together and install confidence once more. For instance, Jeremy Hunt has remained as Chancellor of the Exchequer. Some positive news came as the value of Sterling recovered some ground as investors welcomed Sunak’s victory. This may well be the beginning of confidence being restored in the UK. However, all eyes will be focused on the fiscal statement announcement which was scheduled for 31st October but has been delayed until November 17th following the appointment of Rishi Sunak’s new government. This, in theory, will be designed to stop markets spiralling out of control once again. Whilst the delay may initially seem frustrating it will allow the government to carefully prepare their announcement.

On Thursday 13th October, the US released CPI data for the 12 months ending in September of 8.2%, little changed from August’s 8.3% (9.1% in June and 8.5% in July). The US has also experienced many companies releasing quarterly earnings throughout October. For example, it was a brutal earnings week for large Tech names (other than Apple who beat revenue expectations). Alphabet and Microsoft provided disappointing revenue, with Alphabet declining c.7.4% and Microsoft declining c.6.9% following their individual announcements. Meta Platforms declined c.22% on the 27th October and Amazon also saw declines. Combined, the four big Tech names ‘lost over $350 billion in market cap after offering concerning commentary for the third quarter and the remainder of the year’[iii]. In the UK Shell posted profits of £8 billion for the quarter with the share price increase c.5% on 27th October. UK CPI data was released on 19th October dropping to 10.1% for the 12 months ending in September after 9.9% in August and matching the July 40 year high. The ECB met on 27th October and made the decision to increase interest rates by 0.75% to the highest rate in over a decade. Both the Bank of England and The Federal Reserve will hold their meeting in the first week of November before announcing their decision on interest rates.

In Japan, the Yen has been declining against the dollar for some time. The Bank of Japan has intervened for the second time on 21st October spending ‘a record 5.4 trillion to 5.5 trillion yen ($36.16 billion to £36.83 billion) in its yen buying intervention’[iv]. The dollar maintained its value but weakened after S&P Purchasing Managers Index data showed a fourth consecutive contraction.

Overall, October has witnessed the volatility continue with further unprecedented affairs, especially in the UK. At the end of the month Global Markets saw a late rally despite mixed corporate earnings season; European equities increased c.9%, US equities increased c.8% and UK large cap equities increased c.3%. Investors seem to be reconsidering the possibility of a soft landing in the US in 2023. We still believe a focus on diversification across asset types, styles and strategies remains of critical importance to portfolios. Bond yields remain to high in value. After the OPEC meeting the price of Brent Crude is trading c.$95 per barrel. Sterling has become extremely volatile against the dollar.

[i] https://www.forbes.com/sites/qai/2022/10/07/the-british-pound-has-fallen-to-its-lowest-level-against-the-us-dollar-since-1985heres-why/?sh=4edb4d5c74a7

[ii] https://www.reuters.com/world/uk/bank-englands-bailey-tells-pension-funds-they-have-3-days-rebalance-2022-10-11/

[iii] https://www.cnbc.com/2022/10/28/big-tech-falters-on-q3-2022-results-as-meta-has-worst-week-ever.html

[iv] https://www.cnbc.com/2022/10/24/forex-markets-currencies-japan-yen-bank-of-japan-intervention.html

GLOBAL INSIGHT Q4 2022

Hoop of Glory

By Carol Frizelle

Seeking some respite from the UK’s current economic situation I thought I would take the opportunity to share my daughter’s recent success at the 2022 Commonwealth Games held in Birmingham in August.

It was here that my oldest daughter Gemma became the first ever Welsh Rhythmic Gymnast to win a Gold medal with the Hoop at the Commonwealth Games!

This was a huge achievement and something Gemma has worked tirelessly toward since a very young age.

Delivering a routine which shows clean, balanced movements alongside perfect technique is the goal of every gymnast but was something that Gemma had felt less confident in being able to deliver heading into the Games. The interruption of COVID (and the resulting lack of competition) coupled with both injury and nerves did not bode well for her performances or her confidence.

Despite all these difficulties I, of course, knew she could do it!

Her coach would tell me that judges often approached Gemma whilst at competitions overseas and complimented her on how graceful and skilled she was. She was even once told that she might be among the best gymnasts in the world if she could perform consistently clean routines. This was the message we were getting but, at the end of the day, it was only Gemma that could go on to deliver.

As the games approached Gemma suffered a painful spinal injury during an intense training camp in Baku. For several weeks it really was touch and go as to whether she would be able to compete at the Commonwealth Games. It was such a stressful time for her, having to entertain the idea that all she had trained for and worked towards over the past four years might go to waste. Thankfully, a team of local specialists were able to support Gemma with her medical condition and just one week before the games, was given the go ahead to compete! I was so thrilled for Gemma but also unsure of how it would go. I believed she was a medal contender under any normal circumstances but given the difficulties surrounding the injury I felt unusually apprehensive as the Games approached.

On day one of the competition Gemma hit the floor clearly meaning business and went on to deliver a series of fantastic routines. She successfully qualified for the overall Finals and went on to qualify for a further two individual finals on day three (with her best apparatus I may add). Day two had been slightly more difficult and I could see that she was battling pain and suffering from the intensity of her efforts on day one. Despite this she still fought hard and competed well.

On the morning of the individual Finals, I text Gemma, as usual, and simply said:

“You’ve got this!!”

She knew exactly what she needed to do.

I had a positive feeling that morning that she was going to place highly. She went into the day ranked in 5th place, but I simply knew she could do better. Gemma later told me that she too felt confident in being able to secure a medal or, at the very least, place in 4th!

The rest is history.

Gemma came onto the floor and delivered a fantastic routine. I knew it was good, but it wasn’t until the final score appeared that I knew just how good it was. We then had to wait nervously for 5 other gymnasts to compete before learning that she had won the Gold Medal!!!!!

Proudest Mum ever.

September Investment Review: Eye of the Storm

By Haith Nori

September has seen significant increased levels of volatility return to Global Markets once more. Central Banks in Europe, the UK and the US all scheduled meetings in September following the Jackson Hole meeting. Liquid Natural Gas (LNG) deliveries have taken a turn for the worst with Nord Stream 1 in Germany being closed by Russia, sending energy prices higher in Europe. China have been selling Russian LNG back to Europe at a much larger cost. More and more ships have been able to leave Ukrainian shores delivering agricultural products to African, Asian and European countries. The UK has appointed a new Prime Minister Liz Truss at the beginning of September. Global tensions between countries continues as the US have made a deal of $1.1billion weapons sale to Taiwan, angering China and Russia are buying rockets and weapons from North Korea. Furthermore, China has once again been entering into local lockdowns in the Chengdu and Shenzhen areas due to its zero Covid policy. Queen Elizabeth II, the United Kingdom’s long reigning monarch sadly passed away on September 8th, seeing the country in mourning, the cancellation of key sport events, and pushing the BOE base rate decision back a week later out of respect.

Inflation has been the hot topic on all Central Bank’s minds, and they have taken drastic action. Markets have reacted negatively surrounding the meetings which were scattered throughout September. On Thursday 8th September the ECB confirmed a 75 basis point rate hike to 1.25%, which was the largest since its creation in 1999, signalling further rate hikes to come. On Tuesday 13th September the US released CPI data for the 12 months ending in August of 8.3%, slowing down for the second consecutive month (9.1% in June and 8.5% in July). However, the rate of decline was lower than expected and US markets reacted negatively closing down c.4%, having their worst day since June 2020. In the UK CPI data was released on 14th September dropping to 9.9% for the 12 months ending in August from 10.1% in July ‘offering some respite to households and the Bank of England after inflation hit a 40-year high the month before’[i]. On 21st September the FOMC made the decision to increase interest rates in the US by 75 basis points, for the third consecutive time taking the target range to 3%-3.25% being the ’highest the fed funds rate has been since the global financial crisis in 2008’[ii]. The Bank of England has also raised interest rates by 50 basis points on 22nd September raising the rate to 2.25%. Many anticipated a 0.75% rate hike from the BOE but this came as ‘the bank said it believed the U.K. economy was already in a recession, as it forecast GDP would contract by 0.1% in the third quarter, down from a previous forecast of 0.4%’ [iii]. The Swedish Central Bank (The Riksbank) has also surprised markets with a historically hawkish 100 Basis Points interest rate hike which is its biggest in three decades. The Bank of Japan (BOJ) has maintained ultra-low interest rates to support the country’s fragile economic recovery but intervened in the currency markets on 22nd September to buy Yen, deploying some of its $1.3 trillion in reserves, for the first time since 1998. The Yen strengthened against the Dollar c.2% after the announcement.

After August’s dramatic increase in bond yields both the UK 10 year Gilt and the US 10 year Treasury yields continue to trade over or nearing 4% which is looking attractive given it is near to overtaking the yield on equity markets. The US 10 year Treasury has reached a level not seen since 2011 breaking the 3.5% mark. The strength of the US Dollar continues to rage on in the foreign exchange markets and it is on track to have its best year since 1984. Sterling has decreased against the Dollar hitting its 37 year low ‘after the new U.K. Government announced a radical economic plan in a bid to boost growth’[iv], including a number of tax cuts. The BOE stepped in to buy £65 billion of UK long dated gilts to help stable the gilt market ‘after the new government’s tax cut plans triggered the biggest sell-off in decades’[v].

Raising interest rates though, whilst being effective to control inflation, may not be able to reduce the ever growing price of LNG and hence energy, especially in Europe. With Russia closing Nord Stream 1 on Monday 5th September which delivers LNG into Germany, initially stating indefinitely, caused a phenomenal increase in the cost of energy. Gazprom’s Deputy Chief Executive Officer Vitaly Markelov claimed they would not resume shipments until Siemen’s Energy repairs faulty equipment. Furthermore, Nord Stream 2 has experienced various leaks further depleting the supply of LNG and Poland, Denmark and Germany are not ruling out sabotage. China, having excess LNG, saw an opportunity to sell Russian LNG back to Europe at a higher cost being the Expensive Middle Man. To further muddy the waters, Russia offered China their LNG in both Yuan and the Ruble. With the new appointment of Liz Truss as Britain’s Prime Minister, she has initially stated she will combat the cost of energy in the UK by putting a freeze on energy bills at £2,500 until October 2025. Ships began to set sail from Ukraine from August 1st, by the end of August more than 50 ships had left Ukraine, and now over 200 have left successfully delivering to African, Asian and European countries carrying c.5.3 million tonnes of agricultural products. At least we can see one area improving in the hope of reducing global hunger and effectively reduce food prices!

Overall, September which has notoriously been one of the worst months for Global Equities, has seen great levels of volatility return. Global equities fell 9.46% in dollar terms during the month closing out the quarter 6.58% lower. We still believe a focus on diversification across asset types, styles and strategies remains of critical importance to portfolios. Central Banks are still taking aggressive action to try and combat inflation with most stating the end is still not in sight. Bond yields continue to increase in value, the price of Brent Crude is trading at c.$90 per barrel, and Sterling continues to decrease against the dollar.

[i] www.reuters.com/world/uk/uk-consumer-price-inflation-falls-unexpectedly-2022-09-14/

[ii] https://edition.cnn.com/2022/09/21/economy/fed-rate-hike-september/index.html

[iii] www.cnbc.com/2022/09/22/bank-of-england-raises-rates-by-50-basis-points-in-seventh-consecutive-hike.html

[iv] https://www.cnbc.com/2022/09/23/british-pound-plunges-to-fresh-37-year-low-of-1point10-.html

[v] https://www.reuters.com/markets/europe/bank-england-buy-long-dated-bonds-suspends-gilt-sales-2022-09-28/

August Investment Review: Dose of Reality

By Haith Nori

August has seen some level of order being restored to markets but could simply be a bear market rally. Central Banks continue to shock the economies by taking aggressive action to control inflation. The first ships have been allowed to leave Ukraine, ending the Russian blockade on the Ukrainian Ports. Nancy Pelosi, speaker of the United States House of Representatives has made a political statement by visiting Taiwan to publicly show support for the island’s independence, however, this may ignite the buried tension between China and the US.

Inflation once again remains a key factor in Global Economies. The cost of energy is rising and a bleak forecast for January 2023 has been painted that energy bills will reach a new record high having serious implications for the cost of living. Food prices also remain at a higher cost causing a shift in consumer spending to more affordable options. Ships carrying much needed grain have finally left the Ukrainian shores with the first carrying 26,000 tonnes of corn to Lebanon. Since the sea blockade was lifted on August 1st more than 50 ships have set sail from Ukraine delivering to not only the poorest regions, the immediate plan, but branching out to the rest of the world. This marks a major breakthrough since the Russian invasion as this now will help address global hunger and restore some normality. At the beginning of August, the UK joined the US and EU in a ‘shock’ increase in interest rates, the largest in 27 years, up 50 basis points to 1.75%, the sixth time since December 2021. In the US, markets were shocked by the Non-Farm Payroll figures on 5th August, adding 528,000 jobs, versus the 250,000 expected providing positive efforts to reduce unemployment. On 10th August the US released the CPI data for July of 8.5% vs 9.1% in June. Equities rallied and Treasury yields decreased with signs of ‘decelerating U.S. inflation prompted bets that the Federal Reserve would “pivot” raising rates at a slower pace than previously expected’[i]. In the UK CPI data was released on 17th August which saw Consumer Price Inflation jump to ‘10.1% in July, its highest since February 1982, up from an annual rate of 9.4% in June, intensifying the squeeze on households’[ii]. The Bank of England will continue to increase interest rates if they need to, keeping a tight control on inflation. Analysts at Citi Bank have suggested that the CPI figure in the UK could reach as high as ‘18.6% in January, more than nine times the Bank of England’s target’[iii]!

On 26th August at the Jackson Hole meeting in Wyoming, Federal Reserve Chair Jerome Powell gave a very ‘hawkish’ speech sending US markets into a downward spiral, reiterating the central bank’s commitment to halting inflation and price stability. The next Federal Reserve meeting will be on September 21st where they will review the decision to increase interest rates once more. After the last interest rate hike of 75 basis points in July, Powell mentioned ‘another unusually large increase could be appropriate at our next meeting’[iv]. There will be several economic data inflows to review before that meeting which will guide the next decision. European and Asian markets also fell after the meeting. The outlook from the meeting that many investors were hoping for that there would be one large rate hike in an attempt to bring inflation back to normal, sadly was not witnessed suggesting further surprising rate hikes to come. Also at the Jackson Hole meeting, Isabel Schnabel, an ECB executive board member, called for ‘strong determination to bring inflation back to target quickly’[v], adding that the persistence of inflation must not be underestimated and that sacrifices would be needed to tame surging inflation. Clearly, not only the US will be continuing to tighten monetary policy after the Jackson Hole meeting.

In the UK Fixed Interest Markets two year Gilt yields increased by more this month than any other month since May 1994. On August 24th two year Gilt yields hit 2.959%, their highest level since November 2008, up from 1.72% at the start of the month.

Countries around the world are attempting to assist with the energy crisis in Europe. The US, in particular, has shifted more Liquified Natural Gas (LNG) to Europe in the month of June than it did for the whole of 2021 and is planning more in the second half of the year. Currently, Europe has filled their reserve tanks 70% for the winter but to fully refill will come at a cost of c.50-55 billion Euros with the end consumer taking the brunt of the cost. With Russia still limiting the distribution of LNG to Europe, it is essential for them to find alternative options. Olaf Scholz, Chancellor of Germany signed a green hydrogen deal with Canada on Tuesday 23rd August. This is a promising step towards both an alternative and sustainable source of energy, but the first deliveries will not be until 2025, meaning the current situation still needs to be urgently addressed.

Overall, August has seen a correlation in asset markets. We still believe a focus on diversification across asset types, styles and strategies remains of critical importance to portfolios. However, global markets have eased after rallying back in July. Central Banks are still taking aggressive action to try and combat inflation with most stating the end is still not in sight. The two year UK Gilt yield has hit its highest level since November 2008 while Brent Crude has fallen below $100 a barrel. At the Jackson Hole meeting Powell gave a very hawkish view suggesting further interest rate hikes are coming in order to halt rising inflation with the potential of other central banks following suit. Sterling has been depreciating in the run up to the announcement of the new Prime Minister in the UK scheduled to be announced on September 5th.

[i] https://www.reuters.com/markets/europe/global-markets-midday-wrapup-1-2022-08-10/

[ii] www.reuters.com/world/uk/uk-cpi-inflation-rate-rises-101-july-2022-08-17/

[iii] https://www.reuters.com/world/uk/uk-inflation-hit-18-early-2023-citi-forecasts-2022-08-22/

[iv] www.bloomberg.com/news/articles/2022-08-26/read-fed-chair-jerome-powell-s-speech-at-jackson-hole-symposium

[v] www.ft.com/content/5afd5140-605f-447d-a30c-cc7355ceea59

July Investment Review: A Return to Normal

By Adam Jones

Following a June in which global equity markets declined by 8%, July offered investors some welcome respite as markets rose by >7% over the month. Government bond yields trended lower, however measures of bond volatility (which indicate the extent to which prices fluctuate) remain highly elevated as market participants attempt to front-run the policy adjustments of developed market central banks. The US central bank raised interest rates by 0.75% in July and the ECB raised by 0.50%, bringing their Deposit rate back up to 0% following 8 years of negative interest rates. The Bank of England is also expected to make its next move higher on August 4th, with futures markets currently anticipating an increase of 0.5% in the base rate[i].

These moves are being made primarily in attempts to address the ongoing issue of inflation. US data once again surprised on the upside in July, with the headline inflation rate pushing to new highs of 9.1%. Similarly eye-watering figures arose both here in the UK (9.4%) and in Europe (8.9%). Part of the difficulty central banks currently face is that a large proportion of this inflation is being driven by factors that are outside of their control, such as commodity prices, ongoing supply chain issues and tight labour markets. In our view this greatly increases the probability that mistakes will be made as consumer demand falls further into what appears to be an already slowing global economy.

Major indicators of sentiment and economic activity in Europe fell to levels last seen during the pandemic and in our belief is that the Euro Area remains particularly vulnerable in terms of its dependence on imported energy. A further reduction in gas from Russia in July drove the European Union to agree to cutting gas consumption by 15%[ii], however natural gas prices in Europe remain far higher than those in other parts of the world. In the US economic activity also showed signs of deceleration as early estimates of services & manufacturing activity fell to its lowest level in two years[iii].

In China we received news that the country’s economy had contracted in Q2, due in large part to continued lockdowns in the wake of renewed pandemic fears. The government is making efforts to shore up the property market and support economic growth, however a Zero-Covid policy remains its top priority which will continue to affect the region.

July also saw the beginning of the Q2 US earnings season, which provided some useful insight into the performance of many of the world’s largest companies. Results here have been fairly mixed, however as at the end of July some 77% of the largest US companies had reported earnings that came in ahead of analyst expectations[iv]. Often seen as something of an economic bellwether, Walmart Inc declared that it expected full year profits to fall by more than 10% as customers continued to cut back on discretionary purchases amidst higher food & energy costs[v]. In stark contrast to this, however, excellent results were delivered by global payment companies such as Visa and Mastercard whose management teams suggested they are still seeing no signs of a slowdown in consumer spending.

In currency markets the US Dollar showed tentative signs of having peaked in mid-July, however the Dollar tends to perform well in an environment of slowing global growth which, at least to us, feels increasingly likely to be the case moving forward. During July we saw the Euro (very) briefly trade through parity versus its US counterpart, however the currency went on to recover marginally and close the month nearer 1.02. The British pound displayed similar dynamics, strengthening in the latter half of the month to close at 1.22 vs the Dollar. Following a period of very significant weakness the Japanese Yen posted its largest weekly gain in over 4 months, a move which could be self-reinforcing given the large number of speculative traders who are betting against the currency[vi].

In some respects July saw the return of more ‘normal’ market relationships (bond yields lower, equities higher), however we continue to believe that the distribution of potential outcomes remains wide for both markets and economies moving forward and that a focus on diversification across asset types, styles and strategies remains of critical importance.

[i] Refinitiv, CME Group SONIA Futures

[ii] EU Seeks 15% Cut in Gas Use on Russian Supply Squeeze (yahoo.com)

[iii] U.S. July flash PMI data show ‘worrying deterioration’ in economy | Morningstar

[iv] I/B/E/S Data from Refinitiv

[vi] Yen rises to two-month high as investors slash short bets | Financial Times (ft.com)

GLOBAL INSIGHT Q3 2022

June Investment Review: Central Banks Taking Aggressive Action

By Haith Nori

June has been another chaotic month for most asset classes. Central Banks are taking aggressive action to control inflation. The Ukraine Crisis has entered its fifth month presenting further global issues. Russia has taken control of Ukraine’s major ports or has hemmed in by its naval blockade (Ukraine is a critical global producer of wheat) which could lead to a serious impact on global hunger. In China, after the good news of lifting Covid restrictions, and markets factoring in the positive news, further lockdowns were introduced under its zero Covid policy as cases accelerated once again.

Inflation remains a hot topic for global central banks which, in June, have begun to take more aggressive action in raising interest rates. After the US May Inflation data – the single most important data point for the global economy (released on 10th June) – delivered a headline number of 8.6%, markets immediately factored in an expected 50 basis point rise in interest rates by the US Federal Reserve. In the end markets were surprised with a more aggressive increase of 75 basis points at the Federal Open Market Committee (FOMC) meeting on June 15th, with Chair Powell stating;

“The Committee is strongly committed to returning inflation to its 2 percent objective” [i]

This suggests the path of interest rate hikes in the US might have further to run, along with the expectation that inflation must be bought under control. However, this may come with a nasty side effect – The slowing of the US economy along with the potential for a higher unemployment rate.

After an initial recovery, which was sadly short lived, US equity markets declined significantly the following day, falling more than 3%. The Swiss National Bank also went on to surprise markets with a 50bps increase in interest rates (the first in 15 years) from -0.75% to -0.25%. Here in the UK, on 16th June the Bank of England (BoE) also took action to raise interest rates for the fifth time since December 2021 by another 25 basis points up to 1.25%, the highest level seen in 13 years. The FTSE 100 also fell following this news.

On the 9th of June Christine Lagarde, President of the European Central Bank (ECB), after months of suggesting an increase in interest rates, finally announced a plan to tackle the ever-growing issue of European Inflation. Currently it is engaged in Corporate-Bond buying which Lagarde has now stated will end on July 1st – a €3 Trillion bond-buying programme. Also, the ECB will begin to combat inflation by raising interest rates by a suggested 25 basis points later that month, ‘the first interest rate hike since 2011 followed by a potentially larger move in September’[ii] which may be as high as 50 basis points. With inflation in Europe currently at c.8.1% (and still rising), the ECB needs to take drastic action in order to achieve their 2% target.

Over in Japan the Bank of Japan (BoJ) on 17th June decided to maintain ultra-low interest rates and ‘vowed to defend its cap on bond yields with unlimited buying, bucking a global wave of monetary tightening in a show of resolve to focus on supporting a tepid economic recovery’[iii].

The Japanese Yen has historically been considered a ‘safe haven’ within the investment community. However, over the past few years the price has depreciated very significantly against major currency crosses given a monetary policy stance which stands in stark contrast to that of other developed market peers. Since its highest point in January 2021 the Yen has depreciated by 31.4% against the US Dollar, reaching its lowest level since 1970.

Global equity markets showed signs of a rally later in the month as the G7 Summit took place in Germany over the 26th-28th June. Markets are factoring the hope that some resolution may come of the G7 Summit with Global leaders, for instance trying to find alternative overground routes for grain exports. The S&P 500 had its largest one-day percentage gain in more than two years on Friday 24th June.

China’s escape from lockdown was short lived at the start of the month as, due to their zero-tolerance policy, new lockdowns were once again imposed. China remains unpredictable as June data does not ‘show the powerhouse bounce-back most expected, perhaps reflecting the view that corporates do not see their Covid Zero nightmare as over’[iv]. We can not rule out the end of Covid Lockdowns which will continue to exert an impact on global markets. Perhaps counterintuitively, Chinese equities are in a bull market, with the Shanghai Shenzhen CSI 300 Index having risen from its low point 26th April of 3784.12 to 4486.08 at the end of June– up 18.6%!

To conclude, the S&P 500 started the month at 4101.23 and fell by 7.7% to end the month at 3785.38. The FTSE 100 also gave back some of its more recent relative gains, having entered June at 7532.95 while going on to close at 7169.28, a reduction of 4.8%. In Germany, the DAX opened the month at 14,340.47 and finished at 12,783.77, a fall of 10.86%. The French CAC40 Index fell from 6418.89 to 5922.86, a reduction of 7.7%. The Italian MIB fell from 24,283.56 to 21,293.86, a decline of 12.3%. Japan’s Nikkei 225 fell from 27,457.89 at the beginning of June to also end lower at 26393.04, a decline of 3.9% during the month. Brent Crude, having rose to highs of $123.58 during June, started the month at $116.29 ending at $114.81.

Overall, it has been an extremely volatile month for many asset classes, especially equities. The best performers remain companies with sufficient pricing power to avoid suffering from inflation. Healthcare, Consumer Staples and utilities were the best performing sectors through June. Both the effects of Covid restrictions and the Ukraine Invasion are still very much having an impact on global markets. Central Banks are acting much more aggressively in trying to combat the overall cost of living and inflation.

Finally, US stocks have capped off their worst first half year performance since 1970.

[i] Bloomberg Points of Return – Be Warned – So Now we have Clarity. The World has Changed

[ii] https://www.reuters.com/markets/europe/ecb-chart-course-out-stimulus-setting-stage-rate-hikes-2022-06-08/

[iii] https://www.reuters.com/markets/currencies/boj-maintain-ultra-low-rates-sound-warning-over-weak-yen-2022-06-16/

[iv] Bloomberg Points of Return – Be Warned – Gaming the Post-Peak Rates World Is No Easy Task