Author: admin@hottinger.co.uk

Idiosyncrasies may affect Financial Markets in 2022

By Tim Sharp

The key questions that are likely to affect investment decisions in the medium-term focus on the effects of the Omicron variant on global growth, earnings growth justifying current equity valuations, and the strength of inflation accelerating changes in monetary policy.

There are many categories of risk within markets and investment management, and we would like to focus on idiosyncratic risks for a moment. Idiosyncratic risks are the opposite to systemic risk as they are uncorrelated to overall market risk and effect individual assets or investments. The risk may come from the macro-environment, including economic, political and society risks, or from determinants within a specific industry. Moreover, the term may be used to refer to non-financial, unsystematic risks within the global economy whose effects on financial markets may be difficult to quantify, such as, natural disasters, pandemics, and geo-political tensions.

We believe the rise in geo-political risks, such as Russian / Ukraine tensions, and social tensions caused by new Covid-19 variants, can be added to supply chain disruptions, continued uneven economic reopening’s, and the short-term spike in energy prices, amongst others, that make up an important list of idiosyncratic risks that could have a material effect on financial markets in 2022.

The present disruptions to supply chains are arguably caused by the rise in the consumption of goods instead of services during the pandemic that continues while complete re-opening is delayed. Furthermore, should companies decide that shortening or onshoring of their supply chain would reduce risks in the long term then this disruption will also influence global growth both at a consumption and a country level. More recently there have been reports of companies over-ordering in fear of continuing component shortages leading inadvertently to the very shortages they hoped to overcome. While China continues with a zero-tolerant COVID response policy and other Emerging countries continue to ramp up their vaccination responses, this headwind could last into 2023 in some instances with the inevitable cost to earnings, growth, and financial returns. Absolute Strategy Research (ASR) has recently cut its equity forecasts for 2022 from 10%-20% to 5%-10% in line with the belief that idiosyncratic risks will constrain risk assets meaning EPS growth will fall to 0-15% as nominal growth slows[i].

The likelihood of a China slowdown in 2022 as the economy transitions to a consumer-led framework could see GDP growth of approximately 5% in 2022 falling further to 4.5% in 2023[ii]. This has significant implications for commodity markets unless another systemic consumer comes to the fore – such as perhaps sustainable energy sources. The EU plans to put EUR1trn to work in sustainable investment over the next 10 years as part of the Green Deal making Europe one of the global leaders in sustainable energy[iii]. We believe the level of proposed investment will allow European to embrace the environmental challenge with innovation that could see European companies at the forefront of green energy technologies.

The rapid rise of ESG investing coinciding with an increase in the fiscal response to climate change as highlighted by COP 26, will continue to shape the investment landscape. Many investors are looking for pure play green energy investments when it seems that many of the existing energy companies are transitioning towards alternative energy sources. Total has changed its name to TotalEnergies in an attempt to highlight its multi-source energy strategy and activist investors are trying to persuade energy companies to split green and fossil fuel businesses[iv]. This has led to many traditional energy companies such as Shell, BP, TotalEnergies, ExxonMobil, and Chevron facing ESG discounts, further highlighting investors unwillingness to invest in carbon intensive industries. We believe that the world’s reliance on fossil fuels during the transition to sustainable energy sources should not be under-estimated and the role of the incumbent energy suppliers in investing in that transition is currently not being fully valued by investorsi.

Although the strength and persistence of the inflation spike means that it is difficult to continue to consider the implications as temporary, some of the pricing pressures do seem to us to be linked to the imbalances from the delayed re-opening of the global economy which is likely to be exacerbated by the Omicron variant. High vaccination rates in the western world could also discourage governments from imposing greater restrictions. Ironically as Central Banks meet this week to implement the beginnings of a change to a tighter policy, the characteristics of the new variant could have a restrictive effect on consumer behaviour and government guidance. In the UK there is a reasonably close link between hospitalisations and people choosing to stay at home[v], however, equity investors have bought the dips over the last week as anecdotal evidence from South Africa suggests that although more easily transmissible, the symptoms are weaker than previous variants.

Scarring of the global economy due to the effects of Covid-19 has been debated throughout the pandemic and much of the evidence will become clear once the economy has re-opened. However, the emergence of the Omicron variant creating another wave of infections may bring the virus closer to its conclusion, but not before many temporary changes in consumer behaviour potentially become the new normal. ASR point to a Gallup poll that suggests approximately 70% of US white collar workers are still working-from-home[vi] suggesting a new hybrid working week could become more likely in the future. This will have an effect on the number of housing bubbles that have inflated during the pandemic as consumers switch between suburban and out-of-town living with consequences for housebuilders, office rental companies, and consumer service providers. The Omicron wave may also be the event that alters business travel behaviour for good with inevitable effects on airlines, hotels, and remote communications providers. We believe the longer it takes for the global economy to emerge from the pandemic the more the likelihood that consumer behaviour will move to a new normal.

If we are approaching the final phase, Absolute Strategy Research are predicting that many of the current inflation causes will prove temporary and the rate will return to 2% over the course of 2022i. Consumption growth would eventually normalise between goods and services alleviating some of the employment shortages and supply chain disruptions. Energy prices would be expected to normalise, and the continued strength of the US dollar would remain a headwind for global growth. Under this scenario of weaker growth and less pricing power leading to lower corporate earnings, we may see the cyclical recovery replaced by a move into more defensive sectors, such as, healthcare, consumer staples and utilities.

In conclusion, we believe there are many transitional events taking place in the global economy, increasing the level of idiosyncratic risk in financial markets that will affect the outlook for sectors, industries, and companies at different levels. As active investment managers we will look to navigate the path to consistent, long-term returns, and anticipate the effects of a changing world on portfolios.

[i] Absolute Strategy Research – Asset Allocation – De-Risking in a “Trend Everything” World – December 9, 2021

[ii] Absolute Strategy Research – 2022 Outlook: a test of regime change – November 30, 2021

[iii] Portfolio Adviser – Why European Equities could rise as the US Stock Market lustre fades by Cherry Reynard, October 14, 2020.

[iv] FT.Com – Shell warns hedge funds risk derailing energy transition – October 28, 2021

[v] Absolute Strategy Research – New variant, same activity concerns? – December 3, 2021

[vi] Absolute Strategy Research – Omicron & On – December 14, 2021

November Strategy Meeting: Omicron and Delta meet Growth and Inflation head on

By Tim Sharp

November started with an FOMC meeting that confirmed the arrival of balance sheet tapering at the expected rate $15bn per month, although Chair Powell did give himself some flexibility to be able to adjust the pace of the taper in 2022. Mid-month it was confirmed by President Biden, after much speculation, that Jay Powell would retain the Chair for a further 4-year term with the other candidate Lael Brainard being offered the vice Chair position, thereby providing a sense of stability at this time of transition.

The November jobs report was strong with the Covid affected Leisure and Hospitality sectors also seeing some recovery which is encouraging. The JOLTS data[i] also showed that 4.4m people, or 3% of the total US labour force, quit their jobs in September which has been a phenomenon of the second half of this year. Although there are a fair percentage of people leaving the workforce for reasons such as Covid fears, early retirement or lifestyle change many moves reflect a confidence in finding higher paid jobs, suggesting to us that wage inflation may have further to run.

The uncertainty surrounding the response of central banks to inflation will continue to influence investors as the transitory nature of the near-term rate feels increasingly persistent, with wages and rental income looking to have gained medium term momentum. Owners’ Equivalent Rent (OER) makes up about 34% of the CPI basket and the ongoing strength in house prices provides a tailwind for rent rises to remain persistent. Moreover, the market is beginning to price in future rate hikes with 3 hikes now priced in for 2022, making 5 or 6 hikes expected by the end of 2023 we believe, which is more aggressive than speculation in September or October. This also suggests that the market expects tapering to be more aggressive in 2022 if this timetable of interest rate hikes is to prove accurate and this was confirmed by Fed Chair Powell during his testimony to the Senate Banking, Housing and Urban Affairs Committee yesterday. We are surprised by the nature of this turnaround and believe that the markets may be pricing in the prospect of a Fed misstep as much a fear of persistently strong inflation.

In the UK the Bank of England Monetary Policy Committee surprised the markets by leaving rates unchanged in November having guided in October of their intention to hike boosting market volatility at the prospect. As a result, markets had priced in a certain 0.15% hike in November with expectation for an additional tightening during the first quarter. When it came to the meeting, however, Governor Andrew Bailey said the committee needed further clarity regarding employment after the ending of the furlough scheme. This apparent U-turn caused great upheaval in the bond markets and one of the largest one day moves in 5-year gilts since the Brexit referendum. Despite this, markets have still priced in a 1% move by the end of 2022 when growth forecasts are more pessimistic which again suggests to us that the outlook is misaligned.

With bond yields drifting higher but not matching the rate tightening expectations we believe the environment remains more favourable to equity investment. Bond yields remain low versus equity yields which favours the economy and equities from a relative valuation perspective. Absolute Strategy Research (ASR) analysis suggests 10-year US Treasury yields would need to rise above 2.5% (1.5% currently) to pose a significant risk to equities and modestly higher yields can also support a rotation into more value orientated companies without undermining equity markets overall[ii]. Despite the inflation headlines and central bank uncertainty equity markets have largely remained unruffled even though many companies have guided to lower earnings growth in the fourth quarter. Investors may be concerned about supply chain disruption and rising wages squeezing earnings but, at least historically, periods of wage growth tend to be periods when pricing power is rising for companies so that margins also tend to rise when inflation is above trendii.

However, the reopening story has not followed the expected script in 2020 and much demand has been deferred due to production issues and continuing disruption from the Delta variant of Covid-19. The vaccination roll-out has not been consistent across the developed world and almost non-existent in the frontier markets. Although vaccination rates have picked up sharply in the developing world, we have fears that scarring from the pandemic will have a lasting effect on potential growth rates in the long term. The increased rate tightening expectations in the US have also underpinned the US Dollar – up 2.0% over the month – which creates a further headwind for emerging market investment. The aggressive stance towards Covid outbreaks in China, plus energy shortages and a real estate crisis, have knocked an already slowing economy thereby creating another headwind for global growth, and the developing world. Local government infrastructure spend may provide a much-needed boost to China’s fiscal spending plans, but we feel China as a global engine for growth may take a back seat in 2022.

As we went into the US Thanksgiving holiday equity markets were buoyant, the S&P500 was up 2.1% on the month at 4,701, near all-time highs, and the NASDAQ was similar, although off its peak, as investors undertook another mini rotation out of growth stocks. However, the announcement of another variant of concern, now known as Omicron, first detected in Botswana, caused a significant “risk-off” day when markets re-opened on the Friday with equities, oil, and commodities all significantly lower. Initial investigations suggest the Omicron variant is more infectious than Delta, but there is currently little evidence that it is more lethal, but we live in fear in the developed world that there will come a new variant that is resistant to current vaccines. As global travel routes were closed, many leisure and airline stocks bore the brunt of the sell-off especially as the first signs of the implementation of Covid restrictions in Europe due to the spread of the Delta variant were also hitting the headlines and finding resistance amongst certain elements of their populations.

If the Omicron variant does prove to be vaccine resistant, then we face further social and economic disruption as governments try to persuade the populous to restrict their movements once more. Although it is widely reported that pharmaceutical groups seem confident that they will be able to tweak existing vaccines quite quickly to deal with a new strain. With the weekend to reconsider markets clearly decided that the sell-off was overdone, and many markets and sectors rebounded but remained unstable into month end. Most major equity indices ended November in negative territory as Omicron and Delta met growth and inflation head on, and Chair Powell and Treasury Secretary Yellen offered little comfort during their testimony to the Senate Committee yesterday. The Omicron news also caused markets to move out rate tightening expectations as investors show concern for the implied growth trajectory over coming quarters. Weaker growth may help with the more persistent inflation trends, however, John Authers reports[iii] that according to the San Francisco Fed, pandemic delays and stoppages may drive higher inflation in the goods and services most sensitive to the pandemic, so we conclude that the future path of policy rates in the developed world remains uncertain. Moreover, we do believe that a further wave of Covid-19 will likely affect the developing world harder than the developed world increasing the economic scarring and recovery gap between developed and developing economies. Many economists have shown a degree of optimism regarding the impact of Omicron on the global economy[iv] and, as the data is released, we expect equity market optimism to continue.

[i] The Job Openings and Labour Turnover Survey – https://www.bls.gov/jlt/

[ii] ASR Investment Committee Briefing – November 1, 2021

[iii] Bloomberg Opinion – Points of Return – Risk-Omicr-Off – November 29, 2021

[iv] Financial Time – Economists optimistic on impact of variant – Chris Giles – November 30, 2021

The Rise in the Subscription Economy

By Hottinger Investment Management

The subscription economy is a term coined by the Zuora ‘Subscription Economy Index’ which highlights the rise among companies shifting from a traditional product sales model to selling recurring subscriptions in exchange for access to products or services over time. Whilst the idea of subscriptions is not particularly new, we have historically only seen this concept in a small handful of industries such as magazines and gyms. Due to technological developments subscription-based models are now seen across a much wider array of industries including media, groceries, makeup, transportation and even clothing.

Over the last seven and a half years the subscription economy has grown by more than 350%[1] as economic, societal, and technological changes have allowed subscription-based business models to thrive. The pandemic facilitated a significant shift toward e-commerce and away from traditional retailers. Subscription services shift the idea of physical ownership towards the provision of services and customer discounts. This type of business model proved to be especially resilient during the pandemic, with the Economist reporting that subscription-based firms saw revenue growth of 9.5% during Q1 2020 while revenues of the wider market (as measured by the S&P 500) contracted by 1.9%[2]. Once a customer has enrolled on a subscription service it typically implies a more continuous stream of revenue, which makes it much easier for a business and its investors to predict future revenues; in comparison to pay-per product retailers which can face huge demand fluctuations due to seasonal factors, evident by the pandemic. Moreover, subscriptions tend to increase brand loyalty, 64%[3] of consumers feel more connected to companies they have a subscription with, opposed to companies they engage with for a one-off transaction. Furthermore, the longer a consumer has been with a service the more value they derive from it, making their demand more inelastic and raising their switching cost.

The growth and success of subscription service offerings can partly be attributed to the shift in consumers sentiment away from ownership and towards usership. Recent surveys conducted by Natixis Thematic Asset Management, suggests that 68% of adults no longer value ownership and care more about flexibility and convenience in the products they consume[4]. Why purchase a car and deal with the burden associated with ownership, when you can purchase a subscription and receive a new model monthly?

Technological innovation has meant that we are living in an era where we have instant access to any service or product that we desire. Consumers have become obsessed with instant gratification and crave immediacy in the products and services that they consume, the subscription-based model caters perfectly to this new mind-set. Netflix, for example, has capitalised on our desire for both instant gratification and convenience; it has taken away the burden and cost that once came with the ownership of DVDs, and its unlimited media library enables users to “binge-watch” entire seasons in a single sitting, providing instant gratification.

Spotify is another successful subscription-based model, however, with a slight twist. Spotify operates on a “freemium model”, offering a basic free ad-supported service and a premium paid membership option. The advantage of a freemium model is that the free service encourages users to join the platform without having to commit financially. However, users quickly become frustrated with the basic plan; ad-breaks and the inability to select certain songs prohibits users need for instantaneous consumption, spurring them to switch to the premium version. This is simply just one factor behind Spotify impressive 46% conversion rate, from free to premium users[5]. The flexibility and convenience of its service has made CDs obsolete, as it provides users access to an unlimited music library, a concept that would have been in-feasible with CDs.

Companies that develop a subscription-based service that satisfies our demand for immediacy and provide a convenient and flexible service for users will probably excel. There are reportedly 1.3bn payment enabled smartphones sold annually and currently 6.4bn smartphone subscriptions worldwide[6]. In addition, the significant potential growth from the developing world becoming more tech-enabled should see the total addressable market for the subscription economy continue to expand. We believe technological innovation will only amplify our need for instant gratification and obsession with consuming services on-demand.

[1] John Phillips, general manager, EMEA at Zuora, a cloud-based subscription management platform.

[2] How the pandemic has changed the weather in the technology industry – the Economist – October 30, 2021

[3] Zuora Financial

[4] Thematics Asset Management Subscription Economy Fund, Manager Nolan Hoffmeyer.

[5] The Fader, 2015

[6] https://www.statista.com/topics/840/smartphones/#dossierKeyfigures

October Strategy Meeting: Earnings versus Inflation Concerns

By Tim Sharp

The key questions that are likely to affect investment decisions in the medium-term focus on earnings growth justifying current equity valuations, and the persistent level of inflation accelerating changes in monetary policy. Supply side disruptions have been a significant headwind to growth over recent months, none more so than rising energy prices, and the European gas price shock, which impacts both the growth and the inflation outlook. As we approach COP26 which we believe could have a marked effect on future investment planning; we feel the ability of renewable energy sources to provide consistent supply as the global economy transitions away from traditional energy sources will be key to ensuring minimal supply disruption and fewer such incidents in the future.

COP26 may also indicate a change in the main drivers of future global growth as China’s own change of emphasis in economic development to “common prosperity” could see its prominence as the world’s largest consumer of raw materials superseded by the expected investment in sustainable energy sources. Iron ore and copper have both seen prices weaken as Chinese demand is reduced by its own government directives on energy use and emissions[i] as well as “Dr. Copper’s” ability to react to changes in the global growth trajectory. However, our research suggests copper is likely to be one of the pivotal raw materials in the production of green energy probably ensuring a long-term tailwind for the price.

We believe that it is unlikely that the energy crisis will prove to be anything but temporary, but there are other supply side pressures that may well prove more persistent. The imbalances between the reopening of different sector of economies has thrown up unexpected labour shortages not just in the UK where Brexit fallout is also having an impact, but also well reported in the US. US Wage pressures are now notable, and it is still unclear if the significant levels of people reportedly quitting their jobs or not returning to the workplace after lockdowns, especially in lower income roles, will have a more persistent effect on inflation rates. There is little doubt, in our opinion, that despite the debate regarding the temporary nature of many current inflation pressures, the underlying trend is higher which is probably unsurprising following the unprecedented policy support throughout the pandemic and its lagged effect on inflation.

The ability of central banks to gauge the tightening of policy rates we expect will be scrutinised by investors keen to see global growth recover unchecked by cautious monetary policy decisions. In our view, the recovery from the Global Financial Crisis was dominated by monetary policy and austerity measures, whereas the recovery from the Covid pandemic has been overseen by massive fiscal support leaving rate setters with the dilemma of when to engage monetary levers without choking the recovery.

It is still early in the reporting window for third quarter earnings, but so far reports are above expectations with EPS growth at 32% yoy in Europe and 39% yoy in the US[ii]. Margins are obviously under pressure due to supply side disruption issues which makes the beats the more impressive, and early guidance would suggest that overall firms are seeing demand remaining intact, which could spell good news for the outlook for 2022ii. Absolute Strategy Research (ASR) expect 15-20% yoy global EPS growth over the next 12 months which will continue to drive equity valuations especially if inflation trends lower as the temporary pressures begin to fade, and companies are able to maintain pricing poweri. However, if central bank policy decisions are made too early so as to stifle activity, then we feel investors may start to question valuations once more. Despite recent market trends back into growth stocks when bond yields were unreactive to rising inflation, we remain confident that the reflation trade will prevail emphasised by bond yields that started to move higher in the latter part of the month. ASR point out that rising bond yields tend to favour value over growth, although equity investors really need to see both growth and value perform in a rising market in order to maximise equity outperformance vs. bonds[iii].

Technically, the future for gold should be bright as a storer of value in an inflationary world, however, the gold price is negative 5.4% year-to-date with over $10bn being sold down from the major gold exchange traded funds[iv]. Furthermore, the dollar has revived alongside the US economy putting further pressure on the gold price and leaving investors without the traditional inflation protection that gold has provided. The recent issue of an exchange traded fund that invests in the Bitcoin future has once more pushed the cryptocurrency back into the spotlight and potentially opened the door to more traditional investors to gain exposure. This has led to some investors, most notably Paul Tudor Jones, to see Bitcoin as a portfolio diversifier, and a hedge against inflation particularly as the number of coins that can be mined is limited at 21 million against the unlimited printing presses of central banksiv. However, we believe the rather short and volatile history of Bitcoin’s valuation since 2009 may prove to be its undoing, and more persistent inflation could prove a tailwind for commodity prices, including gold, attracting back investors looking for a more predictable inflation hedge.

Finally, the banking sector seems to be benefitting from an ideal environment for increasing earnings so could be considered as another long only inflation hedge. Over the last week the 5 largest US banks (JPMorgan, Citibank, Bank America, Wells Fargo and Morgan Stanley) have reported consensus beating earnings results helped by high advisory activity, and lower loan loss reserves. All were also remarkably upbeat on the state of the US economy and the financial condition of the US consumer, while supply chain problems were not expected to de-rail the recovery[v]. Moreover, we find European banks are seeing a similar positive environment, and relative valuations are undemanding with most trading well below book values. Asset quality has significantly improved, and we are seeing the highest capital levels since 2008 underlining the general strength of balance sheets. We still favour banks, financials, healthcare, and industrials in equity sectors, but also include sectors that have the power and presence to set market prices, such as large global consumer staples companies which have also featured well so far in this earnings round.

[i] Absolute Strategy Research – October Investment Committee Briefing – October 1, 2021

[ii] Barclays – Earnings beats help alleviate rates pressure – October 22, 2021

[iii] Absolute Strategy Research – The three toughest questions from Q3 marketing – October 14, 2021

[iv] Financial Times – Inflation fears push investors to flee gold for digital currencies – October 22, 2021

[v] Barclays – Earnings to the Rescue – October 19, 2021

GLOBAL INSIGHT Q4 2021

September Strategy Meeting: Volatility is Set to Rise

By Tim Sharp

The weak September seasonality of financial markets showed up again this year and the world remembered the 20th anniversary of the 9/11 bombings. Inflation has risen sharply in recent months and although the expectations are that rates in the developed world will be lower next year as many causes prove transitory, we believe it is likely that some prices, such as housing, will remain elevated, and further upward pressure from wages is also likely. It is probably true to say that the underlying trend in inflation is rising[i] assisted by the expectation that central banks will allow a period of above target price growth to run and the strong recovery of economies following the 2020 shutdowns.

The FOMC projections for PCE inflation see inflation ending the year at 4.2% before falling to 2.2% in 2022 and 2023 getting back to 2.1% in 2024[ii]. This underscores the belief that the current high levels will be transitory but shows less confidence in GDP growth being maintained. Looking at US breakeven rates the Fed would seem to be more confident in its inflation forecast than bond markets who price the 6-year breakeven rate at 2.51% well above the longer run projection of 2%[iii]. Markets had built up an apprehension over the Fed September meeting, but despite the frank press release outlining the change in the environment this fear dissipated without a serious threat to risk assets.

The reopening of economies has once more shone a light on persistent supply side disruptions and the risks to financial markets. The lockdown in Vietnam appears to have left Nike, amongst others, with major supply headaches, and the semi-conductor shortages have affected many industries most notably automobile production with the knock-on effect to the second-hand car market. Absolute Strategy Research (ASR) believe that the forced reshoring of supply chains would be a net negative for the global economy and the disruption to the global goods economy ongoing. Along with the rise in COVID cases this has caused many forecasts for global growth in the second half of the year to be downgraded, with the Fed itself lowering its US growth target for 2021 to 5.9% from 7% in June ii, which is also very similar to ASR’s global projection of 5.75% for this year[iv]. In our opinion, recent global PMI data has also pointed to decelerating growth, and we remain cautious of the likely weakening in the PMI data during the next couple of months may prove significant.

Having been the global engine for growth following the global financial crisis we feel China is now proving to be a drag on its region’s ability to recover and causing instability in both economic and geo-political terms. The credit tightening particularly in the property market has led to a slowing economy and the Evergrande saga that has played out over the past two weeks increased fears regarding the risk of contagion spooking investors. It is also clear that the Chinese government is also worried about the flow of data and money through certain sectors most notably technology and private education. The new data protection laws and regulations for internet companies have seen the tech sector shares weaken significantly as the legislature tries to rein in the power of popular internet platforms by standardizing datai. This process appears to be ongoing and its effect on global data gathering currently unknown but with deeper divisions of trust between China and western economies it is difficult to gauge how far the effects are likely to reach.

It is true to say that risk asset markets always seem to be climbing a wall of worry but there seems to have been a number of reasons to cause the additional anxiety in September including the rise of delta variant cases, the persistent rise in inflation, European gas price shock, Fed to start tapering QE, the easing of growth forecasts, continued strength of technology stocks, Evergrande contagion, US government default and shutdown, and the pressure on corporate tax rates to name but a few. However, until this week at least US 10yr Yields remained anchored below 1.40 and the dollar was once more a safe haven, turning TINA into TRINA – There Really Is No Alternative to equities at present despite a mainly negative month for both developed bonds and equities we believe. The S&P500 gave up 4.76% over the month while the more tech-heavy NASDAQ lost 5.31% leaving it negative over the course of the quarter. The Xetra DAX Index (-3.63%) and CAC 40 Index (-2.40%) followed the US lead while the already underperforming UK FTSE 100 finished the month down only 0.47% but still flat on the quarter. Japan showed some of its safe haven qualities with the Nikkei 225 index up 4.85% on the month against a weaker Yen versus the Dollar.

In the last few days, the US bond market has started to react to the surprisingly hawkish FOMC meeting with 10yr yields trading as high as 1.56% rising above its 100- and 200- day moving averages as the curve steepens once more. We feel UK MPC minutes have also been surprisingly hawkish forecasting CPI above 4% into Q2 22 with the Gilt market pricing in two hikes in 2022 with the first in the first quarter. The ten-year Gilt now nominally yields approximately 1%. It is looking increasingly likely that the BOE will take the interesting step of tightening rates before finishing QE. Furthermore, Norges Bank in Norway was the first central bank to raise policy rates by 25bps suggesting that Central Banks have made the first tentative steps to unwinding the accommodative environment that has supported markets for so long[v].

We believe this has been an important inflection point in the reopening of economies as markets consider the slowing growth forecasts for the second half of this year and the heightened risk of a correction in equity markets that comes with it. We still believe equities remain expensive in absolute terms but are still supported by their relative valuation to bonds and the strength of corporate earnings reporting over the past year. It is, therefore, unlikely that the medium-term risk overweight positioning will change but we feel it is likely that market volatility will rise as we enter the fourth quarter starting with the most volatile month in the calendar year – October. We have positioned ourselves for the reflation trade and the focus to move more towards Europe away from US growth stocks which has been undermined by the rotation back into Technology over the summer which was reversed as September came to a close. The S&P Growth Index lost 5.95% over the month versus -3.85% for the Value Index. As real rates become negative the search for real, long term growth prospects become stronger. However, rising inflation is a real headwind for growth stocks as it undermines future cashflows and potentially reduces revenue growth opportunities, so we expect the markets to come back round again. We still favour banks, financials, healthcare, and industrials in equity sectors, but our focus remains on alternative revenue streams to bonds and equities through collectives that are looking at real assets, structural growth opportunities, and the strength in IPO and M&A markets.

[i] ASR’s Investment Committee Briefing – September 2021

[ii] FOMC Summary of Economic projections – September 22, 2021

[iii] Bloomberg – Points of Return: The Tapir Cometh – John Authers – September 23, 2021

[iv] ASR Economics – Growing Pains – Dominic White – September 14, 2021

[v] Barclays – Global Macro Thoughts: A Rising Wall of Worry – September 28, 2021

From Paper to Taper: Fed Chairman Powell seems to have averted a tantrum

By Tim Sharp

Following Ben Bernanke’s 2013 market induced taper tantrum Chairman Powell has been keen not to be responsible for a repeat by carefully planning his press releases since the summer so as not to spook the bond market. The results seem to suggest that he has successfully convinced the market that there is a difference between the reduction or tapering of quantitative easing and initiating a rate hiking cycle. Arguably the press release following the September Fed Open Market Committee (FOMC) meeting pointed to a more hawkish Fed outlook than the market probably expected. However, this failed to trigger a major reaction especially as the global stock markets have been in a state of flux following the anxiety surrounding the potential failure of Chinese property developer Evergrande; rising cases of the Delta variant threatening global growth prospects in the second half of 2021; rising inflation that may become persistent rather than transitory; and an FOMC meeting to discuss the reduction in US bond market support.

Last night’s meeting made the balance sheet the focal point with Powell stressing that no inference should be made regarding the path for rate hikes[1] which have a clear higher hurdle. Powell made an unambiguous statement that barring surprisingly bad economic data over the next month, we should assume that the tapering process will be initiated at the November meeting and will reduce its purchasing of Treasury Securities to conclude around the middle of next year. This translates as a reduction of $10bn per month from November until June which arguably is a much more aggressive taper than the market had expected[2].

The market’s reaction was startlingly benign, we believe a testament to the management of the Fed’s press releases. Bond market volatility has remained low, stock markets ended the day mainly flat while the VIX index hovered around 20.

For the record, the benchmark overnight lending rate was kept in its current range of 0% – 0.25% where it has remained since March 2020. The minutes that are released on October 13 should continue to imply that balance sheet actions are separate from a hiking cycle but the “dot plot” of members interest rate forecasts should show that more members now expect to start raising interest rates next year. Nine, up from seven in June, out of eighteen members, now expect the hiking cycle to start next year leaving only one, down from five, that forecast rates to remain unchanged by the end of 2023. This is a clear indication that the FOMC has grown more hawkish than it was at the June meeting. The swifter pace of interest rate hikes from policymakers’ last set of projections in June comes amid the fastest economic recovery in U.S. history after a brief recession last year, and robust debate at the Fed about balancing its maximum employment and 2% average inflation goals[3].

The FOMC projections for PCE inflation see inflation ending the year at 4.2% before falling to 2.2% in 2022 and 2023 getting back to 2.1% in 2024. This underscores the belief that the current high levels will be transitory and shows less confidence in GDP growth being maintained. Real GDP growth is forecast to be 5.9% at year-end (7% in June), falling to 3.8% by the end of next year, and 2.5% in 2023[4]. Looking at US breakevens the Fed would seem to be more confident in its inflation forecast than bond markets who price the 6-year breakeven rate at 2.51% well above the longer run projection of 2%2.

Although the median interest rate of 1.8% by 2024 is still below the 2.5% level seen as neither stimulating or restricting growth over the long run3 the US Treasury yield curve between 5 years and 30 years flattened 1% after the press release suggesting that the risk of a monetary tightening mistake by the Fed has risen. The Jackson Hole symposium suggested that the Fed would be inclined to run inflation “hot” under its new Average Inflation Targeting strategy but a forecast that sees inflation falling back to 2.1% in 2024 after a decade under target will not feel particularly accommodative to some in the long run and may bring into question the reflation trade. However, the markets reactions show no fear of the taper despite a more hawkish press release than many would have expected, and bank shares as well as the wider stock market seems to be continuing its long term rally after a brief stumble on Monday.

[1] Morgan Stanley – FOMC Reaction: A Tidy Taper – Ellen Zentner – September 23, 2021

[2] Bloomberg – Points of Return: The Tapir Cometh – John Authers – September 23, 2021

[3] Hottinger & Co. Limited – FOMC – Quick Summary – Adam Jones – September 22, 2021

[4] FOMC Summary of Economic Projections – September 22, 2021

GLOBAL INSIGHT Q3 2021

August Strategy Meeting: Peak Growth, Peak Liquidity

By Adam Jones

Having historically been a relatively quiet month owing to summer holidays, August proved no exception as most regional equity indices delivered low single digit returns while developed market sovereign bond yields traded in a fairly narrow range.

The Jackson Hole Economic Symposium panning August 26th to the 28th had been eagerly anticipated by market participants who were keen to gain some insight as to the Federal Reserve’s current thinking on macroeconomic data and monetary policy. As a reminder the Federal Reserve has a dual policy mandate tasked with fostering economic conditions that achieve both stable prices (i.e. average inflation of 2%) and sustainable employment, with Chair Powell having the difficult task of presenting the FOMC’s current thinking on these issues in his speech on August 27th.

Turning firstly to inflation we received confirmation that the Federal Reserve now views this side of its mandate as having been fulfilled. From a short-term perspective, Powell noted the concentration of price rises in the durable goods sector which the Committee continue to view as temporary due to ongoing supply constraints and staff shortages.

Longer term measures of inflation also remain well anchored. In terms of wages there has been some mild upward pressure but only to an extent that is consistent with the Fed’s longer-term objective of 2%.

From an employment perspective the data has continued to improve in recent months although it is worth noting that total US employment is running some 6 million jobs below their February 2020 level (5 million of which are within the service sector). Whilst the total unemployment rate has declined to 5.4% the Committee believes this is “still much too high….and significantly understates the amount of labor market slack”.

Payrolls are expected to have increased by an additional 732k in data released this week and a simple (perhaps optimistic) extrapolation of this rate would imply a full recovery in 8 months time. As such the Committee maintained expectations that they will begin the tapering of their balance sheet prior to year end 2021. Interestingly, however, Chair Powell was very keen to emphasise the separation between balance sheet tapering and hiking rates;

“The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test………

Jerome Powell – Jackson Hole, 27th August 2021

As such our view is that the Federal Reserve will indeed proceed with tapering, perhaps at some point as early as this month. This marks the beginning of a slow withdrawal of liquidity in a market that has very much become accustomed to its provision.

On top of this liquidity withdrawal we also of the view that the peak of accelerating economic growth is now firmly in the rear view mirror. Many of our cross-asset cyclical indicators have been telegraphing this deceleration for several months and have since been confirmed by lower readings across leading economic indicators.

This confluence of factors causes us to adopt a more cautious approach toward markets in the very near term.

One market we are monitoring closely is China, which has seen a very high degree of volatility in recent months as a direct result of government actions. The Chinese government have been tightening their grip on the internet & technology sector since late 2020 through various investigations into monopolistic practices and offshore listings, which have only intensified over the course of 2021 to date.

In our view the crackdown stems from China’s crudely implemented effort to redistribute capital and human talent toward specific sectors within Technology (outside a narrow subset of dominant e-commerce names). The 14th 5-year plan (2021-2025) was released in February of this year and very clearly prioritised the pursuit of ongoing innovation and an increase in technological self-reliance across ‘core’ sectors such as semiconductors and biotech.

The second aspect of their relates to equality. The online Education sector has effectively been forced (via regulations implemented in late July) to become a non-profit sector, with the aim being one of ensuring education is more accessible to its lower earning citizens.

Both of these episodes serve as a useful reminder of the risks inherent to investing in a socialist economy, however we believe recent volatility has also created a number of interesting opportunities in individual businesses.

From a macro perspective China is also not immune from the wider slow-down in global economic data, with the New Orders component of the Chinese Manufacturing Survey having recently fallen into negative territory and the spectre of default risk having risen from the likes of China Evergrande (China’s 2nd largest property developer).

As such the PBOC has already moved to reduce the reserve requirement ratio (the amount of capital banks are required to hold against their lending portfolios) and just last week alluded to likely doing so again in the near future. Allied with a more positive outlook for fiscal expenditure into year-end we expect more accommodative policy to deliver support for Chinese equity markets.

UK Banks: Laying the past to rest…

by Adam Jones

In the years leading up to the great financial crisis British bank Northern Rock had expanded aggressively, turning to international money markets to fund exceptional growth in its loan book. By the summer of 2007 it had become clear that issues originating in the US sub-prime mortgage market would quickly spill over into Europe.

As they did so Northern Rock’s primary source of financing all but evaporated and on the 14th September 2007 the bank’s perilous position was made public. Despite liquidity support from the Bank of England the news triggered the first run on a UK bank for over 140 years. The subsequent 18 months would see the bail outs of Bear Sterns and AIG, the failure of Lehman Brothers, the merger of Lloyds TSB with HBOS, the nationalisation of Bradford & Bingley and the rescue of RBS (among countless other government support programs).

The crisis marked the beginning of major regulatory reform for the banking industry with the aim of increasing resilience across the global financial system. In the years since the banking sector has undergone a significant transformation under the Basel III regulatory framework. These are an internationally agreed set of measures developed by the Basel Committee on Banking Supervision which serve to strengthen the regulation, supervision and risk management of banks.

The result has been a banking sector focused primarily on strengthening and rebuilding its capital position at the expense of both profitability and shareholder returns.

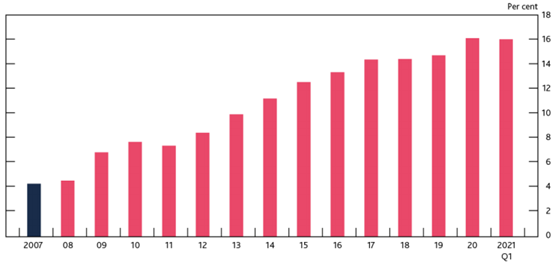

UK Banks – Aggregate Core-Equity Tier One Capital Ratios since the Global Financial Crisis

Source: Bank of England Financial Stability Report, July 2021

Source: Bank of England Financial Stability Report, July 2021

A bank’s fundamental role in the economy is to engage in both maturity transformation (i.e. borrowing short dated funds to lend longer dated funds) and credit extension (lending to those whom the bank believes have the capacity and willingness to repay), processes which are hampered by the flattening of interest rate curves. As longer dated interest rates move closer to shorter dated interest rates the available ‘spread’ on bank lending becomes less profitable. These are the very conditions that have prevailed since (and perhaps to some extent because of) the financial crisis.

GBP Yield Curve – 10yr minus 2yr Yields

Source: Refinitiv

In the context of banks striving to rebuild balance sheets, attempting to keep up with incoming torrents of new regulation and wrestling with market conditions that serve to directly reduce their profitability it becomes relatively easy to understand why long-suffering shareholders have experienced so little in terms of returns over the past decade. The below chart highlights this point all too clearly.

FTSE 350 £ Banks Index – A lost decade…

Source: Refinitiv

In our view there are, however, clear signs that this prolonged period of difficulty for banks could be drawing to a close. Here in the UK banks find themselves in the position of being very well capitalised (even relative to the regulatory constraints imposed in the aftermath of the financial crisis) with major UK bank capital ratios some 3 times higher than those heading into 2007 according to the Bank of England. Indeed we can think of no greater test of their supposed resilience than the onset of a global Pandemic resulting in an almost overnight closure of the domestic economy.

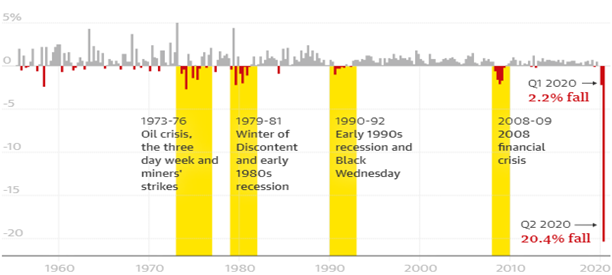

According to the Office for National Statistics UK Gross Domestic Product (a measure of the size and health of a country’s economy) contracted by some 20.4% in the second quarter of 2020, the largest decline since comparable records began in 1955.

UK Gross Domestic Product, Quarter-on-Quarter Growth

Source: UK Office for National Statistics

As a precautionary measure in March 2020 the UK’s Prudential Regulatory Authority (tasked with the supervision of banks and other financial institutions) stepped in to request that banks suspend dividends and buybacks until at least the end of the year and, in addition, that the payment of any outstanding 2019 dividends and restricted cash bonus payments to staff be cancelled. We believe this was absolutely the right thing to do given the uncertainties associated with the pandemic and the outlook for economic growth. These actions no doubt helped to stabilise share prices.

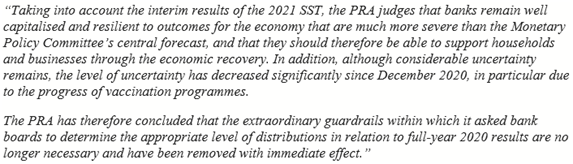

Since then the PRA has also begun to undertake its annual solvency stress test for 2021, which assesses the resilience of the UK banking system to ‘a very severe macroeconomic stress’. The interim results of the test were released in July’s Financial Stability Report and have been sufficiently encouraging for the PRA to have lifted the restrictions on bank capital distributions.

Update on shareholder distributions by large UK banks, July 13th 2021

Source: Bank of England, Prudential Regulation Authority

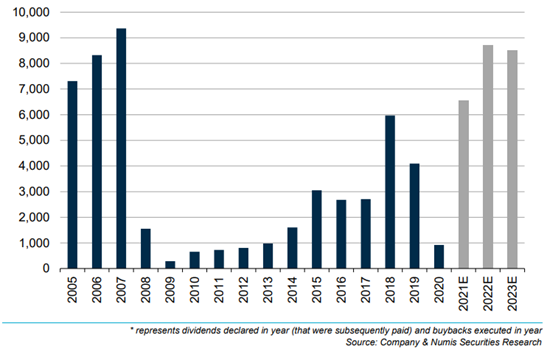

In our view this paves the way for a significant increase in the ongoing return of capital to shareholders at a time when the valuations of many UK banks are exceptionally low (likely a result of their torrid past). Recently announced results have only served to strengthen our belief in this view, with many of the UK’s largest banks having declared significant equity buy-back programs coupled with the resumption of ongoing dividend distributions.

Total distributions* across the domestic UK Banks sector since 2005, £m

Source: Numis Securities

Source: Numis Securities

In addition to our outlook for UK banks at the ‘micro’ level (an uplift in capital returns couple with attractive valuations) there is also a ‘macro’ tailwind which we believe could well be on the horizon. Owing to many of the factors discussed above banks around the world have not been growing their loan books at an especially high level (outside of mortgages, which could be a separate blog in its own right). This has had the effect of constraining earnings in a sector which had become far more conservative. Recent data from the US, however, indicates that we could well be entering a period of increasing loan growth which would tie in well with our more constructive outlook for the global economy.

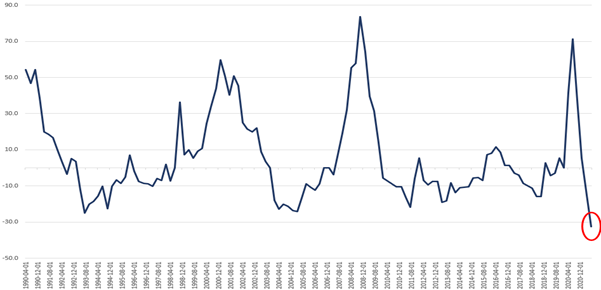

The Senior Loan Officers Opinions Survey is conducted by the US Federal Reserve on a quarterly basis across 80 bank participants and seeks to gain insight on current standards of lending practices and conditions. One of the outputs of the Survey is the net percentage of domestic banks who are currently tightening standards for commercial and industrial loans to large and mid-sized firms (i.e. banks that are making their lending requirements more stringent). Whilst this is clearly US data, the release for July 2021 shows the lowest proportion of banks tightening lending standards on record, a situation which has historically preceded significant expansions in bank lending.

Net Percentage of Domestic Banks Tightening Standards for Commercial & Industrial Loans to Large & Mid-Market Firms

Source: St. Louis Federal Reserve Database

Source: St. Louis Federal Reserve Database

An expansion in global credit could see consumption driven demand increase significantly which has the potential to drive stronger economic growth, persistently higher inflation and perhaps even higher interest rates, particularly at the longer end of the curve as those at the short end remain anchored by domestic central banks.

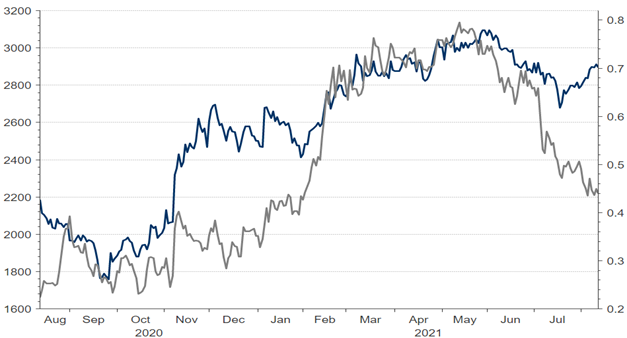

As discussed above this is a phenomenon which we believe could significantly increase the ongoing profitability of domestic banks, an expectation which can be seen by a cursory look at the correlation of bank equity prices with the overall shape of the yield curve.

FTSE 350 £ Banks Index (Blue) vs GBP 10yr vs 2yr Yield Curve Slope

Source: Refinitiv

Source: Refinitiv

In summary we believe that UK banks are finally a position to lay their past to rest and begin to refocus on profitability coupled with shareholder returns. General investor perceptions of the sector remain negative as can be seen through the lens of valuations which we believe remain low in the context of both history and future potential.

July Strategy Meeting: Equity Strength Underpinned by Strong Fundamentals

By Tim Sharp, Hottinger & Co.

The success of the vaccine roll-out in western economies seems to have checked the economic impact of the increased cases of the Delta variant with increasing evidence that the relationship between new cases and hospitalisations and deaths has been disrupted, while the developing world where vaccination penetration remains low, risks remain elevated[i]. This has caused some jitters in financial markets that the removal of restrictions may be delayed with the inevitable effect on global growth.

The IMF released its latest report this week on global growth, warning that limited access to vaccines risks hindering the global recovery by splitting the world into two blocs. However, by cutting the forecast for emerging markets and increasing the forecast for the developed world the overall global growth forecast remained at 6% for 2021. The UK gained the biggest uplift to 7% with the economic impact of the rise of the Delta Variant in the developed world difficult to calculate. The second risk is that inflation may prove to be more persistent than currently anticipated prompting a more aggressive central bank reaction[ii].

Interestingly, fund flows into fixed income have overtaken equity flows year-to-date in July, according to Barclays, although equity flows are also still positive. The level of Treasury holdings on bank balance sheets has soared in line with the savings rate and there has been a public warning from a consortium of 30 private and public sector experts including Timothy Geithner, Larry Summers, and Mervyn King regarding the stability of Treasury markets. Recommendations include a single marketplace, and a mechanism by which the Fed can provide participants with a short-term swap for cash to provide liquidity that can dry up at times of extreme stress as was seen in March 2020[iii].

The US Treasury ten-year continues to ignore the current strength of inflation preferring to believe that temporary supply bottlenecks are the route cause, due to an uneven reopening, with the yield dropping to 1.24%. Moreover, there are signs that some pressures are easing with prices in lumber and other raw materials lower, and the semi-conductor shortage working its way through in the auto sector[iv]. It would appear that markets have suffered a growth shock rather than fears surrounding elevated inflation which has expressed itself in a curve flattening as long duration bonds reflect global growth fears.

Morgan Stanley challenges the notion that global growth is weakening instead seeing a strong economic recovery underway. They believe second quarter US GDP is going to be approximately 12% and continue to estimate global growth for 2021 of 6.5%i. We continue to believe that despite the recent value to growth rotation, the movement towards stocks with stable earnings, strong cash flow generation and robust balance sheets will provide an element of consistency and protection to valuations.

Second quarter earnings have started strongly with Absolute Strategy Research (ASR) predicting 55% year-on-year gains although guidance remains key for investors particularly when valuations are so stretched[v]. Interestingly US Treasury thirty-year yields have dropped to 1.89% while the S&P500 dividend yield is 1.76% and until bond markets start reacting more consistently to the expected path to higher inflation this will help underpin equities. Most notable to us has been the strong results from the global banking sector which has seen loan reserves reduced following unexpected corporate strength during the pandemic, the resumption of dividend payments in many regions, and strong revenue gains. We believe that a strong performance from banks will further underpin equity markets and add to investor confidence.

The outperformance of US equities has been related to the strength of the US dollar over the last two months, in our opinion, and the rise of long-term growth stocks as bond yields have fallen. The S&P 500 gained another 2.3% in July versus 1.7% for the MSCI World Index. If the rotation back into growth stocks proves to be a short-term reaction to the rise in Covid-19 cases, then we would expect to see European equities come back to the forefront. The EU’s Next Generation Recovery Fund sees 71% of spending aimed at key green and digital transmission investments which are expected to have long term productivity enhancementsiv.

Fears of global slowdown, rising coronavirus cases, weaker commodity prices, a Chinese Producer Price Index inflation rate of 9% and a stronger dollar, was not a comfortable environment for developing markets although the difference between commodity exporters and importers saw Latin America outperform Asia and the broader index albeit to the downside[vi]. Declines in Chinese internet stocks such as Alibaba, and Tencent have been significant as Chinese regulators continue to step up their oversight and plan heavy penalties in the technology, private education and food delivery sectors causing anxiety amongst investors[vii]. This also leaked into the heavily debt-laden real estate sector where the authorities are trying to cool demand with new restrictions. We believe a renewal of the long-term trends including a return to dollar weakness should see emerging markets recover once more.

Following last month’s research into corporate debt markets we believe corporate credit spreads offer little value to investors with added duration risk, and in line with our views on the relative attraction of emerging market currencies we see emerging market local currency debt as an area of fixed income that still offers opportunities to investors. The expected path of developed market government bond yields and the expectations of a continuation in the steepening of the curve leaves investors looking to reduce bond exposure in the interim. We continue to favour the relative valuation of developed equity markets and the strengths of quality stocks particularly in the UK and Europe. The flash GDP release for the Euro Area rose by 2% quarter-on-quarter in the second quarter well above consensus expectations of 1.5% marking the beginning of a cyclical rebound that could see pre-crisis levels by the fourth quarter[viii].

[i] Morgan Stanley – Summer Doldrums _ Where Do We Stand? – July 25, 2021

[ii] IMF World Economic Outlook – Fault lines widen in the global recovery – July 2021

[iii] Financial Times – Flawed $22tn US debt market a threat to stability, warn grandees – Colby Smith, July 29,2021

[iv] Absolute Strategy Research – Investment Committee Briefing – July 1, 2021

[v] Absolute Strategy Research – Supply Constraints and Inflation Favour Cyclical Stocks – July 15, 2021

[vi] Comparison of MSCI Indices on the Refinitiv platform by Hottinger Investment Management

[vii] https://www.cnbc.com/2021/07/28/investing-china-stocks-among-asias-worst-performing-amid-regulatory-scrutiny.html

[viii] Barclays – Buckle up, we’re in the fast lane now – July 20, 2021

June Strategy Meeting: Inflation Remains Transitory

By Tim Sharp, Hottinger & Co.

June, much like May has been dominated by concerns regarding rising inflation. The statement following this month’s Federal Open Market Committee (FOMC) meeting was more hawkish than expectations but rather than suggesting the US Federal Reserve (Fed) is going to pull back from Average Inflation Targeting we believe pointed to the fact that the committee had started to discuss a timetable for reducing or tapering Quantitative Easing. There was actually no change in policy and little change in economic outlook, although the committee members’ “dot plot” interest rate projections showed seven members electing to pencil in the first hike for next year and most had moved to two hikes in 2023. This probably indicated that the Fed was potentially behind the curve and is now more aligned with markets[i].

The rebound in global demand and the continued increase in job openings has seen several bottlenecks emerge in supply side production, as well as logistical constraints, that have pushed US core inflation to its highest rate since 1995[ii] leading many investors to question the transitory nature of the strength in inflation. For our part we tend to agree with the Fed and the Bank of England that the current jump in inflation is tied to irregularities in the reopening of economies and the continuing fiscal support offered by governments making employment in low paid sectors less attractive meaning that this may prove to be the peak in near term inflation pressures[iii]. There is little doubt in our opinion that the risks point to higher inflation over time and that the loose monetary and fiscal conditions probably rule out future deflationary trends.

From a developed equity perspective, markets had a wobble following the FOMC meeting as the change in rhetoric caused a rotation into defensive stocks away from cyclicals sectors. Absolute Strategy Research (ASR) point out that this actually started in May when indicators suggested inventory conditions were tight and the FOMC meeting purely underlined this message[iv]. Morgan Stanley have been ahead of consensus with their mid-cycle transition from consumer discretionary into consumer staples but are receiving push back from clients due to the belief that the savings glut will perpetuate the re-opening trade. Morgan Stanley counter that over-consumption in 2020 will likely curtail the re-opening trade and discretionary spending is more early cycle than mid-cycle[v]. Interestingly, June saw Russell 2000 Growth Index significantly outperform the Value Index by approximately 5.29% with Banks and Resources stocks under pressure, suggesting that the reflation trade may have peaked near-term. However, we believe the underlying current in equity markets remains optimistic and investors took advantage of opportunities in the recent re-balancing to invest in long term equity holdings.

In our opinion, we have reached the stage where owning robust, fairly valued stocks in companies with strong cash flow and low debt; that have shown an ability to perform in different parts of the cycle will likely offer an element of downside protection in long-only portfolios. This description lends itself most naturally to defensive, value stocks but we also see many examples of expensive equities in such sectors. This could be an opportunity for good stock-picking to overcome sector allocation, and growth vs. value, however, we still favour banks and materials as the best way to play rising long term inflation trends.

Regionally, we have positioned ourselves to take advantage of the green energy investment that is being rolled out in Europe and continue to believe that the discount currently experienced by UK equities vs. other developed markets will close. We posit current M&A trends suggest the value in the UK has been recognised at an institutional level and we believe that equity investors will also want to increase their participation in UK markets[vi]. During June the FTSE All-Share index was flat on the month while the MSCI Europe ex UK Index gained 1.89%. Finally, Japan is the last developed value market that continues to underperform developed markets, the Nikkei 225 Index was 0.24% weaker over June. There are good reasons for Japan to outperform in this environment as pointed out by ASR – weaker Yen, rising US Treasury yields and stronger dataii. However, the vaccine roll-out has seen a slow take up by the population so the threat of another wave of the Delta variant cannot be ruled out, and the slowdown in China has potentially also affected Japanese sentiment- in our opinion.

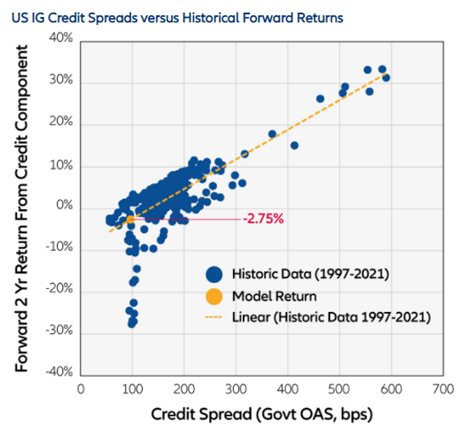

Developments in bond markets, most notably the lack of further upside in 10-year US Treasury Yields despite rising inflation concerns also point to the markets belief that current inflationary pressures will prove transitory. The current 10-year benchmark yield started the month at 1.61% already well off the high of 1.73% and is currently 1.46% with inflation break-evens already pricing in high inflation expectations. Our investigations into credit markets concluded that the tightness of spreads, with the likelihood that developed markets could only tighten further, leaves very little return for investors.

Moreover, we believe it is unlikely that the outlook for the second half of the year will disrupt credit markets so our emphasis should perhaps shift to Emerging Market debt. The case for Emerging Market currencies to strengthen over the course of 2021 further suggests to us that a local currency emerging market debt fund may be an efficient way of capturing positive returns.

The expected path of developed market government bond yields and the expected continued steepening of the curve leaves investors looking to reduce bond exposure in the interim. With the risks to inflation firmly to the upside the move to include commodities, real assets, and alternative strategies at the expense of traditional fixed income exposure will continue to occupy this committee and other multi-asset investors. Gold had rallied strongly in May but failed to hold on to those gains in June falling from a high of $1908 to $1770 over the month. The future path of Gold will probably be a trade-off between a weaker dollar and rising real yields following already stretched break-evens rather than any correlation to Bitcoin, suggesting to us a move lower under this scenario in the medium term.

[i] The J.P. Morgan View – FOMC meeting isn’t a game changer – June 21. 2021

[ii] Absolute Strategy Research – Investment Committee Briefing – June 2021

[iii] https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2021/june-2021

[iv] Absolute Strategy Research – Long duration Reprise – Back to the Future – June 22, 2021

[v] Morgan Stanley Sunday Start – Great Expectations – June 6, 2021

[vi] Hedge Fund Short Sellers Face Off Private Equity in Morrison Supermarkets Deal – Bloomberg

Clearer skies ahead….?

by Adam Jones

With the global pandemic now firmly in the rear-view mirror we have been reflecting on the performance of various economies and markets over the past 12 to 18 months. Since the pre-pandemic peak in late February 2020 global equities (as measured by the MSCI World Index) have delivered returns of c.17% to UK investors. Europe has closely followed suit (delivering a 14% return) but the clear laggard has been the UK itself, with the FTSE 100 being effectively flat over the same period.

This is perhaps unsurprising given the number of headwinds over recent years, but as the clouds begin to part we find ourselves becoming increasingly optimistic on the outlook for the UK.

Enthusiasm for UK equities, which had already been dampened by protracted Brexit negotiations, has struggled further under the weight of the pandemic given a particularly high market exposure to those sectors most affected by lock-downs.

Even prior to the Brexit vote global fund managers have generally been underweight the UK market, preferring instead to maintain exposure to those markets geared toward secular growth dynamics (US Tech being the clearest example);

This makes absolute sense in a world where economic growth is scarce and interest rates are low. However, for now at least, that does not appear to be the situation we find ourselves in.

Successful vaccine roll-outs are beginning to take hold and continued re-opening looks set to drive a wave of demand from consumers all across the developed world, many of whom are waking up to the fact that their bank accounts are full of unspent earnings and/or unemployment benefits.

Household savings rates here in the UK remain elevated and from our (perhaps optimistic) perspective this provides a supportive backdrop for spending in the months ahead;

Source: ONS

The true scale and duration of fiscal support packages is yet to be seen given the politics involved, however there is little doubt that it will come through in one form or another. This provides yet another leg of support for the stool of economic growth.

As a thought exercise we felt it useful to identify and expand on some of the key reasons why we feel the UK market is especially well placed to deliver more attractive returns on a forward-looking basis;

- An increasingly robust intellectual property base – The UK offers an almost unparalleled breadth and depth of IP, spanning its football clubs (almost half of the top 30 global football clubs by revenue) to its universities (3 of which consistently feature in the world’s top 10 universities). This is not to mention the disproportionate impact UK scientists had on the impressive and rapid development of a Covid vaccine.

- Economic strength – Whilst not boasting the headline GDP growth numbers sported by some other countries the UK can hold its head high in having maintained a consistently low unemployment rate (particularly when compared with those in Europe & the US).

- Funding strength – One consequence of higher bond yields (which we have seen over recent months) is that it increases the cost of a governments borrowing. This is likely to become more of an issue over time and it is worth noting the UK has by far the longest average term to maturity of its debt across the developed world (17.8yrs vs just 6 in the US). This essentially means the UK has fixed its borrowing costs for a much longer period and thus has lower refinancing risks than many other economies.

- Falling political risk – Clearly Brexit and the associated uncertainty has weighed heavily on the UK as a whole. However, with the most critical negotiations now behind us we see many reasons to believe that excessive risk premia associated with Brexit should begin to recede. It also feels increasingly clear to us that leaving the EU also allows the UK government to turn its attention more toward stimulating domestic investment and growth.

- Cheap equity valuations, cheap currency – The UK market continues to trade at a significant discount to other developed markets and has more recently traded at lower earnings multiple than the (arguably much riskier) Emerging Market equity universe;

This is a fact that does not appear lost on overseas investors given the significant pick up in M&A activity YTD, with overseas corporate and private equity investors looking to take advantage of this apparent dislocation.

All in all, we can think of far more reasons to own UK equities here than not to. Whilst it is very possible that we are being overly optimistic about the outlook the balance of risk and reward appears to be very much in our favour.

May Strategy Meeting: Equity Markets Have Stalled

By Tim Sharp, Hottinger & Co.

Equity markets appear to have stalled during May as the two main catalysts of reopening economies and reflation seem to have run their course in the short term. The MSCI World Index is up 1.26% in dollar terms during the month and despite the continued apparent “buy-on-dip” mentality which is still holding markets firm, the bounces in growth and reopening plays have been shorter lived each time. The S&P 500 outperformed the NASDAQ again in May 0.55% versus -1.53%, but the near-term catalysts do not seem to be enough to drive valuations from here at present. Towards the end of the 1st quarter the correlation between increased volatility and returns was high, suggesting strong risk appetite amongst investors, but this month the same measure for global equity risk appetite is far more neutral[i]. Furthermore, as noted last month, the share price reaction to the Q1 US earnings beats continues to be muted by historical standards as investors look at the guidance for signs that companies will be able to sustain margins[ii]. The question is whether this leads to a broader weakening in risk appetite that would point to a near term high in bond yields.

The European earnings season is by contrast slower to evolve than its US counterpart with 217 out of 600 companies having reported at the time of analysis, however, earnings have beaten expectations by 31% which would be the best result in over a decade according to Absolute Strategy Research (ASR)[iii]. This would point to a quicker recovery than initially expected with year-on-year earnings growth of approximately 150% and the sales-earnings ratio points to a profit margin exceeding pre-pandemic levels. ASR confirm that this would be the highest level for 15 years further underlining our belief in the prospects for European equities[iii]. European equities have had a solid month with EUROSTOXX gaining 1.87%, the CAC 40 gaining 2.83% and the DAX 1.88%.

We believe the UK could be the cheapest of the main equity markets based on historical metrics, with a high weighting towards both value and the reflation trade through energy, basic materials, financials, and consumer staples sectors. The FTSE 100 has had a flat month up 0.76% while the more domestically oriented small cap index gained 1.97%. The vaccination rollout has gone well and the government looks to have strong approval ratings following recent elections, so the domestic landscape in the UK should be attracting investors. We posit that the contraction in Q1 GDP reflected the tighter restrictions following the rapid spread of COVID variants, while statistics suggest a rapid recovery is now underway and that the gap that exists to other developed markets could close by the year end.

Despite warnings from many economists that a transitory increase in inflation should be expected as restrictions ease, the markets have still been surprised by the strength of supply side inflation and an unexpected tightness in labour markets. We are now in a period where base effects will push the annual rate of inflation higher, but we are also witnessing considerable supply chain cost pressures coupled with increases in demand. Although these pricing pressures are expected to dissipate over the coming quarters, markets were jolted by May’s employment report which determined that just 266,000 new jobs had been added versus an expectation of 1,000,000. Many new openings are reportedly unfilled by a workforce that seems unenthused by the prospect of employment[iv].

The pandemic has seen a move from monetary policy responses, such as quantitative easing after the Global Financial Crisis, to an increase in fiscal policy by developed economy governments looking to build an infrastructure capable of supporting the bounce back in global growth. The increase in infrastructure spending has also seen increased momentum in green infrastructure spending, particularly in Europe, in the build up to the COP26 climate summit in November. The need to provide plans on how to achieve the transition to a sustainable world will also highlight the costs to both public and private finances, with ASR pointing to an estimate of $1trn of additional spending per year[v]. Increases in government spending normally lead to a focus on the tax regime for funding. While there is more emphasis on employee welfare and the living wage, it is widely reported that the Biden administration under Treasury Secretary Janet Yellen has been pushing for a landmark agreement that will see a new base in place in the developed world for corporate taxation that will inevitably reverse the trend in lowering the corporate tax burden. This will potentially affect future earnings, increase the pressure on margins, and further add to investors anxieties regarding valuations in our opinion.