by Alex Hulkhory

As a foreword to this investment commentary, although very much the focus of this piece, we wanted to acknowledge the current environment outside of the dispassionate lens through which we aim to assess markets. We very much appreciate and understand how challenging these periods can be. Whilst episodes of heightened volatility are never comfortable – and we work hard to avoid their impacts on investment portfolios – they are a function of investing in risk assets. In our role, as custodians of your wealth, we take this responsibility incredibly seriously. As an extension of this, we are always available for a conversation, so please do get in touch if you have any concerns or would like to discuss anything in more detail.

The below will centre on the key events that have unfolded over the past 11 days as markets try to digest the implications of President Trumps current policy agenda spearheaded by tariffs. Like any financially focused writing, we would be amiss to not include the relevant risk warnings and disclaimers! It has been a highly changeable environment, with news flow becoming outdated in minutes and hours!

The What

‘Liberation’ day – or the 2nd April to the uninitiated – saw President Trump announce a slew of ‘reciprocal’ tariffs on goods imported into the United States. Since the announcement we have witnessed a spike in volatility and in the five following trading days, a pronounced sell off in equity markets. Over this period, the S&P500 shed over 12%, with the FTSE100 and STOXX600 down 8.07% and 9.25, respectively.

Then on the 9th April, after a bout of extreme volatility President Trump announced that the proposed tariffs would be paused for 90 days, with the exception of China. The result? One of the single largest one-day gains for the S&P500, with the index up 9.5% on the day. In our opinion, this does highlight the benefit of staying invested during these periods, as the best and worst days in markets tend to be closely clustered. However, since liberation day, despite the almost record daily gain, the market is down -7.07% and we are very much not out of the woods!

The proposed Tariffs were only due to come into effect on the 9th April, with the market rout having firmly taken place in the days prior, before any of the direct economic impacts had been felt. Investment markets are forward looking and hate uncertainty. In our view, attempting to rewrite the established global order of the last 80 years, may not bode well for the future, with a higher likelihood of a recession and certainly increased levels of uncertainty.

RECESSION??!!?!

Whilst the direct impact of tariffs has yet to come into effect. There are signs that it may be beginning to impact the economy. Looking at the Atlanta Fed’s GDP NowTM[i] – a combination of indicators that attempts to provide an estimate of US GDP growth in real time – would suggest that the US economy is slowing, with an estimate of -2.4% for the first quarter of 2025. When the policy environment becomes more uncertain and the risk of a recession increases, this can cause businesses to delay hiring and investment decisions, along with individuals deferring spending. In turn, making the risk of a recession a self-fulfilling prophecy.

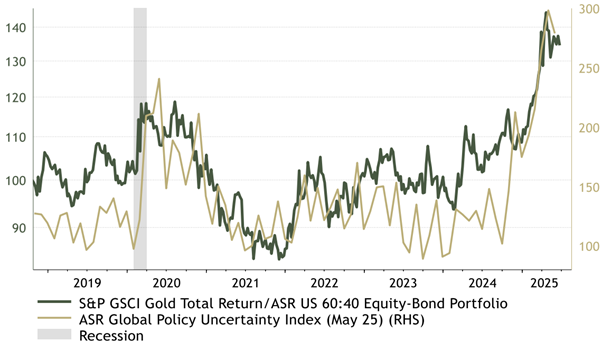

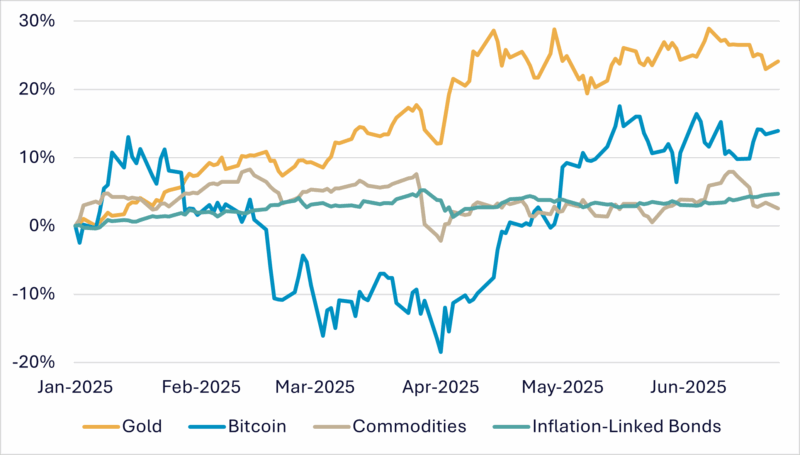

In our view, one of the biggest fears for markets is Stagflation, economic weakness combined with high inflation. Think the 1970s. Typically, when we have economic slowdowns, it is accompanied by a slump in demand, which reduces inflationary pressures, allowing a robust policy response – such as cutting interest rates – to support the economy. However, in a tariff induced slowdown scenario, there would be significant upward pressure on prices. Historically this has been a terrible environment for markets, as policy makers must balance supporting the economy against the risk of an inflation spiral.

Jam today, or Jam tomorrow.

Mathematically, the value of a company is all future cashflows you will receive as a shareholder, discounted back to the present day. During periods of elevated uncertainty, forecasting the future becomes challenging. Naturally, with an uncertain outlook for the road ahead, trying to accurately predict how many iPhones Apple will sell many years in the future, and correspondingly its profits – an arduous task already – becomes near impossible!

Rationally, as investors projections for the future become more dispersed, the less they should be willing to pay for the future earnings of a company. In reality, these moments of elevated uncertainty can lead to a frenzied panic, in which we can see wild fluctuations in asset prices. Looking at CNN’s fear and greed index[ii] – a gauge of investor sentiment – which reached lows of 3 (out of one hundred) last week, suggests investors were exhibiting behaviours associated with extreme panic.

Although downturns in markets are unavoidable, a prominent feature in our attitude to portfolio construction is to insulate portfolios as best we can. Our investment approach aims to focus on high quality companies, which have a high degree of predictability in their earnings. We aim to identify these companies at an attractive valuation to provide a significant enough margin of safety for when bumps in the road emerge. Whilst painful at the time, these moments can offer excellent opportunities for long-term investors.

The Why

In our view, interpreting the musings of President Trump has been an exercise in futility. And yet, we try! From our perspective, President Trump was elected on three key policy pillars. Tariffs, taxation and immigration. Having described Tariffs [iii]as “the most beautiful word in the dictionary”, to date, President Trump has made them the centrepiece in his mission to “make America great again”.

Central to this, has been plans to reindustrialise the US, by reshoring much of the manufacturing that has been moved to countries with lower input costs over recent decades. To us, a key tenet for President Trump has been the idea that trade deficits equate to the US being taken advantage of. Tariffs being the weapon of choice to redress these injustices.

As an aside, tariffs are not an inherently evil policy and are used by lots of countries globally. Much like any of the tools in policymaker’s armoury they can be useful if used appropriately. Historically they have been an effective way for poorer developing nations to protect and foster nascent industries, before they are ready to compete on the global stage. They are also regularly used to protect domestic markets for critical sectors, such as agricultural goods.

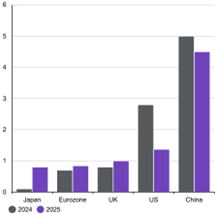

However, to suggest in any way that the world’s second largest manufacturing hub is in anyway nascent or in need of protection is derisory. We think this is also a view that will be shared by all major trading partners and sets the stage for retaliation. Risking an all-out trade war. Creating a lose-lose environment, in which the comparative advantages that have been established globally are torpedoed, lowering global output.

Trade war? That sounds bad…?

Front and centre of the evolving trade dispute has been increasing escalation between the US and China. Perceived as the worst culprit of trade injustice towards the US with a $295Bn[iv] surplus, China did not get a 90-day reprieve on tariffs. At the time of writing, tariffs on China stand at 34%, 104%, 125%, 145%! The climbing tariff rate has been a reflection of an approach of doubling down each time we have seen a response from Beijing, with China currently having a 125% tariff on US import. Beyond a certain point, the number becomes slightly meaningless as it effectively will choke off all trade between the two nations, or at the very least lead to considerable rerouting through neighbouring countries with lower tariffs.

The real bully!

Former advisor to the Clinton administration, Jimmy Carville is famed for his quote “if there was reincarnation, I would like to come back as the bond market. You can intimidate everybody”. After what appeared to us as complete indifference to the pronounced sell off in the equity markets, it seems to be the turmoil in the bond market that moved President Trump to action.

Typically, during periods of stress, investors flock to ‘safe haven’ assets seeking refuge from sinking equity prices. In our view, historically the US dollar and US treasuries have been one of the highest regarded safe haven assets, with the yield (return) offered by these US government bonds being synonymous with the ‘risk free’ level return.

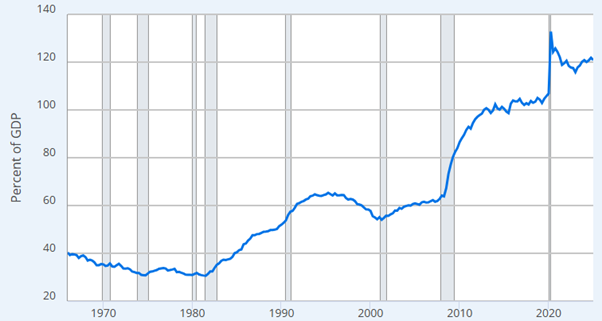

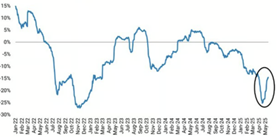

Interestingly this week, we have witnessed a steep climb in yields on longer dated government bonds. In plain English, investors are demanding to be compensated more for taking on the risk of lending to the US government. This has been most pronounced in 30 yr bonds, where yields have climbed to the eye watering 4.97%.

Given America’s level of indebtedness, in our view this has significant implications for the administration’s spending plans. With $9.2 Trillion[v] of Debt due to be refinanced in 2025, a significant increase in debt servicing costs is likely to curtail other aspects of President Trump’s policy agenda. From our perspective, any proposed extension to Trump’s tax cuts from his first term in office would become challenging.

Reasons to be cheerful.

Whilst the above paints a rather bleak outlook, and we would certainly expect volatility to be a significant theme over the near-term there are several positives we can take from the current environment. Firstly, comparing to previous crises. The weakness we have seen in markets has very much been a function of policy rather than an exogenous shock to the economy. During the COVID-19 pandemic there was no off ramp that could immediately resolve the key issue in minutes.

Further to this, as long-term allocators of capital, periods of panic and uncertainty in markets can allow us to opportunistically deploy capital at exceptionally attractive valuations. Napoleon defined a military genius as “a person who can do the average thing when everyone else is losing their mind.” Remaining calm through these periods of volatility can provide us with a meaningful edge. We very much continue to believe attractive returns are available for patient investors.

References

[i] https://www.atlantafed.org/cqer/research/gdpnow

[ii] https://edition.cnn.com/markets/fear-and-greed

[iii] https://www.bloomberg.com/news/newsletters/2024-10-15/in-trump-s-economic-plan-tariff-is-the-most-beautiful-word

[iv] https://www.census.gov/foreign-trade/balance/c5700.html

[v] https://www.businesstoday.in/latest/economy/story/its-all-engineered-for-us-recession-isnt-a-risk-but-a-tool-warns-rivigo-founder-471364-2025-04-09