By Tim Sharp, Hottinger & Co.

June, much like May has been dominated by concerns regarding rising inflation. The statement following this month’s Federal Open Market Committee (FOMC) meeting was more hawkish than expectations but rather than suggesting the US Federal Reserve (Fed) is going to pull back from Average Inflation Targeting we believe pointed to the fact that the committee had started to discuss a timetable for reducing or tapering Quantitative Easing. There was actually no change in policy and little change in economic outlook, although the committee members’ “dot plot” interest rate projections showed seven members electing to pencil in the first hike for next year and most had moved to two hikes in 2023. This probably indicated that the Fed was potentially behind the curve and is now more aligned with markets[i].

The rebound in global demand and the continued increase in job openings has seen several bottlenecks emerge in supply side production, as well as logistical constraints, that have pushed US core inflation to its highest rate since 1995[ii] leading many investors to question the transitory nature of the strength in inflation. For our part we tend to agree with the Fed and the Bank of England that the current jump in inflation is tied to irregularities in the reopening of economies and the continuing fiscal support offered by governments making employment in low paid sectors less attractive meaning that this may prove to be the peak in near term inflation pressures[iii]. There is little doubt in our opinion that the risks point to higher inflation over time and that the loose monetary and fiscal conditions probably rule out future deflationary trends.

From a developed equity perspective, markets had a wobble following the FOMC meeting as the change in rhetoric caused a rotation into defensive stocks away from cyclicals sectors. Absolute Strategy Research (ASR) point out that this actually started in May when indicators suggested inventory conditions were tight and the FOMC meeting purely underlined this message[iv]. Morgan Stanley have been ahead of consensus with their mid-cycle transition from consumer discretionary into consumer staples but are receiving push back from clients due to the belief that the savings glut will perpetuate the re-opening trade. Morgan Stanley counter that over-consumption in 2020 will likely curtail the re-opening trade and discretionary spending is more early cycle than mid-cycle[v]. Interestingly, June saw Russell 2000 Growth Index significantly outperform the Value Index by approximately 5.29% with Banks and Resources stocks under pressure, suggesting that the reflation trade may have peaked near-term. However, we believe the underlying current in equity markets remains optimistic and investors took advantage of opportunities in the recent re-balancing to invest in long term equity holdings.

In our opinion, we have reached the stage where owning robust, fairly valued stocks in companies with strong cash flow and low debt; that have shown an ability to perform in different parts of the cycle will likely offer an element of downside protection in long-only portfolios. This description lends itself most naturally to defensive, value stocks but we also see many examples of expensive equities in such sectors. This could be an opportunity for good stock-picking to overcome sector allocation, and growth vs. value, however, we still favour banks and materials as the best way to play rising long term inflation trends.

Regionally, we have positioned ourselves to take advantage of the green energy investment that is being rolled out in Europe and continue to believe that the discount currently experienced by UK equities vs. other developed markets will close. We posit current M&A trends suggest the value in the UK has been recognised at an institutional level and we believe that equity investors will also want to increase their participation in UK markets[vi]. During June the FTSE All-Share index was flat on the month while the MSCI Europe ex UK Index gained 1.89%. Finally, Japan is the last developed value market that continues to underperform developed markets, the Nikkei 225 Index was 0.24% weaker over June. There are good reasons for Japan to outperform in this environment as pointed out by ASR – weaker Yen, rising US Treasury yields and stronger dataii. However, the vaccine roll-out has seen a slow take up by the population so the threat of another wave of the Delta variant cannot be ruled out, and the slowdown in China has potentially also affected Japanese sentiment- in our opinion.

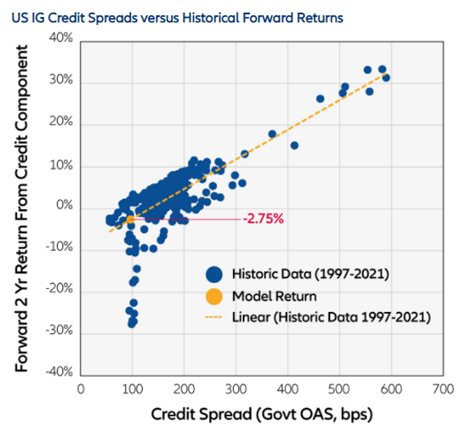

Developments in bond markets, most notably the lack of further upside in 10-year US Treasury Yields despite rising inflation concerns also point to the markets belief that current inflationary pressures will prove transitory. The current 10-year benchmark yield started the month at 1.61% already well off the high of 1.73% and is currently 1.46% with inflation break-evens already pricing in high inflation expectations. Our investigations into credit markets concluded that the tightness of spreads, with the likelihood that developed markets could only tighten further, leaves very little return for investors.

Moreover, we believe it is unlikely that the outlook for the second half of the year will disrupt credit markets so our emphasis should perhaps shift to Emerging Market debt. The case for Emerging Market currencies to strengthen over the course of 2021 further suggests to us that a local currency emerging market debt fund may be an efficient way of capturing positive returns.

The expected path of developed market government bond yields and the expected continued steepening of the curve leaves investors looking to reduce bond exposure in the interim. With the risks to inflation firmly to the upside the move to include commodities, real assets, and alternative strategies at the expense of traditional fixed income exposure will continue to occupy this committee and other multi-asset investors. Gold had rallied strongly in May but failed to hold on to those gains in June falling from a high of $1908 to $1770 over the month. The future path of Gold will probably be a trade-off between a weaker dollar and rising real yields following already stretched break-evens rather than any correlation to Bitcoin, suggesting to us a move lower under this scenario in the medium term.

[i] The J.P. Morgan View – FOMC meeting isn’t a game changer – June 21. 2021

[ii] Absolute Strategy Research – Investment Committee Briefing – June 2021

[iii] https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2021/june-2021

[iv] Absolute Strategy Research – Long duration Reprise – Back to the Future – June 22, 2021

[v] Morgan Stanley Sunday Start – Great Expectations – June 6, 2021

[vi] Hedge Fund Short Sellers Face Off Private Equity in Morrison Supermarkets Deal – Bloomberg

Our investment strategy committee, which consists of seasoned strategists and investment managers, meets regularly to review asset allocation, geographical spread, sector preferences and key global market drivers and our economist produces research and views on global economies which complement this process.

Our quarterly report presents our views on the world economic outlook and equity, fixed income and foreign exchange markets. Please click the link to download.