Blog

Market Review – December – Anticipating 2025

By Tim Sharp

November was a risk-on month, following the unexpected Republican clean sweep in the Presidential elections that saw the markets react with a “Trump Trade”. Global equities rallied 4% in November with the US leading the way (+6.5%) and more specifically Small Caps (+11%) seen as a beneficiary of Trump policies to reduce corporate taxation, loosen fiscal constraints, and reduce regulation. Mega-tech was seen outperforming the wider US market, and Growth equities (+4.3%) were the next best performing factor. Global fixed income (+0.9%) was also in positive territory and led, in local terms, by Italian BTPs and German Bunds. This has been an indication of the level of fiscal stimulus being used by the US administration, creating loose conditions to facilitate future Fed easing. Although the December meeting saw the widely expected 25 basis point cut to the Fed Funds Rate, the euphoria in some parts of the US equity market was tempered by hawkish comments from Chair Powell. Financial markets had come to expect inflation to continue to fall despite the reflationary policies being considered by the new administration after the inauguration. The Fed therefore decided to remind markets of the pressures still showing within the US economy that could keep rates higher than forecasts predict for 2025. Furthermore, the breadth of equity market returns had narrowed once more, and the 10-yr US Treasury yield had passed the psychological 4.5% level that tends to affect equities. US equities have duly reset and now find themselves, at the time of writing, in negative territory for the month. Several concerns are creating year end headwinds, including Fed policy uncertainty, and an unexpected debt-ceiling debate despite the Republican majority.

There remains much political uncertainty in the developed world and – while we would normally deduce that politics rarely has long term effects on global financial markets – 2025 could be an exception. The change in policy outlook of a Trump administration has been taken as broadly equity positive, but the order of priorities could potentially change that outlook. For example, limiting or deporting immigrants, implementing tariffs aggressively, or cutting government spending are likely to have a poorer result on the growth outlook than cutting taxes or deregulation, with knock-on ramifications for the global economy. Furthermore, the expectations for an escalation in the US-China trade war are elevated and could affect both external demand and the relationship with alternative trading partners, at a time when existing fiscal and monetary stimulus has started to influence domestic demand. The chance of further fiscal stimulus may see China become more influential on global growth, as President Xi reportedly predicts China will hit its 5% growth target for 2024 in contrast to the expectations of many economic forecasters.

Further political uncertainties exist within the Eurozone, where a vote of no confidence in France’s Barnier government led to the dissolution of parliament, and the rejection of a tightening budget that the financial markets had looked upon favourably. This leaves President Macron to attempt another minority coalition with a more populist prime minister. Germany also faces snap elections in February after a no confidence vote in the current Scholz-led coalition in the face of rising right wing populist support and a potential change in the way the EU supports unity in fiscal policies. Germany remains one of the most conservative and influential countries within the EU in our opinion, so any loosening of the economic constraints by a more economically liberal government could impact the approach to governance and EU funding. European growth has surprised on the upside in 2024, and as monetary and fiscal drag reduce, is expected to continue in 2025. There is little doubt that Trump’s approach to the Russia-Ukraine conflict is likely to significantly impact the European outlook, potentially more so than the threat of tariffs. However, the potential for China to surprise on the upside will also influence the outlook for Europe.

In summary, we believe it is likely that the Trump trade and US exceptionalism will run into 2025 with technology, small caps, and cyclicals rallying on the potential for lower taxes and the loosening of regulation. We note that the differential between European and US valuations remains at its widest historically, which is being justified by the higher earnings growth forecast in the US. JPMorgan expect S&P500 earnings to grow by 14%, and European ex-UK by 8%, with multiples of 22x vs. 14x, respectively, while their UK forecast calls for 8% earnings growth in a market trading at just 11x[i]. This suggests to us that a significant discount for lower earnings estimates may already be priced into valuations. Some elements may be attributable to composition of sectors, especially the weighting to technology at 32% vs 9%, however, most sectors trade at a sizeable historical valuation discount to the US. There is a possibility for policy surprises in both the US and Europe, while earnings and margins will need to continue to expand to justify the US valuation premium.

In the meantime, we remain cognisant of relative valuations, the changing macroeconomic environment, and the geopolitical risks that we expect to significantly impact the global economy and financial markets. We wish everyone an enjoyable holiday period and look forward to 2025 with anticipation.

[i] Karen Ward _ JPMorgan Asset Management EMEA _ Investment Outlook 2025 _ November 2024

Acknowledgements

Zahra Ward-Murphy _ Absolute Strategy Research _ Investment Committee Briefing _ 2nd December 2024

October Investment Review: Invest, Invest, Invest

by Tim Sharp

October has proved to be a significant month for markets. Global equities lost 2% reversing September gains, government bond yields rise, wars in Ukraine and the Middle East escalate, betting on the outcome of the Presidential election in the US is relaxed with interesting results, and the UK Labour Government holds its first budget since 2010 delivered for the first time in history by a woman.

US equities outperformed world equities although monthly returns were led by Japan (1.9%) after surprise election results while after a strong middle of the month the NASDAQ weakened (-0.52%) as the “MAG7” gave up 3.6% over the closing days versus a 1% monthly decrease in the S&P500. US Q3 earnings are currently surprising by 6%[i] led by Technology, with Banks in US and Europe also producing quarterly results above expectations. Furthermore, there appears to be a broadening out in Q3 earnings within the S&P493 (ex-MAG7) with growth running at 2%, 5.3% ex-Energy[ii], and European earnings results are also strong surprising by 7%[i].

Following the robust September US jobs report which added 254,000 jobs versus 150,000 expected, and saw the unemployment rate fall back to 4.1%, many investors questioned whether the Federal Open Market Committee would have agreed to cut rates by 0.50% instead of 0.25% if they were in possession of this data. The bond market started to reconsider its rate cutting forecasts particularly as the US Presidential Election date moves ever closer. Betting prediction sites particularly Polymarket which does not limit the size of bets that are made show a late improvement in the odds of a Trump win although opinion polls, traditional sites such as PredictIt that limit wagers, and companies such as Robinhood and Kalshi that offer derivative Event Contracts, seem to have the result too close to call.

The general press seems to believe that the late momentum is with Trump and markets are reacting to that[iii]. Despite stronger economic data resulting in higher real interest rates (adjusted for the effects of inflation), the chances of a Trump win, and the odds of a Republican clean sweep, increase the possibility of sweeping tax cuts, imposition of higher trade tariffs, and a sharper increase in the deficit. This has helped the 10-year US Treasury yield rise from 3.80% to 4.28% over the month as it moves to predicting only 50bps of easing by the Fed over the next three meetings from 100bps. John Authers further points out in his daily Bloomberg column that there is a striking comparison in the moves in the 10-year yield and Trump odds according to Polymarket[iv]. The MOVE bond volatility index remains at its highest levels for the year in stark contrast to the stable condition of the VIX stock market volatility index.

A Trump win is considered to be positive for equities which explains the leadership once more of Mega-Tech. However, the market considered most likely to benefit from a loosening of regulation under a Trump presidency is cryptocurrencies, underscored by his keynote speech at the Bitcoin 2024 Conference in July[v]. Bitcoin has rallied from $53,955 on September 6 to an all-time high of over $72,500 by the end of October with over $3.6bn of net inflows into Spot Bitcoin Exchange-Traded Funds (ETF’s)[vi]. It appears Bitcoin is also gaining traction as an inflation hedge with alternative investors. Gold – the classic inflation hedge – has also reached a new high of $2,777 on the back of its safe haven status and protection against extreme policy changes! We are less than a week away from election day but could be weeks away from a result being declared so we believe we will see increased volatility during the period of uncertainty.

Rachel Reeves delivered what has been reported as a blockbuster UK budget on October 30 second only to Norman Lamont’s 1993 budget. With the major themes of borrowing to invest, and to cover a contested hole of £22bn in the finances inherited from the last government, broadly telegraphed over the previous months, we feel the market reaction has still been surprisingly benign. Although the 10-Year Gilt has followed European and US Treasury counterparts higher from 3.94% to 4.41%, the move since the budget is approximately 6bps allaying any fears of a Truss-like mini-budget reaction to increased borrowing. Moves in £/$ and £/EUR have also been benign suggesting that the change in investment philosophy which has been echoed by the IMF[vii] appears to have been accepted by financial markets.

At a headline level, the budget involved £40bn in tax rises, £100bn in capital spending, and an extra £35bn to be funded through higher borrowing. Following a review of the main points we would like to highlight some changes that may affect investment decision-making.

In summary, tax receipts are expected to be £36bn higher on average and capital expenditure £24bn meaning public sector borrowing is set to rise £32bn per year on average. This means the new measure of debt defined as Public Sector Net Financial Liabilities will rise to 84.2% of GDP by 2026-27 from 83.5% now. The emphasis of the budget is to stimulate growth and ASR project that GDP growth will be 0.6% better in 2024-25 fiscal year, 0.4% in 2025-26, and 0.1% in 2026-27 all generated from central government investment. ASR further point out that the level of the UK government’s inward investment is significantly less than that carried out by its G7 counterparts and although this budget closes the gap by approximately 0.3% of GDP it remains little more than a step in the right direction[viii]. The importance of the Chancellor’s message regarding the direction of travel probably outlines a strategic change under this government that will require future action if it is to provide the improvements in productivity and growth that is required to compete with similar nations.

.

[i] ASR _ Investment Committee Briefing November _ November 1, 2024

[ii] ASR _ Q3 Earnings – Looking for broadening _ October 31, 2024

[iii] Forbes _ Jay Ginsbach _ Trump-Harris Betting Markets And Swing States Odds With US President Projections _ October 31, 2024

[iv] Bloomberg _ Points of Return _ John Authers _ Helter-Skelter in bonds as markets doubt Fed cuts _ October 22, 2024

[v] https://www.youtube.com/watch?v=9UxAUryUKXM

[vi] Bloomberg _ Points of Return _ John Authers _ Bitcoin is boss, bonds at a loss _ October 31, 2024

[vii] https://www.reuters.com/world/uk/imf-fiscal-chief-says-uk-needs-bring-debt-under-control-welcomes-fiscal-rules-2024-10-23/

[viii] ASR _ Ben Blanchard _ “Invest, Invest, Invest”_ October 31, 2024

Hottinger Group Charity of the Year 2024/2025: Supporting Great Ormond Street Hospital Charity

At Hottinger, we believe in giving back to the community and supporting causes that make a meaningful difference. This year, we are proud to announce that we have chosen Great Ormond Street Hospital Charity (GOSH Charity) as our charity of the year.

Great Ormond Street Hospital (GOSH) provides world-class care to children with serious health conditions and supports families through some of the most challenging times of their lives. GOSH cares for thousands of children each year, offering help when it is needed the most, and we are honoured to play a part in supporting their vital work.

Our Challenge: Marathon des Alpes-Maritimes Nice-Cannes

To kickstart our fundraising efforts, two of our dedicated team members will be taking part in the French Riviera Marathon on 3rd November 2024. Both participants have committed to months of intense training and preparation for this event. By taking on this physical and mental challenge, they aim to inspire our team, clients and peers to contribute to this worthy cause.

How You Can Help

We encourage clients, colleagues and the community to join us in supporting GOSH Charity by donating to our fundraising campaign. Your contributions will help ensure that GOSH can continue providing world-class care, research, and support for children and their families.

We will be incredibly grateful for any donation, no matter the size. 100% of our fundraising will be going to our JustGiving page for GOSH Charity. If you would like to donate, please use the following link.

Hottinger Group is fundraising for Great Ormond Street Hospital Children’s Charity (justgiving.com)

Thank you so much for your support!

GLOBAL INSIGHT Q4 2024

September Investment Review: The Beginning of an Easing Cycle

by Tim Sharp

September and October are historically the most challenging period for financial markets as participants return from summer breaks and we enter the final quarter of the year starting with the anniversary of 9/11. Markets have been data dependent ever since central banks announced that they were relying on the data to signal the beginning of the easing cycle, having already suggested that we had reached peak rates over the summer. Following the Jackson Hole Symposium speech by Fed Chair Powell speculation had moved from when the first cut would materialise to whether the cut in September would be 25bps or 50bps and – to the surprise of some – the FOMC voted for a 50bps cut at its September meeting. It is not unusual for the Fed to start an easing cycle with a larger-than-normal cut in rates, but then it is unusual to start easing when the underlying economy is as resilient as it is currently showing, so this is an important shift in momentum. Financial markets are now pricing in another 50bps before year-end and a neutral R-Star rate of approximately 3%i. R* or R-Star is the real short-term interest rate that would prevail if the economy was at equilibrium. It is by nature difficult to calculate and largely notional but would neutralise the business cycle.

There have been many economists predicting a recession for most of 2024 following the steep rise in interest rates during the prior year, and western economies led by the US have largely shown their resilience, but as we see August Personal Consumption Expenditure (PCE) falling close to the 2% target, US unemployment above 3.2%, and consumer confidence beginning to flag despite strong revisions in corporate earnings and margins, concerns that the momentum may deteriorate sharply have motivated the Fed to assert that it is ahead of the curve.

In our opinion the indicators of a looming recession such as overleverage, credit market stresses, high default rates, and other signs of growing imbalances in the economy are currently absent outside of the US Treasury yield curve which dis-inverted during September and currently sits at +17bps 2yrs-10yrs, a strong historical indicator of a recession. We are also wary of deteriorating employment figures and consumer balance sheets, although these pressures are most acute in lower wage cohorts that have a limited impact on aggregate consumption. As we have stated previously, the environment still favours risk assets and – after a short show of nerves at the Fed’s decision – equity markets have gone on to post a positive September after another shaky start on the back of poor data. The S&P500 gained 2% and the NASDAQ 2.7%, while major European and UK bourses are flat on the month.

Germany’s IFO survey of business sentiment fell again in September for a fourth consecutive month to 85.4 from 86.4 in August after the economy contracted in the second quarter. A contraction in the third quarter would indicate that Germany is in recession, if it is not already, with the business climate index in manufacturing falling to its lowest level since June 2020. The European Central Bank (ECB) followed the Fed’s move in September, but many economists are pushing for another cut in October in line with the ECB’s “meeting by meeting” approach after September’s Purchasing Managers Index Survey (PMI) data continues to point to economic weakness.

Europe relies heavily on its relationship with China, its largest trading partner, and Chinese exports have flooded European markets as the region tries to stimulate its lagging economy. The Chinese Central Bank (PBoC) in an unusual western-style announcement on September 24 lowered bank reserve requirements, cut interest rates by 0.1%, and stated that it will provide funds to brokers to buy stocks. The announcement pushed Chinese stocks higher, leaving the Shanghai SE up 17.4% on the month. The commitment to further action if needed may be enough to lift sentiment as well as asset prices and deliver a rebound in consumer demand and the ailing property sector, although growth still appears to be tracking well below the 5% target. There remains a reluctance for corporates and consumers to increase their borrowing due to already highly-leveraged positions after the property slump, so, in our opinion, making more stimulus available without addressing these concerns in the longer term may not be enough.

Inflation in the UK is proving a little stickier than elsewhere, as referenced in Bank of England (BOE) Governor Andrew Bailey’s Jackson Hole Symposium speech leaving expectations that rates would be left unchanged in September by the Monetary Policy Committee (MPC), and they duly were. The MPC would like to see inflation “squeezed out of the system” entirely before embarking on an easing cycle. This has been good news for sterling, which has gained 1.8% versus the dollar over the month rising to 1.34 and 1.1% versus the Euro climbing to over 1.20. Labour supply remains very tight following Brexit, and 7% of the UK workforce is not working due to long-term sickness[i], which leaves the UK workforce with bargaining power, despite a surprising drop in consumer confidence in September. Forecasts suggest a more gradual 150bps decline in UK rates by the end of 2025 with the next cut expected at the November meeting.

Falling interest rates, a weaker dollar, and a worsening geo-political back drop is a good environment for gold as a safe-haven asset, and the price has continued to strengthen to as high as $2,670 /oz during September, a 30% rally this year. Since the economic sanctions imposed on Russia by the US, many central banks have been keen buyers of gold to boost reserves and reduce their reliability on fiat currencies – not least the dollar and US Treasuries. China and India reportedly have added significantly to their gold reserves this year and central bank buying has generally added a significant tailwind to the price[ii]. It is difficult to justify the rally in gold this year without the involvement of central bank demand leaving the price extremely overbought unless the global economy is heading for a deep recession or a prolonged period of uncertainty, which we currently doubt.

In summary, there are signs that the US economy is slowing, bringing renewed calls for a pending recession from parts of the market. However, as we expected, we see an economy that seems to be heading for a soft landing and a broadening out of returns and we therefore continue to favour risk assets.

[i] Ward Karen _ JPMAM _ My Key Question This Month _ Should the BOE follow the FED _ 2024.09.25

[ii] Authers John _ Bloomberg Opinion _ Points of Return _ All That Glitters _ 2024.09.27

August Investment Review – When Investor Anxiety Meets Illiquidity

by Tim Sharp

The markets’ wobble at the beginning of the month was well documented in our mid-month commentary. To recap, a mixture of softening economic data led investors to believe that the US Federal Reserve (Fed) was behind the curve, risking a hard landing. These concerns combined with the unwinding of the Yen carry trade, as the currency strengthened significantly following an unexpected rate tightening by the Bank of Japan (BOJ).

Two weeks later, headline CPI fell below 3%, the lowest inflation print since March 2021, and into the Fed’s target zone. Concurrently, many economists – such as Dr Torsten Slok of Apollo, via his Daily Spark note – pointed out signs of enduring strength in the US economy[i]:

“Looking at the latest daily and weekly data shows that retail sales are strong, jobless claims are falling, restaurant bookings are strong, air travel is strong, hotel occupancy rates are high, bank credit growth is accelerating, bankruptcy filings are trending lower, credit card spending is solid, and Broadway show attendance and box office grosses are strong.

The bottom line is that there are no signs of a recession in the incoming data,”

As we predicted, Fed Chair Powell used the Jackson Hole Symposium to underline the Fed’s view of the data and surprised many by his dovish speech. He unambiguously declared:

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

With the Fed clearly believing that inflation is on a sustainable path back to 2%, and with employment data robust but related pressures having eased, the fundamentals for a soft landing are falling into place. As the month draws to a close, Fed Funds Futures are pricing in 100bps of cuts by year-end. With just three meetings remaining until year end, the question for September’s meeting is whether it will see a 25bps or 50bps cut.

The other major event for August was Nvidia’s results, after the market close on August 28th. These were expected to either underline the markets over-optimism in the roll-out of AI (Artificial Intelligence) or extend the run of ‘beat-expectations-and-raise-guidance’ results that investors had become so spectacularly used to receiving. The company reported a very strong second quarter: revenue growth of 122% year-on-year, earnings-per-share (EPS) growth of 152%, and expected third quarter revenue growth of 80%, all of which were higher than the average estimates. However, the results failed to beat the most optimistic of expectations which, combined with the continued slow roll-out of the new Blackwell chip, led to the shares being sold off 8% in after-hours trading, before closing approximately 6% lower the following day. This proves that merely beating expectations is insufficient for mega-tech momentum to continue, against a backdrop of optimistic valuations. Although the belief in the AI story remains, question marks over AI’s ability to generate wider returns through its usage are emerging.

Following the sell-off at the beginning of the month, the equal-weighted S&P500 index regained its all-time high on August 21st, while the market-weighted index took a couple of days longer to do so and has since weakened into month end, following Nvidia’s results. This suggests to us that a broadening out of returns is underway, a contention that the latest earnings season has supported. With over 97% of the S&P500 having reported, aggregate earnings have beaten estimates by 5.6%, versus an historical average of 4.8%, with 74% of companies topping estimates. Second quarter revenues grew on average 5.2%, while EPS grew 11.6%. Although technology was by far the strongest sector, we feel these results reflect broad strength in the US economy and little sign of a looming recession[ii].

The pricing in of future interest rate cuts has also seen the US Treasury curve steepen, with 2-yr bond yields dropping 7 basis points to 3.90%, while 10-yr yields increased to 3.86%. As a result, the curve is inverted by only c. 4bps, which is the closest we have been to a dis-inversion for the last couple of years.

Turning to the UK, the Labour government is gearing up for the Autumn budget by taking the opportunity to announce a £22bn perceived “black hole” in the country’s finances and forewarn the need for tax rises. Investors are focusing on capital gains tax’s equalisation with income tax, which has caused alarm in the buy-to-let property market and in buy-and-hold investment portfolios. Inheritance tax and employer national insurance contributions are rumoured to be in the crosshairs, as the major taxes have been declared off-limits, to ensure that those who can afford to pay more, contribute more. After the ructions of the Conservative time in office, markets seem more constructive about the challenge facing Chancellor Reeves and her attempts to prove fiscal sustainability. The pound is back to 1.31-1.32 versus the dollar, a level which it has not reached since 2020, although it is debatable whether this is sterling strength or broader dollar weakness. However, 1.19 against the Euro is also back to a level last seen in 2022. Sticky inflation suggests that the Bank of England (BOE) may be less likely to cut rates in September than the European Central Bank (ECB) in our opinion, with Governor Andrew Bailey providing a note of caution at the Jackson Hole Symposium and perhaps looking at November for the next move in UK interest rates.

The boost that hosting the Olympics has given France further highlights the weakness of the German economy, where growth contracted in the second quarter, and inflation surprisingly dropped below 2% in August. Spanish inflation was also weaker than expected, highlighting the possibility that Eurozone inflation may be moving closer to the ECB’s 2% target rate. Although other economies have been performing relatively better, former ECB President Mario Draghi has been researching a potential plan for fiscal stimulus which, if implemented in tandem with an ECB rate cut, may boost the region’s economic prospects. August’s Flash PMI figures suggested weakening growth in both manufacturing and services and the ECB’s July meeting pointed to a re-assessment of the appropriate level of monetary policy in September. Rate cut speculation directly affects currencies, and the Euro sits at 1.1050 versus the dollar as we witness a prolonged period of dollar weakness, with markets pricing in easing speculation, providing breathing space for the wider global economy.

The Dollar Index has had a difficult month, losing 2.4% on shifting rate expectations and, more broadly, is down 4% this quarter-to-date, and flat year-to-date, reflecting the shift in relative real yields. Periods of dollar weakness provide a tailwind for the global economy and have pushed gold 2.77% higher in August, to $2,524/oz and burnishing the metal’s role as a hedge against geopolitical risk which is currently rising in the Middle East and Europe.

As we reach US Labour Day, we expect to see volumes start to increase, following a typically slow August as investors return from vacations. August’s volatility will encourage markets to become even more data dependent as we move towards the central bank decision-making period at the end of September. The current data sees inflation continuing to fall towards the 2% target rate, employment market pressures receding, and growth rates consistent with a soft landing. We believe this environment remains healthy for risk assets and, based on relative economic performance, continue to favour the US over other regions, as the need for monetary easing is finely balanced by continued economic resilience.

[i] Slok, Dr Torsten _ Apollo Daily Spark _ The Economy Is Doing Just Fine _ 2024.08.17

[ii] Golub, Jonathan _ UBS _ Earnings Brief 2Q24 August 29 _ 2024.08.29

Fears of a Hard Landing and Summer Trading Volumes

by Tim Sharp

As has been the case for much of the recent history, the path of inflation and interest rates along with the strength of the broader economy continues to dominate markets. Since the last hike from the Federal Reserve (Fed) in August 2023, a central focus of investors has been around the timing of the first cut, along with the trajectory for interest rates going forward. With Chair Powell signalling that the Fed remains data dependent, markets have been whipsawed as different data points have signalled economic strength or weakness.

We believe this was a trigger for the very pronounced moves in both equity and fixed income markets in Q4 2023, as softening data on the economy led investors to price in five rate cuts in 2024. Up until very recently, continued economic resilience largely underpinned by a strong US consumer and a robust labour market led to interest rate expectations moving higher. Equity markets can look through the rate cuts being priced out, if underpinned by a strong economy, although this has led to far more emphasis on earnings. It has been a far more challenging environment for bond markets, which had suffered against this backdrop.

Touching on valuations in the US Technology sector, “Mega-tech” have contributed significantly to the recent performance of the S&P 500 as an AI related boom has propelled earnings and valuations. Against a backdrop of a reducing number of rate hikes being priced in during H1 2024, greater and greater emphasis has been placed on the earnings of these companies. The most recent quarterly earnings season, we see growing concerns around how – and importantly when – these companies will be able to monetise the significant AI related expenditure. This disappointment triggered a significant technical rotation into the small cap Russell 2000 index in July at the expense of “mega-tech”. However, it is still unclear to us whether this will continue from being a technical rebound into a full-blown rotation as many investors still seem drawn to the possible growth story within technology and the free cash flow generated by mega-tech but we believe small caps are historically more interest rate sensitive should the easing cycle get under way.

At present we calculate that markets are back to pricing in five cuts by the end of the year up from the two cuts in July, with an almost 100% probability of a September cut. Our approach through this has been to focus on the longer term, rather than attempting to time short term changes in expectations. It may take wise words from Chair Powell at the Jackson Hole Symposium later in August to calm some of the more anxious investors. Economists we follow point out that although the US has slowed, there is no obvious catalyst for recession with asset prices underpinned, profits strong, and inflation falling allowing the Fed more room to manoeuvre[i]. It is likely that interest rates will be lower in the coming months in our opinion.

Turning to geo-politics. In addition to the two major conflicts ongoing in the world now with fears of further escalation, we expect the US presidential election to take centre stage in the latter part of 2024. As things stand, a Trump presidency appears to be the most likely outcome, although a lot can change between now and November. Whilst there is a lot of uncertainty around what Trump 2.0 might look like, there are two key areas of focus for markets. Expectations are for expansionary fiscal policy and business friendly policies, which should be supportive of company’s earnings. That said given the current size of fiscal deficit, markets may be more punishing towards increased spending. In addition to this, policy towards Ukraine and China has been a potential source of concern as Trump leads with an ‘America first’ campaign.

Looking more specifically at the events since the beginning of August, markets have become once again very concerned with the health of the US economy along with valuations in the mega-cap technology sector. A major catalyst for the latest spike in volatility indices was the August unemployment report. The most recent data for July showed the US added 114,000 jobs, far below market expectations of 175,000 along with unemployment that rose to 4.3% against expectations of 4.1%. This has led to fears that the Federal reserve is ‘behind the curve’, with suggestions that they have been too slow to lower interest rates and provide support for the economy, risking a hard landing.

In addition to this, the rise in unemployment in July triggered the “Sahm rule” which indicates a recession has started when the three-month moving average unemployment rate is 0.5% or higher than the lowest point of the last twelve months, an economic indicator that has previously been a signal that the US economy is in recession. However, we also understand that the easing of a Covid-related backlog in US Visa applications has increased labour supply through immigration[ii] and although we can see that private sector job openings are declining the “Sahm rule” was designed for a decline in labour demand so may be less of an indicator in 2024[ii].

Moreover, there continues to be ongoing Covid related dislocations. Unemployment has been rising from a very low base and although the July report was weak, taking a broader perspective over the past three months the US has averaged 170,000 jobs. Comparing this to the pre pandemic average of 178,000 in 2018 and 2019, would suggest to us that an impending major recession is less likely.

The latest data release was Consumer Price Inflation (CPI) which was also benign enough for markets to continue to expect a September cut in rates. The headline rate of 2.9% year-on-year was lower than the 3% expected and the lowest rate since March 2021, while the 0.2% advance month-on-month was in line with expectations. Core inflation that strips out food and energy was also in line with expectations at 3.2% year-on-year and 0.2% month-on-month. Inflation readings have been slowly drifting back towards the Fed’s 2% target although they are sticky in areas, such as shelter, further reducing inflation as a reason for the Fed to stay on hold.

A hawkish rate hike by the Bank of Japan (BOJ) was the second catalyst for the significant moves in financial markets. Japan was the best performing stock market in dollar terms in July largely due to the performance of the Yen[i] and the technical unwinding of the carry trade leading to Yen short covering during July and into August. Historically, we have seen Japanese investors investing overseas which has meant more recently investing in mega-tech or the NASDAQ Index in the US. As the results season has seen “mega-tech” disappoint and valuations back up, coinciding with significant Yen strength, we believe this has led to many Japanese investors repatriating funds. The reaction of Japanese Government Bonds (JGB) to the change in BOJ policy towards yield curve control and the decision to hike rates into an already strengthening currency has assisted JGB 10-Yr yields rise to 1.1% which may well attract local investors. Despite the 11% rally in $ / Yen taking it from 162 to 144, Purchase – Power – Parity (PPP) comparisons suggest that the Yen is still cheap by historical standards while the US – Japan 10-yr yield differential as calculated by ASR also suggests a stronger Yen could continue[i].

Whilst heightened volatility is certainly uncomfortable, and we are actively monitoring the situation, as long-term investors we remain constructive on risk assets. Summer holiday season often coincides with increased volatility in markets and this year has so far been no exception. We continue to look for a broadening out of returns in US equities and were pleased to see that nine out of eleven sectors have surprised on the upside albeit modestly during this US earnings season. We expect to see the beginning of the US interest rate easing cycle in September, although we currently do not see a recession on the horizon. We continue to favour risk assets but perhaps a period of relative underperformance of “mega-tech” in favour of sectors that outperform during easing cycles such as Healthcare, and Consumer Staples.

[i] Ward-Murphy _ Zara _ Absolute Strategy Research_ Investment Committee Briefing – August 2024

[ii] Slok _ Dr. Thorsten _ The Daily Spark _ Apollo _ August 8, 2024

GLOBAL INSIGHT Q3 2024

June Strategy Meeting: With rate cuts on the horizon, be careful what you wish for

by Rob Cloete

Regional monetary policy, prospects for future easing and the potential for divergent interest rate paths continue to dominate headlines and influence investor positioning. The Eurozone’s widely anticipated June rate cut unusually stole the march on the Federal Reserve, with policymakers willing to risk the adverse ramifications of a strong Dollar for the sake of averting a recession amidst lacklustre economic data. As attention turns stateside, the future path remains unclear, and further complicated by the upcoming elections and inclination for the Federal Reserve to remain unbiased. Meanwhile, the ‘risk on’ (short volatility) environment that’s been in place largely uninterrupted since October 2022 has contributed to lofty valuations across both equities and credit. This note seeks to determine whether hopes pinned on future easing to further drive valuations may be misplaced.

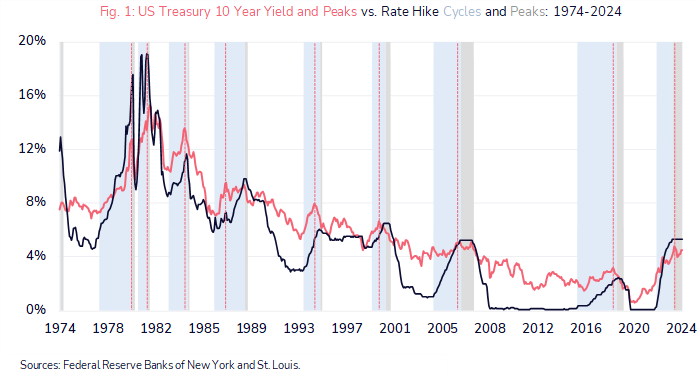

Figure 1 above reflects the relationship between the nominal 10-year treasury yield (coral line) and the policy rate. The vertical dotted lines illustrate that, the market being a future discounting mechanism, treasury yields typically peak during rate hike cycles (light blue bars) and prior to cycle peaks (grey bars). The Federal Reserve paused hikes in the current cycle in August 2023. Should the current level prove to be the cycle peak, then the ‘top may be in’ for treasury yields in this cycle. We remain constructive on duration and are positioned accordingly, not least due to the asymmetric prospective returns from convexity. A rate cut of 100 bps would result in a 12% appreciation in the 10-year treasury, while an equivalent rate rise would cause just a 3% decline. Elsewhere, while nominal yields on credit are optically attractive, with the US High Yield Index for example offering a yield to maturity approaching 700 bps, the spread over government paper is negligible at around 300bps (and near the bottom of the 300-900bps range since 2010 and some 200bps below the average over that period). Refinancing costs have declined, and the maturity schedule provides flexibility, but risk-adjusted compensation remains inadequate.

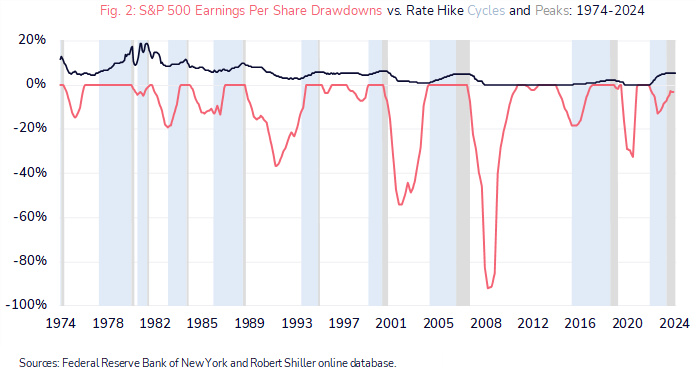

Figure 2 below shows that, contrary to popular opinion, a rate cutting environment may not support equities: rate cutting cycles have historically regularly preceded earnings recessions. The coral line reflects the S&P 500 earnings per share declines that have typically occurred during rate cycle ‘pauses’ (grey bars) and before rate cuts begin. With equity valuations currently elevated (a forward PE ratio of 21x, from which subsequent annualised ten-year returns have been paltry, ranging from 0% to 5% in data going back to 1988), the stakes are high. With multiples having expanded to the point that the risk premium over ‘safer’ investment grade credit is now negative, we maintain our view that earnings will need to do the heavy lifting if major equity indices are to continue their upward trajectory. On this front, there is cause for optimism, with FactSet consensus forecasts anticipating double digit earnings growth in each of the next two years (11% in 2024 and 14% in 20251). While constructive and selective with our equity allocation, we remain cautious, and conscious that stock markets have tended to peak in anticipation of rate cutting cycles (and not during them). Further, equity indices decline in advance of earnings declines, so we remain attuned to changes in earnings expectations as a warning signal that the prevailing ‘risk on’ environment – particularly in the more momentum driven pockets – may be about to turn.

Going forward, while wary of index levels and valuations, we continue to apply our bottom-up approach and valuation discipline to equity selection, exploiting the risk budget that safer allocations elsewhere (to government bonds, gold, and diversifying alternative funds exposures) permits us.

Sources:

1 Butters, J. (21 June 2024). FactSet Earnings Insight. [online].

Available at: https://www.factset.com/earningsinsight

2 Federal Reserve Bank of St. Louis. ICE BofA US High Yield Index Option-Adjusted Spread. [online].

Available at: https://fred.stlouisfed.org/series/BAMLH0A0HYM2

June Investment Review: “Risk – on” driven by Mega Tech

by Tim Sharp

Global equities had a strong May gaining 4.2% after losing 3% in April with US markets once more leading the way as markets turned “risk-on” largely driven by positive corporate earnings. Technology was the strongest sector up approximately 8% and the “Magnificent 7” gained 10%[i] with the main catalyst being Nvidia with another set of outstanding results. Energy, Autos, and Travel were the weakest sectors as energy and discretionary sectors underperformed. US equities gained 4.8% while Europe added 2.6%, and a weaker dollar assisted emerging market equities to a positive result, +1.95%.

Following the release of the results for Nvidia, the stock gained 7.8% in after hours trading which equates to an increase in market capitalisation of approximately $182 billion[ii]. At a capitalisation of $2.7 trillion it remains marginally smaller than Apple and Microsoft and represents 5.8% of the S&P500. In recent history Nvidia has led the market direction, however, its good fortune failed to lift the wider market on this occasion. There is a disconnect between the reported results of the big seven and the wider market leading to total index earnings rising 7% in the US and falling 5% in Europe although earnings were actually expected to fall 10%.[iii]

The correlation between stocks and bonds turned positive in the month with global bonds gaining 0.9% in dollar termsiii. Gilts were buoyed by weaker inflation due to the changes in the energy bill price cap and positive comments for the prospect of lower rates in late summer. Despite, guidance from European Central Bankers that policy rates were likely to be cut in June, this likely move has been well flaggedi, and we believe largely priced in to markets thereby leaving European government bonds flat on the month. In line with “risk-on” credit markets were positive and spreads tightened marginally with many investors we see attracted to the overall yield on bonds instead of being put off by historically tight spreads available in main markets.

The prospect that developed economies have reached peak rates and most will be looking to cut this year has added a tailwind to listed property (+3%) and infrastructure (+6%) where we feel valuations have reached very attractive levels in certain sectors.

Central bankers and, therefore, investors continue to be data dependent as they look to forecast the future path of interest rates. The US Personal Consumption Expenditure Report (PCE) is the Fed’s preferred inflation gauge, and it reported a 0.3% gain in April as expected while the core rate was +0.2%. This will do little to guide markets so we will look towards the next round of central bank meetings in June to provide any change to perceptions. Currently the ECB is likely to move in June, we see markets currently pricing in a move in the UK in August and only 2 cuts in the US later in the year. Investors will scrutinize the press releases following the June FOMC meeting for clues as to the Feds views on inflation and the economy with some economists predicting the first cut in September.

After much speculation, UK Prime Minister Rishi Sunak called the date of the UK General Election as July 4, 2024, even though the Labour Party looks to have a 20-point lead leaving the Conservatives with an uphill task to win a majority. Both the major parties are looking to convince financial markets of their fiscal prudence with commitments not to raise income tax, corporation tax, or National Insurance which will severely limit any new government’s flexibility to tackle problems seen within the NHS or immigration. The UK still has a very tight labour market and a low participation rate since the pandemic compared to other developed economies and plans to increase competitiveness and convince markets that they are pro-business will be an important policy exchange during campaigning. Consumer and business confidence remains low despite high savings rates perhaps pointing to a lack of stability in recent times with five changes of primes minister during the last fourteen years. Perhaps a prolonged period of stability following the election result will support a recovery in the UK economy and UK financial markets.

[i] Ward_Murphy _ Zara _ Absolute Strategy Research _ Investment Committee Briefing _ June 3, 2024

[ii] Authers _ John _ Bloomberg Opinion _ Points of Return _ May 23, 2024

[iii] CIO Office _ Edmond de Rothschild _ Monthly Market review _ May 2024

May Strategy Meeting: Financial Economy Strong, Real Economy Sluggish

by Rob Cloete

Halfway through the second quarter, ongoing geopolitical uncertainty, institutional mistrust, and elongated rate cut expectations have contributed to an unusual combination of a high nominal risk-free rate, gold and Dollar strength, buoyant oil prices and government bond market weakness. Against this fragile backdrop, underpinned by rising global liquidity and despite further but moderating weakness in leading economic indicators, risky asset classes have rallied: equity risk premia and credit spreads have compressed, especially in developed markets.

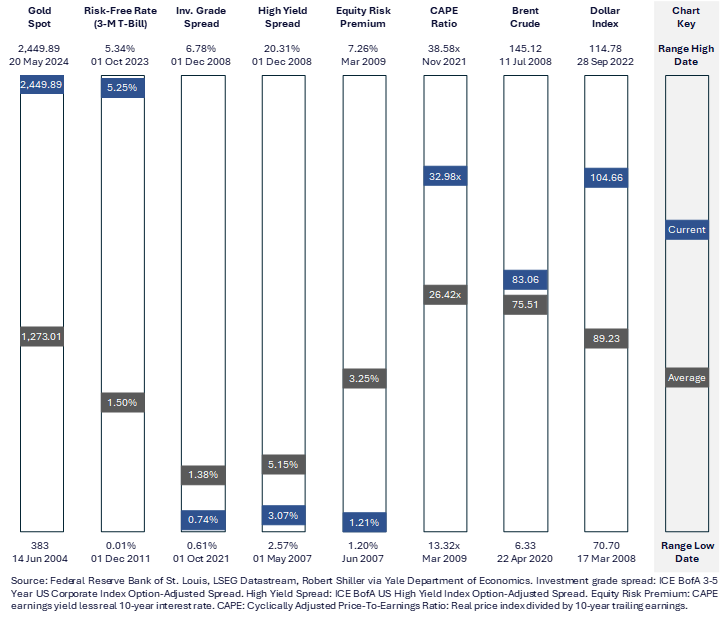

Figure 1: Market Landscape – Gold, Rates, Spreads and Valuations at 20 Year Extremes. Is this sustainable?

With the Federal-Funds rate close to a 20-year high at the time of writing and the three month T-Bill representing gold’s opportunity cost – in the form of yield foregone – it’s unusual to see the gold price near a 20 year-high as well, especially with rate cut expectations moderating (currently two expected by year end, down from five as we entered 2024). Gold’s robust performance is partly attributable to relentless central bank buying: global official gold reserves rose by 290t in 1Q24, a record, with the People’s Bank of China accounting for 27t of this as gold now represents 4.6% or c.$160bn of China’s total reserves (2014: 1.1%). Over the past decade, China’s official holdings of US Treasury Securities have declined by almost 40%, from c.$1.3tr to less than $800bn, as sustained de-dollarisation continues. Over the past decade, the proportion of federal debt held by foreign and international investors has declined from 34% to 24% now, while central bank holdings of gold have grown from 32t to 36t. Going forward, these trends represent a structural, price insensitive bid for gold, and a headwind for treasuries.

While policy rate forecasts have dominated the headlines, liquidity provision has expanded behind the scenes, increasing monetary flows into financial markets, and supporting asset price appreciation. Michael Howell of Crossborder Capital estimates global liquidity, underpinned by central banks, collateralised lending, and cross-border flows, at c.$173tr (vs. 2023 global GDP at $101tr, per the World Bank). The current upward cycle commenced in October 2022 (troughing at c.$160tr) and is expected to peak in late 20251. Following a contraction in April – coinciding with a challenging period for risky assets – conditions are again supportive, with the latest weekly reading at +0.6% m/m. However, recent multiple expansion in the equity markets has compressed the equity risk premium to 20-year lows, elevated the CAPE ratio to within the top 4% of all readings back to 1881 (surpassed only by 2021, 2000 and 1929), and outpaced global liquidity. This has historically presaged a near-term correction.

Going forward, we believe that policymakers will continue to be accommodative where possible, although the US fiscal situation continues to deteriorate: gross federal debt of $34tr as of March 2024 represents 120% of GDP, a federal deficit of -6.2% to GDP, and annualised debt service costs of $1.1tr against federal receipts of $4.4tr (more than half of which comprises politically-sensitive individual income taxes). This burgeoning indebtedness is further exacerbated by the escalating monthly effective interest rate, which has almost doubled from 1.7% to 3.2% since in April 2022, as recent issuance has been dominated by short-dated T-bills and more frequently rolled in a rising rate regime. While the benign inflation environment and rate hikes implemented thus far afford the policymakers some flexibility, cutting rates too soon risks stoking inflation, prompting reactionary rate hikes and, critically, imperilling the Federal Reserve’s ability to service and rollover its debt. In the meantime, growing liquidity provision drives fiat currency debasement, debt monetisation and asset price – as opposed to economic – inflation, while underpinning demand for gold as a store of value.

Putting all of this together, our current view is that the ongoing combination of increasing liquidity, moderating inflation, modest economic and corporate earnings growth, and policy inertia stateside as the elections approach, should continue to broadly support asset prices. Given valuations, however, we remain modestly underweight equities (prioritising quality companies that have the potential to perform robustly in a range of economic environments) and overweight bonds, prioritising short-dated high-quality liquid assets while limiting duration and credit exposure. We maintain positions in commodity-exposed equities and gold, as hedges against a resurgence in inflation and further sustained monetary debasement, respectively.

Sources:

1 Howell, M. (14 May 2024 and 21 May 2024). Global Liquidity Watch: Weekly Update. [online].

Available at: https://capitalwars.substack.com/

April Market Review

by Tim Sharp

Some of the froth was blown away in April as investors became more cautious about a plausible “no landing” in the US and US interest expectations were trimmed further to less than two cuts in 2024 causing the US Treasury yield to test 5% during the month once more. Global equities fell 3.85% over the course of the month in dollar terms, with the S&P 500 down -3.97%, Eurozone -3.22%, and the Nikkei 225 -3.51%.

We have suggested in previous publications that after the multiple expansion of 2023 companies would need to justify equity valuations with earnings during 1st quarter 2024. As we reached the end of April approximately 55% of the S&P 500 had reported with earnings beating expectations by 8.4% versus an historical average of 4.8% and 6.9% recorded last quarter[i]. Earnings surprises are not uncommon, with guidance usually tactically reduced ahead of reporting season. However, this has been less prevalent this quarter; leading to improving outlooks and positive adjustments to Earnings-Per-Share growth.

Our base case this year centred on a broadening out of returns, this began in March and continued into April. Although we think AI is an enduring theme, Meta Platforms results were accompanied by a warning from Mark Zuckerburg that to make the most of the opportunity, the company would need to spend significantly, and the benefits may take longer to reach fruition[ii]. Valuations amongst “Mega Tech” have reached stretched proportions and this might mark the point where a little realism takes hold. A broadening out of returns does not necessarily mean there has to be a downward adjustment in “Mega Tech” but perhaps a period of underperformance may release some pressure on valuations assuming earnings releases to come do not justify valuations.

The broadening out of returns has seen better performance for emerging markets and the UK. A value-based bias, along with a high proportion of overseas earnings has helped UK equities to an outlying position of +2.43% on the month. Rather surprisingly UK equities are now outperforming the NASDAQ Composite year-to-date in price terms 4.99% versus 4.31% as the valuation gap between the major indices narrows favouring markets in deep value territory such as the UK.

Central Banks remains a key focus for markets. It is widely expected that Federal Open Market Committee May meeting will leave rates unchanged. However, signalling around the future trajectory of rates will be closely followed as markets re-calibrate rate cut expectations. The outlook for rates was dealt a blow by the US Employment Cost Index Report for Q1 on the last day of the month which rose 1.2% versus 0.90% in Q423. Private industry saw compensation rise 1.1% and state workers 1.3% suggesting that although job openings are stabilising, wages are still running hot in the US. The importance of a more hawkish stance from the Fed, and the increased risk of inflation rising to financial markets was reflected in equity markets which saw the S&P 500 fall 1.57% and the NASDAQ 2.04%. on the day. We note US headline and core consumer price index inflation were hotter than expected for the third consecutive month at 3.8% and 3.5% respectively despite PMI’s missing expectations to the downside.

Further proof of a global pickup in economic activity saw European, UK, and Japanese PMI’s beat expectations. European GDP has turned a corner after weakness in Germany for most of last year. 1st quarter GDP in Germany and France grew 0.8% on top of growth of 1.2% and 2.8% in Italy and Spain. The European Central Bank (ECB) has been guiding towards a first rate cut in June, and we believe the case for rate cuts in Europe and the UK is stronger than it is in the US although such a move is often constrained by foreign exchange considerations. The Dollar Index continued to build on a stronger 1st quarter to gain another 1.6% against a basket of its largest trading partners in April, a situation that will certainly be considered at the May meetings of the ECB and Bank of England.

Additionally, The Bank of Japan’s decision to leave rates on hold at 0.00% in April coincided with the Japanese Golden Week holiday and in less liquid markets the Yen fell to ¥160 versus the dollar. This is likely a function of pressure created by the interest rate differential to the US. The weakness was short lived, with the currency rapidly strengthening back to ¥154.50 in an unconfirmed sign that the Japanese authorities had intervened. Intervening when volumes are low is a tactic that has been used in the past to maximum effect with signs that $20bn – $35bn of dollar reserves had been utilized, as reported by the Financial Times, although the Ministry of Finance declined to comment. This would suggest that the Japanese authorities may have decided to draw a line at ¥160 versus the dollar but it remains to be seen if they defend this level, if necessary, in the future. Although a weaker currency is good for tourism and overseas profits, it clearly affects the cost of living, and domestic consumption when the BoJ is attempting to reflate the economy and boost economic activity.

In summary, developed equity markets have paused, reacting to quarterly earnings as they are reported, while inflation pressures build, and interest rate cuts are paired back by markets with the inevitable move higher in bond yields. There is little doubt that global economic activity has rebounded, and the US economy is still running hot, which should be supportive of risk assets. Against this backdrop the disinflationary path seems less certain and investors are adjusting expectations accordingly.

[i] Golub_Jonathan _ UBS _ US Equity Strategy _ Earnings Season: Half Time Report _ April 29, 2024

[ii] Murphy_Hannah_Financial Times_April 25, 2024 [Online]

Mark Zuckerberg defends Meta’s AI spending spree as shares tumble (ft.com)

GLOBAL INSIGHT Q2 2024

February Investment Review: Good Results Excite Investors

by Tim Sharp

A strong finish to the earnings season particularly mega tech, and especially Nvidia and Meta Platforms whose reporting took on almost macro-economic event proportions, saw equity markets continue generally higher in February. Sticky inflation continued to vex investors as markets pared interest rate cut expectations back further to only three cuts in the US this year which has caused further adjustment in bond markets. Despite a slightly stronger dollar Emerging Markets rallied 4.6% outperforming the developed world as China bounced strongly following central bank easing of lending rates. Japan remained a dominant force up 5.7% on the back of a weak Yen that finished the month at 150 vs. the dollar. The laggard amongst the major markets was the UK where equities were flat on the month despite resilient data although unable to avoid a technical recession in the latter part of 2023, while Europe which continues to flatline saw equities boosted by China to finish up 3.4%.

Nvidia once more reported earnings that were ahead of expectations in the 4th quarter with revenues up 265% to $22.1 billion vs. $20.4 billion expected guiding even higher for first quarter to rise to $24 billion vs. $22 billion consensus. The markets were unashamedly enthused pushing the shares up 16.4% the next day which was recorded as the largest change in market capitalisation of any stock, anywhere, ever, leaving the shares up 28.6% on the month, 59.7% year-to-date, while the wider S&P500 gained 5.2% in February. The CEO stated a surging global demand for accelerated computing and generative AI had hit a “tipping point” although there are some that believe that many Nvidia customers are over-stocking for fear of demand outstripping supply which may leave an inventory overhang later in the year. In any case the focus on the big 6 technology stocks continues to dominate returns with Meta Platforms also starting the month with bumper earnings. The performance of Meta Platforms following its results when it announced a 3% new dividend added $200bn to its market cap in one session, the equivalent of a gain in the total market cap of Cisco Systems – the darling of the 1999 technology stock boom.

Many active investment managers, including us, run strategies that include exposure to a diverse range of assets and asset classes quite often starting with an equally weighted positioning rather than concentrated in a small number of large positions. This kind of strategy would continue to lag headline indices while they are dominated by a small number of heavy weights even if we had exposure to these main stocks. This means that we must have a view on Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, and Nvidia, even if we do not intend to invest in them because of their ability to influence returns. There is a diverse range of forecasts for forward earnings for mega tech depending on the level of conviction which means that investors can view them as expensive, or fairy valued at today’s prices.

We have been adding to our software exposure this year viewing the mixture of innovation, cash flow generation, and low levels of debt as quality defensive in nature. Absolute Strategy Research (ASR) point out that Global Software has the best earnings momentum of any sector and a strong 4th quarter earnings season. The sector has the highest delivered EBITDA margins, seeing a rise of 4% over the last 12 months, sales outgrowing costs, strong profitability, and fast growth on a valuation of 28x forward earnings[i]. Elsewhere, the emphasis on quality defensives sees us continuing to favour Industrials, Energy, and Consumer Staples.

In terms of fixed income, it was reassuring in some ways to see the negative correlation between bonds and equities return as bond markets priced out aggressive easing of rates particularly in the US where Fed Governor Powell ruled out a cut at the March meeting during the post FOMC press conference. During the month US Treasuries fell 1.4% and the speculation spread to Gilts (-1.3%) and European Government Bonds (-1.2%) where the likelihood of a summer cut is perceived more likely due to the current negative growth environment. Whilst Eurozone Services PMI’s were stronger than expected, manufacturing was weaker, and services continue to outperform manufacturing in the UK too. UK inflation remains higher than other developed countries where headline and core CPI were 4% and 5.1% although lower than anticipated, while US inflation surprised on the upside at 3.1% and 3.9%. Japan and China complete the picture with Japanese Q4 GDP reporting a 2nd negative quarter to join the UK in technical recession while inflation continues to strengthen to 2%, and Chinese disinflation came in weaker than expected at -0.8% yoy[ii]. In summary, the resilience of the US economy is one of the reasons why global growth remains in positive territory presenting the Fed with a dilemma when it comes to the right time to ease monetary conditions.

Although the UK is in a technical recession i.e. back-to-back quarters of negative growth there are tentative signs of a pickup in activity as falling mortgage rates bring buyers back to the housing market pushing prices in January 1.3%, 2.5% yoy which is the strongest rate since 2022. The Business Activity Growth PMI rose to 54.3 vs. 53.4 in December in contrast to the manufacturing index which is affected by Red Sea traffic restrictions. Retail sales rebounded 3.4% in January after a record fall of 3.3% in December although volume of sales remains 1.3% below pre-pandemic levels of February 2020[iii]. Furthermore, the unemployment rate continues to fall, now showing 3.9% to November 2023. The BoE will be watching the path of inflation to try and balance growth and inflation with rate cuts. However, a flat stock market in contrast to the positivity in other developed markets is an indication of the hangover still being felt from Brexit trade restrictions, and the lack of growth stocks within the main indices leaving the UK unloved at present.

Overall, our reasons for caution have not diminished, and the markets readjustment of future rate moves while welcome are still optimistic compared to feedback from the Fed. The possibility of a soft landing is still on the cards although unprecedented in recent market history. The US consumer should not be underestimated, however, there are signs in data and delinquencies that higher rates may be affecting areas of consumer credit notably auto loans and credit cards. US equities appear at a stretched valuation relative to the UK, Europe, and Emerging Markets, but the drive in technological innovation is likely to be reflected in US indices where weightings to growth sectors are higher than elsewhere meaning that US exposure may remain key to future returns.

[i] Nelson, Nick _ Absolute Strategy Research _ Equity Strategy _ Upgrade Software and Telecoms_ 29/02/2024

[ii] Ward-Murphy, Zara _ ASR Investment Committee Briefing _ 01/03/2024

[iii] Razi Salman _ Barclays Private Bank Daily Talking Points _ 16/02/2024