By Jack Williams

Global markets posted a strong rebound in June, but the investment landscape remains clouded by policy uncertainty—particularly around U.S. trade. While recession fears have eased and growth expectations have picked up, the risk of stagflation and geopolitical instability continues to shape a cautious, risk-aware positioning.

Market Performance and Drivers

Global equities rose 4.5% in June (in USD, c.2.5% in GBP), completing a V-shaped recovery from the volatility triggered by “Liberation Day.” For the second quarter, markets delivered a robust 12% return (in USD, c. 6% in GBP), led by U.S. equities. The June rally was led by the “Magnificent Seven” technology names, which returned 8% versus the S&P 500’s 5%, as investor sentiment turned decisively risk-on. Growth stocks outpaced value by 1% in the U.S., while in Europe, value marginally outperformed quality.

The U.S. rally was underpinned by stabilising earnings expectations—consensus forecasts anticipate 9% y/y growth—and renewed investor focus on sectors with strong growth potential, particularly software and AI. These dynamics continue to favour U.S. equities, which remain the global bellwether for innovation-led growth.

Rates, Credit, and Commodities

Despite the Senate’s passage of the “Big Beautiful Bill,” the U.S. yield curve remained flat. Long-dated Treasury yields stabilised, with the 10-year yield declining from 4.5% to 4.2%, retreating from the May peak of 4.6% and down 0.6% from the January high of 4.8%. Credit markets reflected improved sentiment, with spreads tightening across both high-yield and investment-grade segments.

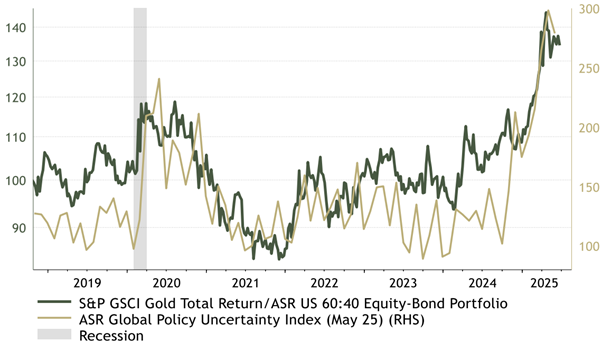

Figure 1 – Gold / US 60:40 Equity-Bond Portfolio vs. Global Policy Uncertainty. Source: Absolute Strategy Research[i]

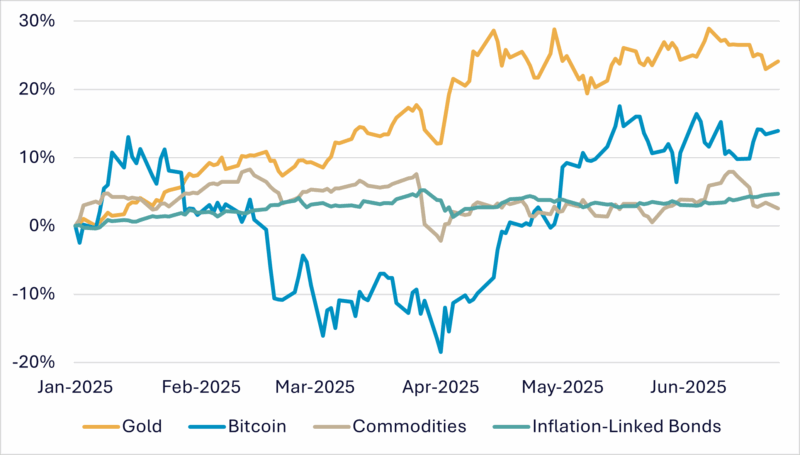

Gold prices were broadly unchanged over the month, although central bank purchases and ETF-driven demand remain robust. Figure 1 above reflects an element of gold’s appeal, illustrating the metal’s strong outperformance of a traditional 60:40 Equity-Bond portfolio when global policy uncertainty is rising and elevated. In the current environment, gold remains our preferred commodity exposure, offering hedging credentials to mitigate fiat currency devaluation and burgeoning geopolitical risk. Traditional hedges against stagflation (below trend growth and above trend inflation)—such as other commodities and inflation-linked bonds—have underperformed gold year to date, as reflected in Figure 2 below, further reinforcing gold’s relative appeal.

Figure 2 – Year to date performance of stagflation hedges: Gold, Bitcoin, Commodities and Inflation-Linked Bonds (Refinitiv Datastream/Workspace)

Oil markets experienced a brief spike following the Iran-Israel conflict, with Brent crude rising from $66 to $82 before retreating to $69 as fears of a Strait of Hormuz blockade were discounted. The episode highlights the fragility of energy markets amid heightened geopolitical risk.

Trade Policy and Currency Dynamics

The most significant source of uncertainty remains U.S. trade policy. While markets have largely recovered from the initial shock of “Liberation Day,” the final shape of tariff policy remains fluid following President Trump’s July 7 executive order. Although the July 9th deadline looms, the administration has extended tariff suspensions for select countries, including a 90-day exemption on Chinese-made semiconductors and a partial suspension of China’s 34% tariff rate until August 11th. Meanwhile, reciprocal tariff letters have been issued to over 50 countries, with new rates—ranging from 25% to 40%—set to take effect on August 12th. While some nations, such as Vietnam and China, have reached agreements, the broader framework remains unsettled. Investors appear to be pricing in a more constructive outcome, but the risk of a stagflationary scenario—rising inflation amid slowing growth—remains material.

The trade-weighted U.S. dollar weakened by 2.5% in June, extending a trend that has shifted momentum toward emerging markets. EM equities led global returns with a 6% gain in dollar terms, while Asia ex-Japan returned 5%, despite the looming threat of higher U.S. tariffs. The dollar’s decline reflects a broader reassessment of its safe-haven status and has implications for capital flows and regional asset performance.

China’s trade surplus has now exceeded $1 trillion, but the traditional recycling of this surplus into U.S. assets has diminished. Instead, China is increasingly settling trade in Renminbi with strategic partners and redirecting investment capital away from U.S. markets. This shift may reflect a broader strategic pivot in China’s international economic policy and could mark a structural transformation in global capital flows, with long-term implications for dollar hegemony and cross-border investment dynamics.

Macro Divergence and Policy Outlook

Financial conditions remain loose by historical standards, and eased during the month, but inflation dynamics are diverging across regions. In the U.S., signs of rising inflation are emerging, with output prices—a lead indicator for inflation—pointing to higher CPI prints in the months ahead. In contrast, inflation is forecast to fall in the EU, affording the ECB greater policy flexibility.

Economic activity indicators present a mixed picture. The ASR Activity Surprise Index remains negative in the U.S. but is positive in the Eurozone, UK, and Japan—all regions with lower equity valuations. PMI data is broadly flat, with most regions hovering near contraction territory. Notable exceptions include relative strength in UK services and Japan’s composite index.

The Atlanta Fed’s GDPNow model reflects recent volatility. Following a brief rebound, the latest estimate has moderated, driven by an inventory build-up that has outpaced demand. Meanwhile, Fed funds futures continue to price in 1–3 rate cuts by year-end and 3–5 over the next 12 months, suggesting that markets expect policy support, despite stubbornly high inflation, to counteract slowing growth.

Asset Allocation and Regional Positioning

The Committee opted to maintain current asset allocation, reflecting a cautious but opportunistic stance. While the removal of immediate recession risk has supported equities, the outlook remains clouded by policy uncertainty and the potential for stagflation in 2H2025.

Within equities, Japan continues to offer attractive valuations and prospective returns. U.S. equities remain supported by strong profit margins and leadership in AI and technology. Europe, by contrast, faces headwinds from negative earnings revisions and may require a fresh catalyst—potentially from fiscal policy support or increased defence spending, as discussed during the recent NATO summit.

The Committee reiterated its preference for quality corporates and a defensive posture. With the earnings yield on the S&P 500 now below the yield on 10-year Treasuries, questions remain about whether investors are being adequately compensated for equity risk. The Committee continues to prefer a minor underweight in, and globally diversified approach to, global equities, with growing exposure to credit and gold.

__________________________

Acknowledgements

Zahra Ward-Murphy _ Absolute Strategy Research _ Investment Committee Briefing _ July 2025

[i] Zahra Ward-Murphy _ Absolute Strategy Research _ Favour Infrastructure and Gold _ 27th June 2025

Hottinger & Co. Limited is authorised and regulated by the Financial Conduct Authority (FCA), whose address is 12 Endeavour Square, London, E20 1JN. Hottinger & Co. Limited’s FCA firm reference number is 208737. For further details on Hottinger & Co. Limited’s regulatory status, please see the FCA’s FS Register at www.fca.gov.uk. Hottinger & Co. Limited is incorporated as a Private Limited Company in England and Wales under the registration number 1573969 and has its registered office at 4 Carlton Gardens, London SW1Y 5AA.

Our investment strategy committee, which consists of seasoned strategists and investment managers, meets regularly to review asset allocation, geographical spread, sector preferences and key global market drivers and our economist produces research and views on global economies which complement this process.

Our quarterly report presents our views on the world economic outlook and equity, fixed income and foreign exchange markets. Please click the link to download.