Author: Tim Sharp

Researcher: Jack Williams

Published: August 25, 2023

Economic woes in China are proving to be worse than initially feared. As we entered the year, many investors were optimistic, expecting to see the economy boom as the country relaxed its Zero Covid lockdowns and rules. As disappointment shrouded the region’s markets, China bulls became expectant, hoping dismal data would force the hands of government officials towards the stimulus lever, which on numerous occasions over the past couple of decades has resulted in an uplift in not just China GDP, but global growth as well.

Figure 1 – CNY/USD (Bloomberg Data/Bloomberg.com)

But how far will the CCP (Chinese Communist Party) have to go to create a meaningful impact, especially since the PBOC (Peoples bank of China) cut rates last Tuesday by 15bps, a move swiftly shrugged off by most. Over the past month or so, we have seen Central Banks such as Peru and Brazil cut rates, each of which were met by a positive response in the markets (although these rate cuts were widely expected).

Prior to the event, 93% of Bloomberg economists surveyed said they did not expect any change in the PBOC bank rate, with just a single economist expecting a cut. The country is currently grappling with a worsening property sector, weak consumer confidence and spending along with mortifying economic data, all of which this latest policy shift has not provided any respite to.

As shown above, China’s biggest bruise is the one on its currency. The Yuan now sits at a similar level to before covid restrictions began to lift and close to a 14-year low marked in 2007 prior to the Lehman collapse. In the last 24 hours, China’s central bank has asked domestic lenders to scale back outward bond investment aimed at limiting the supply of Yuan offshore, its latest attempt to shore up the currency.

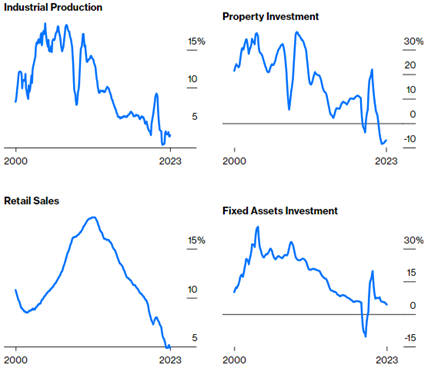

Furthermore, the main metrics of economic activity in the region are all flashing red with industrial production, property investment, and retail sales all at their lowest levels since turn of the millennium.

Shown below is a range of metrics (Industrial Production, Property Investment, Fixed Asset Investment such as infrastructure and Retail Sales) shown via a 6-month moving average.

Figure 2-6M Moving Average of YoY Growth Metrics (Bloomberg Data/Bloomberg.com)

Figure 2-6M Moving Average of YoY Growth Metrics (Bloomberg Data/Bloomberg.com)

All these metrics are at, or near two-decade lows, with property investment falling off a cliff, industrial production readings falling short of expectations and retail sales plummeting at a gradient that would surely be a black run if found on a ski resort. Only fixed income investment is off its lows, but in recent months even this metric has begun falling again.

The PBOC cut rates on its medium-term lending facility last week by 15 bps to 2.5%, marking its second cut since June and the highest cut since 2020. Immediately following the cut, reactions suggested little excitement was generated from investors with any gains on indices being quickly absorbed as investors digested the surprise move.

The Hang Seng Index is down 9.6% from the start of the year, down 6.3% on the month and flat on the week. It Is clear further stimulus would be needed to raise China’s economy, but Xi Jinping has of yet resisted plans for further additions of stimulus into the economy particularly around the property sector, of which numerous red flags are re-emerging.

Figure 4-PBOC 1Y Loan Rates (PBOC/Bloomberg)

Figure 3-Hang Seng Index (Refinitiv Data)

While the property sector continues to give flashbacks to the Evergrande calamity in the back end of 2021. In recent weeks developers such as Country Garden have missed coupon payments on their USD based bonds. Over the past two years calamities within the property sector have wiped out a whopping $87 billion dollars from the industry.

At the time of writing China announces plans to cut stamp duty on domestic stock trading by as much as 50% in a bid to rescue their equity markets. Whether this will work, only time will tell, although it does feel lacklustre compared to the number of issues the region faces.

Earnings within China have been mixed as of late, although tech behemoths such as Apple, Bite Dance (Private Co.), Alibaba, Tencent and to some extent JD.com all reported improvements in China based sales while Shanghai Disneyland saw record high revenue, operating income and margins through the quarter, narrative echoed by Universal Studios Beijing which enjoyed its most profitable quarter since opening.

This paints a picture of bifurcation amidst China’s economy, with huge swathes struggling, whilst others seemingly enjoy similar trends such as increased prioritisation of experiences and entertainment which we have seen since earlier reopening following the pandemic in developed markets. Looking forward it will be vital for China to capitalise on those parts of the economy doing well (Leisure, Entertainment, Food, Technology) whilst introducing confidence back into markets and consumers to address these severe areas of weakness alike property and general retail.

Cheng, E. (2023). What China’s big earnings say about the consumer. [online] CNBC. Available at: https://www.cnbc.com/2023/08/18/what-chinas-big-earnings-say-about-the-consumer.html

Liu, P. (2023). Country Garden Leaves Investors in Dark on Exact Default Deadline. Bloomberg.com. [online] 22 Aug. Available at: https://www.bloomberg.com/news/articles/2023-08-22/country-garden-default-deadline-becomes-guesswork-for-creditors.

Trading Economics (2019). China Loan Prime Rate. [online] Tradingeconomics.com. Available at: https://tradingeconomics.com/china/interest-rate.

Hancock, T. (2023). China’s Consumer Sentiment Starting to Improve, Surveys Show. Bloomberg.com. [online] 24 Aug. Available at: https://www.bloomberg.com/news/articles/2023-08-24/china-s-consumer-sentiment-starting-to-improve-surveys-show.https://www.theguardian.com/business/2023/aug/23/china-economic-model-property-crisis

News, B. (2023). How China’s Faltering Growth Threatens to Derail Commodities Markets. Bloomberg.com. [online] 22 Aug. Available at: https://www.bloomberg.com/news/articles/2023-08-22/how-china-s-faltering-economic-growth-threatens-to-derail-commodities-markets.

Lehner, U.C. (2023). Debating the size of China’s economic rough patch. [online] Asia Times. Available at: https://asiatimes.com/2023/08/debating-the-size-of-chinas-economic-rough-patch/.

Our investment strategy committee, which consists of seasoned strategists and investment managers, meets regularly to review asset allocation, geographical spread, sector preferences and key global market drivers and our economist produces research and views on global economies which complement this process.

Our quarterly report presents our views on the world economic outlook and equity, fixed income and foreign exchange markets. Please click the link to download.