Author: Tim Sharp

Researcher: Jack Williams

Published: June 1, 2023

After Turkish President Tayyip Erdogan’s re-election, Turkey’s financial markets once again experienced turbulence, as the Turkish Lira reached an all-time low against the US dollar, and the country’s sovereign bonds depreciated in value. Erdogan, who has been in office since August 2014, secured another five-year term, defeating opposition leader Kemal Kilicdaroglu, a Turkish economist, retired civil servant, and social democratic politician who was widely regarded as someone capable of addressing the problems that have arisen during Erdogan’s tenure. Since 2016, Turkey has faced strained relations with most European nations, a decline in media freedom, and, most significantly, an increase in the money supply during periods of high inflation, leading to further inflationary pressures.

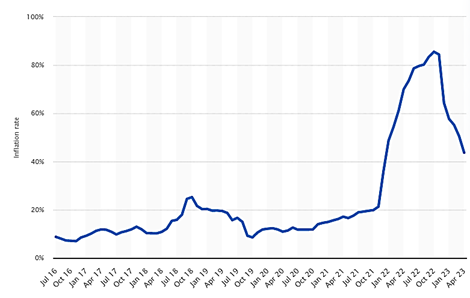

Figure 1 – Turkish Inflation Rate (Statista)

Remarkably, Turkey’s inflation rate over the past 12 months has surpassed a 24-year high, soaring to over 85%. These price surges can be attributed to Erdogan’s unorthodox monetary policy, which contradicts the approach taken by other central banks and countries during this period of high inflation. Rather than raising interest rates, as most would expect, Erdogan has pursued a strategy of lowering rates, resulting in spiralling inflation that has negatively impacted the population. Unsurprisingly, this issue featured prominently in the election campaigns of both major parties in the recent election.

Investors have expressed concerns about this matter and have contemplated whether Erdogan might consider revising his monetary policy to restore financial prudence in the country. In recent weeks, an internal party team has hinted at the possibility of such a policy shift.

This renewed enthusiasm has sparked a rally in Turkish equities, particularly in the banking sector. Notably, the broader Turkish Index (BIST) has surged by 11.84%, while the banking-focused Turkish BIST BANKA index has experienced a remarkable rally of 14.94% in the past five trading days alone. Although Turkish Credit Default Swaps (CDS) have only marginally retreated from their elevated levels, decreasing from 624 to 622, the cost to insure against defaults has significantly risen since the beginning of the year. CDS swaps started the year at a rate of 513, representing an increase of 21.2% to their current levels.

Figure 2 – Turkish BIST Index (RefinitivData)

Figure 3 – Turkish BIST BANKA Index (RefinitvData)

Turkish investors undoubtedly hope for further declines in CDS rates as Erdogan announces his new cabinet, in the expectation that some positions will be filled by candidates who favour a more open-market approach. This would pave the way for the necessary changes to Turkey’s detrimental monetary policy, which both the country and international investors aspire to witness. Presently, Turkish 10-year bonds offer a yield of 9.705% and have performed poorly compared to other emerging market (EM) debt instruments, with a decline of -5.8% as opposed to the -1.6% decrease observed in the broader EM dollar bond space.

Figure 4 – Turkey CDS (WorldGovBond)

Sources:

Al Arabiya English. (2023). Turkey sovereign dollar bonds rise as markets await Erdogan’s economic team. [online] Available at: https://english.alarabiya.net/business/economy/2023/05/30/Turkey-sovereign-dollar-bonds-rise-as-markets-await-Erdogan-s-economic-team [Accessed 31 May 2023].

Karakaya, K. (2023). Turkish Lira Sinks, Stocks Gain as Investors Bet on Policy Shift. Bloomberg.com. [online] 30 May. Available at: https://www.bloomberg.com/news/articles/2023-05-30/turkish-lira-sinks-stocks-gain-as-investors-bet-on-policy-shift.

Parsons, A. (2023). As Kilicdaroglu takes on Erdogan – here’s why Turkey’s election may well be the most important in the world this year. [online] Sky News. Available at: https://news.sky.com/story/as-kilicdaroglu-takes-on-erdogan-heres-why-turkeys-election-may-well-be-the-most-important-in-the-world-this-year-12879032.

Statista. (n.d.). Turkey monthly inflation rate 2022. [online] Available at: https://www.statista.com/statistics/895080/turkey-inflation-rate/.

TradingEconomics (n.d.). Turkey Government Bond 10y – 2022 Data – 2010-2021 Historical – 2023 Forecast – Quote. [online] tradingeconomics.com. Available at: https://tradingeconomics.com/turkey/government-bond-yield.

Charts/Data – RefinitivData / Hottinger Investment Management / YCharts

Our investment strategy committee, which consists of seasoned strategists and investment managers, meets regularly to review asset allocation, geographical spread, sector preferences and key global market drivers and our economist produces research and views on global economies which complement this process.

Our quarterly report presents our views on the world economic outlook and equity, fixed income and foreign exchange markets. Please click the link to download.