by Adam Jones

In the years leading up to the great financial crisis British bank Northern Rock had expanded aggressively, turning to international money markets to fund exceptional growth in its loan book. By the summer of 2007 it had become clear that issues originating in the US sub-prime mortgage market would quickly spill over into Europe.

As they did so Northern Rock’s primary source of financing all but evaporated and on the 14th September 2007 the bank’s perilous position was made public. Despite liquidity support from the Bank of England the news triggered the first run on a UK bank for over 140 years. The subsequent 18 months would see the bail outs of Bear Sterns and AIG, the failure of Lehman Brothers, the merger of Lloyds TSB with HBOS, the nationalisation of Bradford & Bingley and the rescue of RBS (among countless other government support programs).

The crisis marked the beginning of major regulatory reform for the banking industry with the aim of increasing resilience across the global financial system. In the years since the banking sector has undergone a significant transformation under the Basel III regulatory framework. These are an internationally agreed set of measures developed by the Basel Committee on Banking Supervision which serve to strengthen the regulation, supervision and risk management of banks.

The result has been a banking sector focused primarily on strengthening and rebuilding its capital position at the expense of both profitability and shareholder returns.

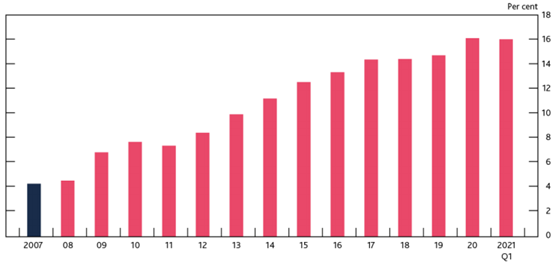

UK Banks – Aggregate Core-Equity Tier One Capital Ratios since the Global Financial Crisis

Source: Bank of England Financial Stability Report, July 2021

Source: Bank of England Financial Stability Report, July 2021

A bank’s fundamental role in the economy is to engage in both maturity transformation (i.e. borrowing short dated funds to lend longer dated funds) and credit extension (lending to those whom the bank believes have the capacity and willingness to repay), processes which are hampered by the flattening of interest rate curves. As longer dated interest rates move closer to shorter dated interest rates the available ‘spread’ on bank lending becomes less profitable. These are the very conditions that have prevailed since (and perhaps to some extent because of) the financial crisis.

GBP Yield Curve – 10yr minus 2yr Yields

Source: Refinitiv

In the context of banks striving to rebuild balance sheets, attempting to keep up with incoming torrents of new regulation and wrestling with market conditions that serve to directly reduce their profitability it becomes relatively easy to understand why long-suffering shareholders have experienced so little in terms of returns over the past decade. The below chart highlights this point all too clearly.

FTSE 350 £ Banks Index – A lost decade…

Source: Refinitiv

In our view there are, however, clear signs that this prolonged period of difficulty for banks could be drawing to a close. Here in the UK banks find themselves in the position of being very well capitalised (even relative to the regulatory constraints imposed in the aftermath of the financial crisis) with major UK bank capital ratios some 3 times higher than those heading into 2007 according to the Bank of England. Indeed we can think of no greater test of their supposed resilience than the onset of a global Pandemic resulting in an almost overnight closure of the domestic economy.

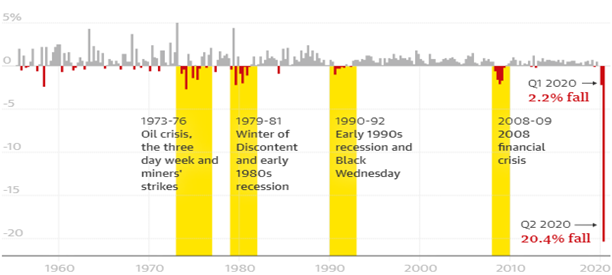

According to the Office for National Statistics UK Gross Domestic Product (a measure of the size and health of a country’s economy) contracted by some 20.4% in the second quarter of 2020, the largest decline since comparable records began in 1955.

UK Gross Domestic Product, Quarter-on-Quarter Growth

Source: UK Office for National Statistics

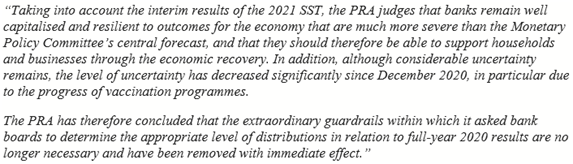

As a precautionary measure in March 2020 the UK’s Prudential Regulatory Authority (tasked with the supervision of banks and other financial institutions) stepped in to request that banks suspend dividends and buybacks until at least the end of the year and, in addition, that the payment of any outstanding 2019 dividends and restricted cash bonus payments to staff be cancelled. We believe this was absolutely the right thing to do given the uncertainties associated with the pandemic and the outlook for economic growth. These actions no doubt helped to stabilise share prices.

Since then the PRA has also begun to undertake its annual solvency stress test for 2021, which assesses the resilience of the UK banking system to ‘a very severe macroeconomic stress’. The interim results of the test were released in July’s Financial Stability Report and have been sufficiently encouraging for the PRA to have lifted the restrictions on bank capital distributions.

Update on shareholder distributions by large UK banks, July 13th 2021

Source: Bank of England, Prudential Regulation Authority

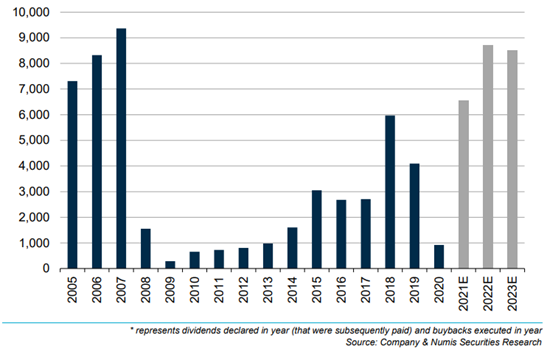

In our view this paves the way for a significant increase in the ongoing return of capital to shareholders at a time when the valuations of many UK banks are exceptionally low (likely a result of their torrid past). Recently announced results have only served to strengthen our belief in this view, with many of the UK’s largest banks having declared significant equity buy-back programs coupled with the resumption of ongoing dividend distributions.

Total distributions* across the domestic UK Banks sector since 2005, £m

Source: Numis Securities

Source: Numis Securities

In addition to our outlook for UK banks at the ‘micro’ level (an uplift in capital returns couple with attractive valuations) there is also a ‘macro’ tailwind which we believe could well be on the horizon. Owing to many of the factors discussed above banks around the world have not been growing their loan books at an especially high level (outside of mortgages, which could be a separate blog in its own right). This has had the effect of constraining earnings in a sector which had become far more conservative. Recent data from the US, however, indicates that we could well be entering a period of increasing loan growth which would tie in well with our more constructive outlook for the global economy.

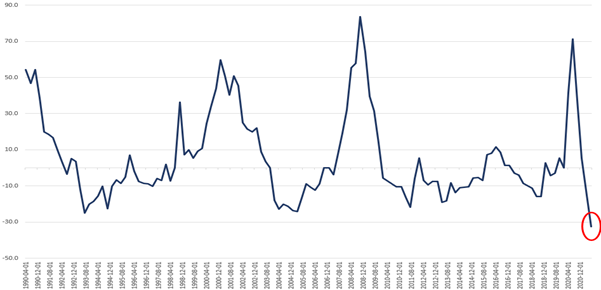

The Senior Loan Officers Opinions Survey is conducted by the US Federal Reserve on a quarterly basis across 80 bank participants and seeks to gain insight on current standards of lending practices and conditions. One of the outputs of the Survey is the net percentage of domestic banks who are currently tightening standards for commercial and industrial loans to large and mid-sized firms (i.e. banks that are making their lending requirements more stringent). Whilst this is clearly US data, the release for July 2021 shows the lowest proportion of banks tightening lending standards on record, a situation which has historically preceded significant expansions in bank lending.

Net Percentage of Domestic Banks Tightening Standards for Commercial & Industrial Loans to Large & Mid-Market Firms

Source: St. Louis Federal Reserve Database

Source: St. Louis Federal Reserve Database

An expansion in global credit could see consumption driven demand increase significantly which has the potential to drive stronger economic growth, persistently higher inflation and perhaps even higher interest rates, particularly at the longer end of the curve as those at the short end remain anchored by domestic central banks.

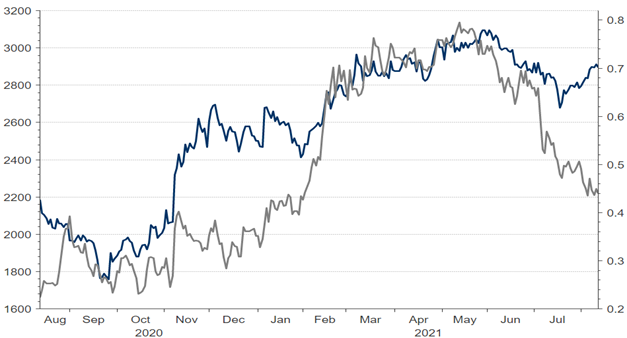

As discussed above this is a phenomenon which we believe could significantly increase the ongoing profitability of domestic banks, an expectation which can be seen by a cursory look at the correlation of bank equity prices with the overall shape of the yield curve.

FTSE 350 £ Banks Index (Blue) vs GBP 10yr vs 2yr Yield Curve Slope

Source: Refinitiv

Source: Refinitiv

In summary we believe that UK banks are finally a position to lay their past to rest and begin to refocus on profitability coupled with shareholder returns. General investor perceptions of the sector remain negative as can be seen through the lens of valuations which we believe remain low in the context of both history and future potential.

Our investment strategy committee, which consists of seasoned strategists and investment managers, meets regularly to review asset allocation, geographical spread, sector preferences and key global market drivers and our economist produces research and views on global economies which complement this process.

Our quarterly report presents our views on the world economic outlook and equity, fixed income and foreign exchange markets. Please click the link to download.