by Tim Sharp

Global equities returned 6% in May encouraged by the “TACO” trade (Trump Always Chickens Out) meaning market reaction to tariff turmoil is becoming more muted because headline threats by the Trump Administration tend to be de-escalated during subsequent negotiation. Global equities completed a full recovery back to all-time highs after the pullback following “Liberation Day”. The agreement to reduce tariffs between China and the US sent a signal to markets that the US administration was more likely to negotiate than expected, reducing recession risk. The US outperformed International Equities and the “Magnificent 7” significantly beat the S&P500 as investors adopted an incrementally “risk-on” stance. However, uncertainty remains as the tariff picture is far from clear. The US Yield curve also steepened as the sell-off in long-dated bonds continued in the light of the “Big Beautiful Bill” (BBB) passing through the House, and pending Senate approval, threatening a significant increase in US Government debt financing. A steepening yield curve while the Dollar is weakening is unusual and suggests that investors are increasingly concerned about their exposure to US assets.

Looking at the global landscape, we see economic activity below trend and currently slowing due to policy uncertainty while inflation is forecast to rise in the US and fall in Europe in line with short-term tariff effects, placing upward pressure on interest rates and constraining monetary easing in the former, while placing downward pressure on interest rates and facilitating monetary easing in the latter. Financial conditions, as measured by the Federal Reserve of Chicago and published online, loosened month-on-month and at month end stood at the 15th percentile over the past 20 years (i.e., have been looser only 15% of the time over that period). Investment-grade and high-yield spreads tightened in line with the “risk-on” mood. Generally, there also remains a disconnect in the US between the backward-looking releases of “hard” economic data which continue to show economic resilience and the “soft” forward-looking data such as consumer surveys and business confidence readings that continue to show underlying concerns amidst ongoing uncertainty. However, it appears that while the US labour market remains broadly robust, US consumers continue to spend.

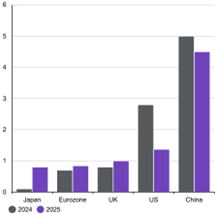

On the macro side we can see core and headline inflation falling everywhere except Japan and the UK creating room for central banks to consider their policies. The Bank of England (BoE) continued its cycle reducing rates to 4.25% from 4.5% although the Bank of Japan (BoJ) held rates at 0.5%. Anecdotally, we heard at a recent meeting with a Japan-focused fund manager that the BoJ has a 1% target but there is no clarity on the timing of their next move. However, so far, each policy change has taken place in 6-month intervals. US unemployment remains stable at 4.2% and payrolls were ahead of expectations in line with flash PMIs also rising. Following the Q1 contraction in GDP, the Atlanta Fed’s GDP. Now figure estimates a bounce back, to growth of 3.8% in Q225 as tariff front-running plays out. Although the US is expected to record the largest year-on-year decline in GDP in 2025 from approximately 2.8% in 2024 to 1.2% in 2025, that would still lead the developed world, where other regions are not expected to rise by more than 1% according to JPMorgan research.

Consensus forecasts for real GDP growth

Source: JP Morgan

The number of Fed cuts priced into markets for this year has reduced to 1-3 from 2-4 in the US where the Fed is behind the European Central Bank (ECB) and BoE in the current easing cycle.

Tensions between China and the EU have alleviated recently with China lifting sanctions against some countries in the hope of reviving previous investment agreements. However, we expect the US to hamper further progress by threatening any trading partner looking to make deals with China that may undermine US tariffs, plus the Chinese support for Russia in relation to the Ukraine conflict, and the fact that both are surplus economies chasing demand. As an aside, Yardeni Research recently pointed out reports of the contradictory position of the EU towards Russia from whom EU countries have purchased approximately EUR209bn in fossil fuels since February 2022 while granting military and economic aid to Ukraine of only approximately EUR148bni.

China’s economy since the 90-day truce in tariffs was declared seems to be showing signs of recovery as surveyed in the China Beige Book that sees domestic consumption in growth sectors reacting to policy stimulusii. Furthermore, the resumption of shipments to the US and the possibility of US importers front-running any return to retaliatory tariffs are also positive. Absolute Strategy Research (ASR) estimates Chinese GDP growth to be 5.7% YoY vs. 6.2% in March, above the government’s target of 5%. Should the economy continue to respond to the stimulus already in place, and track the current 5% target for 2025, then we feel further stimulus is unlikely.

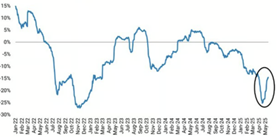

The Q1 earnings season US companies in aggregate beat expectations, but analysts have reduced their full-year forecasts for 2025 and 2026. Dollar weakness has helped Eurozone earnings momentum in Dollar terms and help close regional differentials. Any potential US slowdown will obviously present downside risks to earnings forecasts, especially in sectors with high financial and operating leverage such as Autos. Following 20 weeks of declining earnings revisions, the last 2 weeks have turned positive (i.e. more earnings upgrades than downgrades) according to the Citi US Earnings Revision Index. Morgan Stanley’s S&P500 Earnings Revision Breadth also shows a positive tick up, with history suggesting that such moves have leading properties with respect to forward EPS.

Citi U.S Earnings Revision Index

Source: Bloomberg

Morgan Stanley S&P500 Earnings Revision Breadth

Source: FactSet, Morgan Stanley Research

Equities have rallied since the tariff reprieve on April 9th, assisted by resilient US hard data, robust earnings data, and improving sentiment. However, uncertainty surrounding tariffs and downgrades to earnings forecasts has seen corporate sentiment weaken considerably. The weaker Dollar has led many investors to predict the end of US exceptionalism and the narrowing of valuations with the rest of the world as investors based outside the US repatriate their funds to invest domestically. Although the current outlook for tariffs is more constructive than it was in April, the situation has nevertheless deteriorated since the end of 2024 leading us to conclude that a defensive stance in asset allocation remains appropriate. However, most of the significant drawdowns in equities are related to tariff announcements and, as the markets have become more sanguine of the Trump Administration negotiating tactics, equities are less likely to revisit the lows seen in April. We continue to prefer a minor underweight in, and globally diversified approach to, global equities, with growing exposure to credit and Gold.

Gold has gained 24% year-to-date, including gains totalling 16% across March and April, and remains a major beneficiary of heightened uncertainty especially considering the turbulent policymaking of the Trump Administration. The increased likelihood of a US-led global slowdown in economic activity should also support Gold. Recently, concerns have been raised over the continued safe haven status of the Dollar and US Treasuries, particularly as Trump Administration’s BBB threatens a significant increase in US borrowing. We believe that despite the drop-off in Central Bank demand, investor positioning potentially presents scope for further gains in Gold as the ultimate safe haven again.

Finally, history over the past 2 years would suggest that a US Treasury 10-year yield of 4.5% is an important threshold for global equities. The 10-year yield currently sits at approximately 4.36% driven by an escalating term premium and growing debt servicing obligations not expected to be helped by the BBB’s increase as a proportion of total US debt. We expect government bond markets to focus on the potential for slower growth and Fed monetary policy expectations in the near term with one eye on the growing level of debt issuance. Records show that foreigners hold approximately 30% of US Treasuries, while the composition of global central bank reserves sees a declining allocation to the Dollar suggesting falling demand for future US Treasury issuance. However, the dominance of the Dollar in global trade finance explains why there is little competition from the Euro, Renminbi, Yen or Swiss Franc to the Dollar as the global reserve currency yet.

__________________________

Acknowledgements

Zahra Ward-Murphy _ Absolute Strategy Research _ Investment Committee Briefing _ June 2025

Our investment strategy committee, which consists of seasoned strategists and investment managers, meets regularly to review asset allocation, geographical spread, sector preferences and key global market drivers and our economist produces research and views on global economies which complement this process.

Our quarterly report presents our views on the world economic outlook and equity, fixed income and foreign exchange markets. Please click the link to download.