By Haith Nori

There has been a significant shift in the world’s mindset of how cars will be fuelled. With many major governments committing to ending the sale of petrol and diesel vehicles consumers are being directed towards Electric Vehicles (EV). For the general public this is causing a dramatic change to their lifestyle, as what was once the quick and easy method to re-fuel a car has turned into a more time-consuming experience. Charging an EV at a Petrol Station will take 20 minutes to 1 hour which isn’t always the most convenient, especially if there are queues!

In the UK it is now compulsory for every new house built to have an EV Charging Point installed which may affect the aesthetics of the building; not what every new homeowner may want. However, the UK Government is providing grants to subsidise the charge point[i] (provided by BP) including free installation. This most certainly helps the public and provides a means for charging a vehicle whilst being in the comfort of your own home even though it can take up to 8 hours to fully charge from empty. Whilst there will be an increase in electricity bills, there will be no petrol bills, no road tax, and no congestion charge for all Pure Battery Electric Vehicles[ii]! Governments and energy companies are working to produce a new structure where EV Charging can be facilitated but there is a long way to go before this becomes the ‘new norm’.

Fast charging hubs are being put into production across the UK and the rest of the world. The ‘fast charge’ addresses the key drawback for many consumers but the wait time is still 20/30 minutes. There are not enough fast charge points available for this to be effective enough and will not be fully available until at least 2023 which makes the shift to electric at this present time more difficult. Companies like Pod Point, who had their IPO in November 2021, are providing innovative ways to aid this shift, for instance having charging points in public parking spaces on roads, in supermarkets and golf courses, and hence whilst the car is charging the owner can do a weekly shop or play a round of golf! This undoubtedly ‘fits’ into lifestyles more smoothly. Pod Point provide electric vehicle charging with a focus on ‘charging the UK’ providing Home Charging, Commercial Charging Points and Workplace Charging Points[iii].

However, whilst in theory this is the correct way forward, there are simply not enough charge points for everyone to enjoy this luxury.

In the annual UK sales snapshot for 2021, the Society of Motor Manufacturers and Traders (SMMT), said carmakers sold 190,000 battery electric cars across the country last year[iv], accounting for about 11.6% of total sales and that Britons bought more electric cars in 2021 than in the previous five years combined.[v]

From the data it is very clear that consumers have been making the added effort this past year to make the jump and ‘go electric’. The pandemic has also shifted consumer mind set as there has been an increase in consumer spending on consumer goods and less on consumer services.

Car companies are racing against each other to produce the most efficient and effective EV to add to their range, setting ambitious targets to achieve all electric vehicle sales. On another level car companies are teaming up with electrical companies that are working to find the most effective batteries to impact the longevity of a journey before the need to re-charge. The battery is the most expensive component of an EV. If a company can reduce the cost of the battery without effecting the efficiency of the battery this can potentially reduce the overall cost to the EV in what is becoming a challenging market. For example, Tesla vehicles have always had the reputation for being the most expensive. Panasonic are working with Tesla to produce the batteries to fuel Tesla’s electric fleet and have recently made a significant investment (January 2022) to produce a battery which is both cheaper to produce and has a 20% increase in energy capacity to be released in 2023[vi]. Tesla has a Gigafactory in Nevada from which Panasonic operates to produce batteries for Tesla vehicles. Along with Tesla many other car companies including Daimler and Stellantis are attempting to produce batteries that will have a longer life and lighter weight, thereby adding to the efficiency of the vehicle. As an example, in January 2022 Mercedes-Benz have released their new prototype called VISION EQXX which will have a range of more than 1,000 kilometres per charge[vii] showing automakers are attempting to address the charging situation.

The UK is currently lagging European competitors in battery production – the crucial link in the EV supply chain. In the global race between countries to secure vital battery production the UK Government has added £100million to an existing fund of £3.8billion aimed at building a new battery Gigaplant in Northumberland called ‘the Britishvolt project’[viii]. Switzerland-based mining giant Glencore have also just invested $54million into BritishVolt (February 2022) in a new round of funding, which highlights both a surge of investment in this field and the additional interest in the British economy[ix].

EV’s are more reliable than the Internal Combustion Engine (ICE) which has over 2,000 moving parts compared to an EV which has as little as 20[x]. As always this is beneficial to any consumer, especially when considering a long-term investment. This will encourage firms like Faurecia, an automotive equipment supplier, to expand spending on making the internal parts of an EV more efficient.

Globally, China is leading the race with the largest EV fleet.

With oil giants like BP and Shell finally making the shift from selling petrol to a greater focus on EV Charging Points, consumers can see a better picture that the world is changing and the need to change with it. Originally, oil giants were reluctant to make the shift as it was a loss-making venture. BP is now gearing up to become more profitable from its electric vehicle charging points than it is from selling petrol and by 2025 their EV charging division will be entirely self-sufficient. What once seemed to be large companies investing for the long term, potentially making a loss, has become a profitable business model[xi]. Shell has converted one of their petrol stations in Fulham, London to be their first all-Electric Vehicle Charging Station (January 2022) with 9 charge points. Whilst some consumers will not be happy initially as change is never easy, the shift with oil giants will be the main catalyst in speeding up the process to electric vehicles as driving a petrol car will soon be more difficult to maintain.

EV’s are expensive to buy outright which puts many people off as they simply cannot afford one. However, there are options including leasing which can be much more appealing and currently the most popular option of vehicle financing[xii].

Overall, the consumer has a great deal to consider before making both the investment and commitment to driving their own EV. Whilst the initial cost may cause a slight sting the shift will certainly benefit the consumer in the long run, and they can be sure that the Electric Vehicle journey will continue.

[i] https://www.gov.uk/government/collections/government-grants-for-low-emission-vehicles#electric-vehicle-homecharge-scheme

[ii] https://www.gov.uk/vehicle-exempt-from-vehicle-tax

[iii] https://pod-point.com/

[iv] https://www.smmt.co.uk/vehicle-data/evs-and-afvs-registrations/

[v] https://www.theguardian.com/environment/2022/jan/06/uk-carmakers-report-booming-sales-of-electric-vehicles

[vi] https://www.panasonic.com/global/corporate/ir/presentation.html=

[vii] https://www.reuters.com/business/autos-transportation/mercedes-benz-unveils-1000-km-per-charge-vision-eqxx-prototype-2022-01-03/

[viii] https://www.gov.uk/government/news/government-backs-britishvolt-plans-for-blyth-gigafactory-to-build-electric-vehicle-batteries

[ix] https://www.reuters.com/business/autos-transportation/britishvolt-kicks-off-funding-round-with-54-mln-glencore-2022-02-15/

[x] https://www.forbes.com/sites/sap/2018/09/06/seven-reasons-why-the-internal-combustion-engine-is-a-dead-man-walking-updated/?sh=e643467603fe

[xi] https://www.reuters.com/business/energy/bp-car-chargers-overtake-pumps-profitability-race-2022-01-14/

[xii] https://www.rac.co.uk/drive/electric-cars/choosing/electric-car-leasing-explained-ev-financing-vs-buying/

Source: Bank of England Financial Stability Report, July 2021

Source: Bank of England Financial Stability Report, July 2021

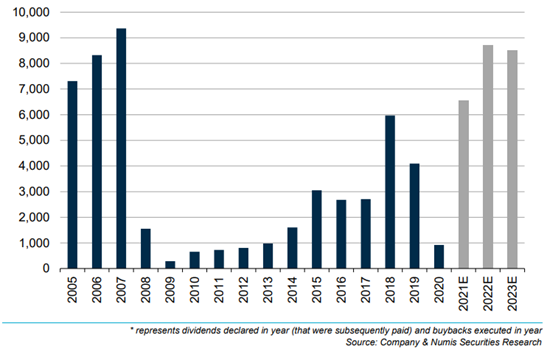

Source: Numis Securities

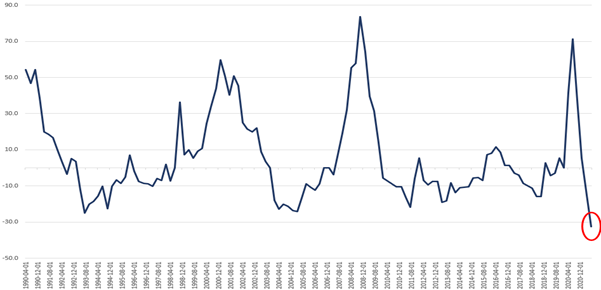

Source: Numis Securities Source: St. Louis Federal Reserve Database

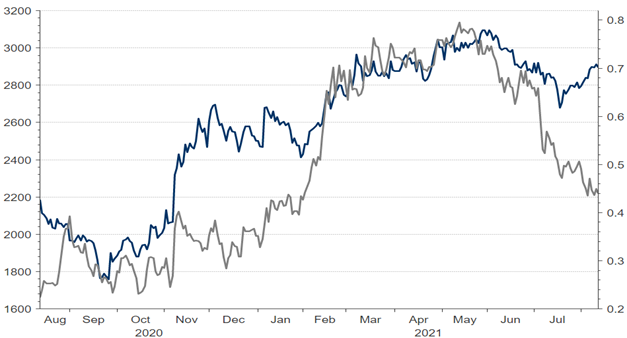

Source: St. Louis Federal Reserve Database Source: Refinitiv

Source: Refinitiv